Ask the trade: How effective are finance tools and is bike leasing viable at retail?

Recently we asked three very different bike shops their take on whether pandemic bought bikes were still in use and whether consumer perception on price to value unlocked had shifted. In this follow up, our panel assess how effective tools such as retail finance are to sell to those worried about price and assess whether leasing is a viable option for bike retailers…

How useful are modern finance tools and cycle to work schemes in converting those on a budget?

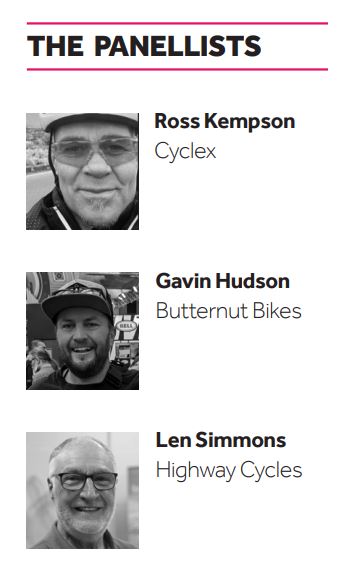

Gavin Hudson, Butternut Bikes

The biggest cycle to work scheme is owned by a company that sold for $3.5bn in 2018; you can’t convince me that they have cyclists nor the IBDs interests at heart. The amount of margin that most schemes take is completely unreasonable for the work done, but employers don’t care about choosing the best one, because they don’t pay, the IBD does. It’s like the days when tenants had to pay the agency fees for landlords. The flow of VC money into the bike industry and the flow of cash out (a big distro in the UK transferred £30m to a tax haven last year) is another subject, don’t get me started.

It rolls to the biggest heap. For high earners they can buy a lovely £4,000 electric bike on C2W, then ