Townley: How new mobility could soon overwhelm the traditional bike business

Words by Jay Townley,

I am an analyst and futurist that has worked in the American bicycle industry and business since I started in a bike shop in 1957, and I will let you do the math as to how long I have been an observer and scribe recording the changes, disruptions and opportunities of the global business.

As 2017 came to a close I looked ahead to 2020, a year that many in the bicycle business, including me have written and fantasized about. 2020 is now imminent and at the risk of eating ground-glass, here is a look at – what we will see when we wake up in 2020!

- Millennials Take Over, and Boomers Move to the Sidelines

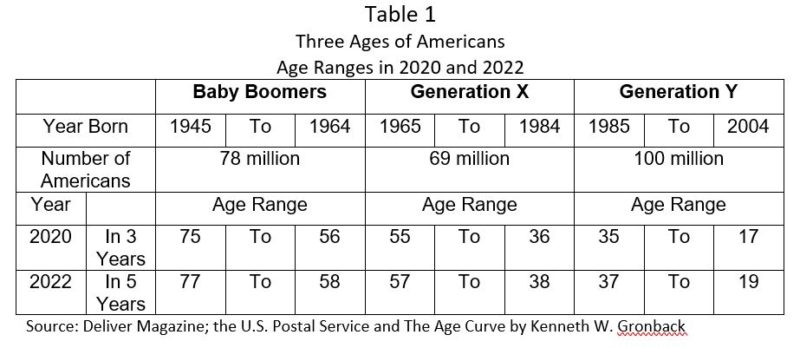

When we wake up January 1, 2020, about 21 months from now, Generation Y, Americans 17 to 35 years of age will solidify their dominance of the consumer marketplace, including having just about taken over the “Sweet-Spot,” 30 to 36 years age, for bicycle sales.

Generation Y is also referred to as Millennials, and there are 100 million of them, making this generation born between 1985 and 2004 the largest of the six living Generations in the United States.

While Baby Boomers and Generation X will still be important to the bicycle business, Generation Y will be the driver of the consumer market place and of the bicycle business and they will expect and demand seamless 24-7 access to shop and purchase Human-Mobility products and services from Omni-channel specialty retailers that provide outstanding shopping experiences, knowledgeable customer service professionals and lifestyle solutions and access to communities of interest.

By 2022, five years from now, all 100 million Millennials will be adults and fully in control of the American consumer marketplace.

- The “Uber Effect” on Transportation

The “Uber Effect” has been pasted on a wide range of new and emerging business models – all of which are part of the Sharing Economy in some form.

Uber just acquired JUMP/Social Bike, self-service bike rental brands and when you wake up in 2020 you will have even more “sharing” options as younger Americans opt out of “owning” and embrace the sharing economy for everything from housing, to cooking, recreation, travel and transportation.

Public transportation in all forms will be strained by the growing demand, and ride-sharing in all forms will step in and fill the growing demand for transportation that can be accessed and ordered through a smart phone and App and paid for all in one seamless digital transaction.

Both “docking” and “dockless” bicycle ride share will spread to more American cities as electric assist is integrated into more ride share bicycles and more large companies like Ford and GM migrate to Human-Mobility and invest in a variety of ride-share business models including vans, bicycles and autonomous electric buses and trams.

- Reshoring Becomes Commonplace

Reshoring or the return of manufacturing to America started well before the November 2016 election, and is the result of global economics. When you wake up January 1, 2020 you will find a growing number of industries returning to America, or “reshoring” including the bicycle manufacturing business.

In 2013, Walmart, America’s largest retailer launched its “Buy America” program, encouraging suppliers to source from within the United States. What Walmart recognized and responded to were the predictions by economists that there would be parity in the global economy whereby certain consumer goods would have the same landed cost in the U.S. from Asia or within the U.S. by 2015-2016.

As a retailer Walmart understands that parity in landed cost of goods between Asian sources and U.S. sources means more inventory turns if the goods are sourced in the U.S. instead of being in a container on the ocean for three-weeks to a month! More inventory turns means more money in Walmart cash registers.

Every smart retailer in the U.S., including Amazon understand what is behind the Walmart “Buy America” program and there will be a growing reshoring movement to states like South Carolina that have already created an alliance between state government, higher education and business to bring the reshoring of manufacturing of consumer goods back to the U.S.

This reshoring movement includes the bicycle manufacturing business and Kent International opened its Bicycle Corporation of America plant in South Carolina in 2014 with plans to manufacture 300,000 bicycles in 2017 and almost twice that number in 2020.

- Who’s Riding a Bicycle, and Why?

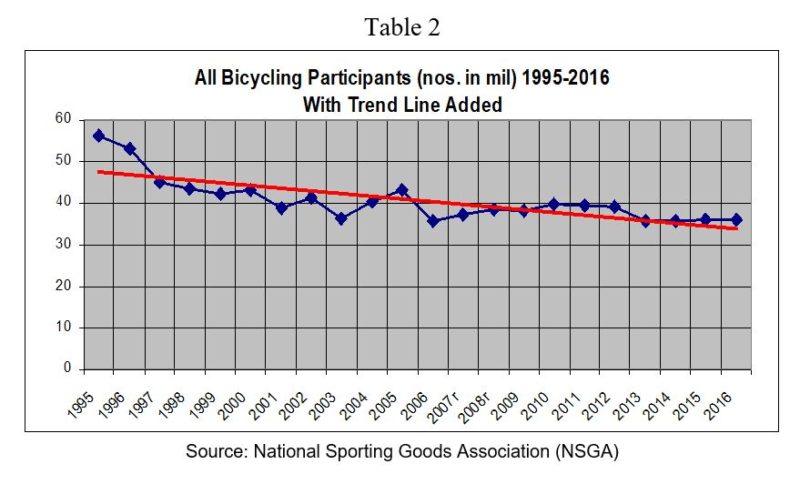

By 2020, if the American bicycle business doesn’t take action to change the national bicycle riding dynamics I am of the opinion that will wake up to something less than 35 million bicycle riding participants, as defined as an American 7 years of age or older that rode a bicycle 6 times or more during a year.

Table 2 shows bicycle riding participation from 1995 to 2016, or over 22 years. The red line is a trend line that shows the direction that participation is taking if the mainstream American bicycle business doesn’t change the way it is doing business and begins to proactively promote bicycles and bicycling to the American public.

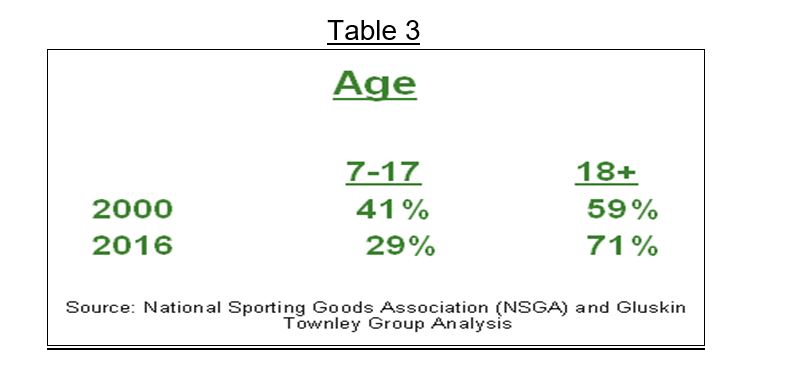

Table 3 shows the shift in the age of American bicycle riders 7 to 17 and 18 years of age and older.

In the year 2000 bicycle riding participants 17 years of age and younger represented 41-percent of all American bike riders. In 2016, 17 years later, bicycle riding participants 17 years of age and younger had declined dramatically to just 29-percent.

Bicycle riding participants 18 years of age and older in the year 2000 represented 59% of all participants. However, 17 years later, in 2016 adult bicycle riding participants 18 and older grew to 71-percent of all American bicycle riders.

This substantial shift is of concern because of the decline in the absolute number of young people riding bicycles, and represents the first challenge and opportunity the bicycle movement and business in American faces.

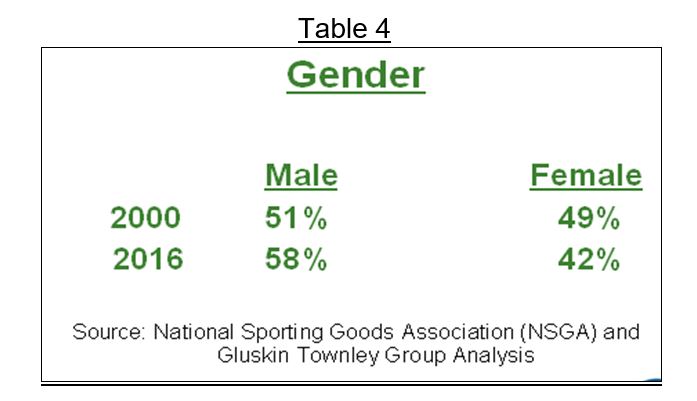

Table 4 shows the gender of bicycle riding participants. In 2000 males were 51 percent of all bicycle riders and females were 49 percent, which at the time was close to national demographics.

By 2016 males had grown to 58 percent of American bicycle riding participants and females had declined to 42 percent.

The 2010 Census showed that women were at least 51 percent of the U.S. population and the 8 to 9 percent difference is a clear indication that women are under served and undersold by the American bicycle business.

This represents the second and perhaps larger change that the mainstream bike industry has to make if it doesn’t want to see overall bicycle riding participation continue to slowly decline.

When you wake up January 1, 2020 who will be riding a bicycle and why? The answer will depend on where you live!

In major metro markets that are already “bicycle friendly” more women of all ages and Millennials will be riding bicycles for recreation, health enhancement, transportation, commuting and for just the fun of it! Bicycle riding participation will have grown in these bicycle friendly market areas by the time you wake up in 2020 – but not everywhere.

Overall bicycle riding participation might come up a bit above 40 million, but overall participation will not happen until the whole nation embraces what now constitutes a bicycle friendly city!

- Why the S. Isn’t Like Europe, and May Never Be

After world war II Europe faced a difficult recovery while the U.S. was on the verge of both a Baby Boom and an economy that was converting from making guns, bombs, tanks and battle ships – to building homes, making cars, toasters, stoves, washing machines and TVs!

It took Europe almost two decades or more to catch up to the American consumer market and even than Europeans never quite succumbed to conspicuous consumption like their American cousins.

Bicycles and e-Bikes are good examples of why the U.S. isn’t Europe and may never be – as much as some in the mainstream bicycle industry on both sides of the Atlantic would like it to be.

The vast majority of Europeans grew up using a bicycle to get to school and for basic transportation. This use of the bicycle continues to the present day, although public transportation and private automobiles have gained in usage over the last 50 years.

The electric bike has become a means for older Europeans to continue a cycling lifestyle they started as children, and want to continue into retirement.

For Americans growing up after World War II bicycles were for children and adults were intent on getting their piece of the American Dream, including a new car in every garage!

Children either walked to school, or rode on school buses and riding a bicycle was looked down upon or not allowed by some schools because of parking issues and liability fears (remember, the U.S. is unique in having tort law, or a judicial system that allows anyone to sue anyone else anytime).

In short, Europeans can easily relate to the bicycle and bicycling and they want to keep doing it, while most Americans can’t relate to bicycles and bicycling, so have no idea of why they should continue something they haven’t done in the first place!

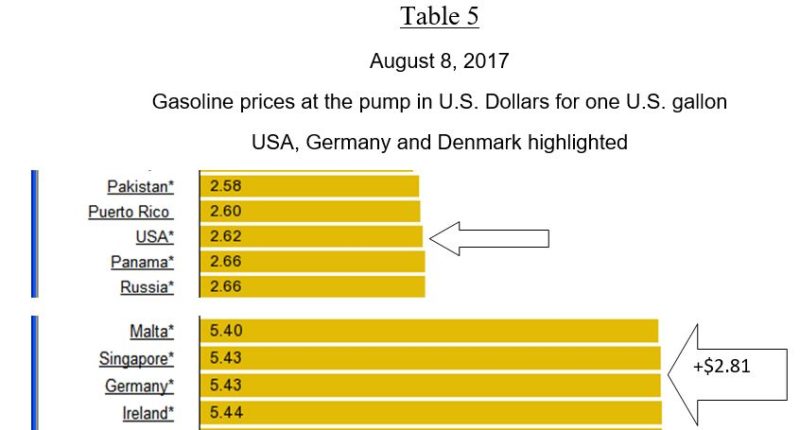

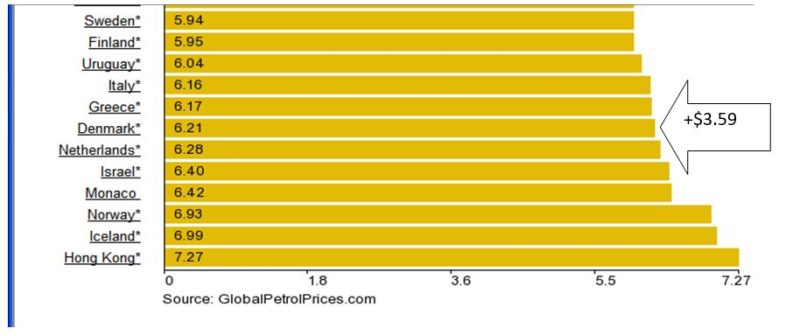

Table 5 shows another big difference between Europe and the U.S. – the price of gasoline!

What Table 5 shows is the cost in U.S. dollars for one U.S. gallon of gasoline in Germany on August 8, 2017 was $5.43 or $2.81 more than the same gallon of gasoline cost in the U.S. Also, the cost in U.S. dollars for one U.S. gallon of gasoline in Denmark on August 8, 2017 was $6.21 or $3.59 more than the same gallon of gasoline cost in the U.S.

Decades ago our European cousins decided that they would build into the cost of gasoline the funding for roads and social programs – something American politicians won’t even discuss much less seriously consider. Using a bicycle or electric bicycle for basic transportation is a much easier decision in Europe than in the U.S. where gas is far cheaper and the road systems aren’t at all conducive or friendly to bicycling.

- Why the Bicycle Industry Will Finally Face Reality

Three paths have emerged that the American bicycle business is currently following, and future growth and real prosperity after 2020 is dependent on how and when these three paths intersect, merge and blend to really serve the mobility, transportation and activity wants and needs of the majority of all Americans. The three paths are:

- The Traditional Mainstream bicycle business

- The New-Wave and Outlier fringe bicycle economy

- The Emerging Tier One OEM supplier bicycle economy

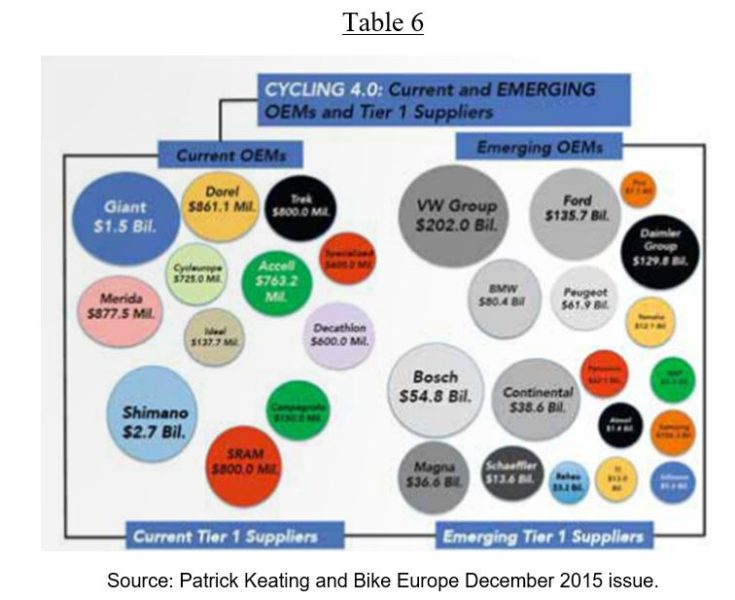

Table 6 accompanied a December 2015 article in Bike Europe and it is stunning to say the least.

What it shows graphically is what Patrick Keating’s extensive research found as the Current and Emerging OEM’s in the mainstream bicycle business and Tier 1 Suppliers on the left, and the Emerging OEM’s and Tier 1 Suppliers, on the right representing some of the largest corporations in the world.

The American bicycle business has already watched as Bosch and others have entered the e-Bike sector of the bicycle market and the estimate for annual revenue for this European based company is $54.8 billion – a corporate revenue roughly 95% larger than the largest Current bicycle industry supplier.

What are these much larger, primarily automotive sector brands and companies interested in the global bicycle business and market for?

The quick answer is electric bicycles – but the more in-depth answer concerning the interest by large automotive parts suppliers and automobile brands in the bike business is the limited live of the internal combustion engine.

Last year Germany’s legislative body, the Bundesrat, passed a resolution to ban internal combustion engines by 2030. While the resolution is without legislative weight, any change of this scale would have to also be ratified by the European Union, it nevertheless signals where European and Asian lawmakers are headed.

Norway has laid out the most aggressive plans. It wants to get there by 2025. It helps that a full 24 percent of the vehicles sold in this oil-rich nation already are battery-electric

The Netherlands already has a relatively high EV sales rate, about 6 percent of its total new vehicles, but it has yet to formally lock down a switch to electric vehicles that some would like to implement by as early as 2025.

India wants to get all of its vehicles switched to battery power by 2030 — and that means it not only wants to end the sale of internal combustion vehicles but convert or replace all other vehicles already on the road by the end of the next decade.

China is using both the carrot and stick to increase sales of so-called New Energy Vehicles. There are now strict limits on the number of new vehicles that can be registered in major cities such as Beijing and Shanghai, but qualified NEV models are exempt, encouraging buyers to shift. With some of the world’s most polluted cities, some observers believe China could call for an outright ban on internal combustion technology in the not-too-distant future.

Ford and General Motors (GM) have joined with others in the global automotive industry in becoming aware and acknowledging that the writing is on the wall – and it is not favorable for traditional mainstream automotive companies.

All of our research and investigation clearly indicates that a new mobility is developing out on the fringe that embraces a new generation of hybrid and electric vehicles, self-driving vehicles and including human powered and electric assist bicycles, recumbents and tri and quad cycles.

Given the current situation we believe the Emerging Tier One OEM supplier economy and the

New-Wave and Outlier fringe bicycle economy will overtake and overwhelm the traditional mainstream American bicycle economy within the next three to fives, or between 2020 and 2022 and when this occurs the American bicycling business will finally face reality and begin to address the Brutal Truths!

Want too be sure to catch Jay’s writing going forwards? Make sure your email preferences are fine tuned here.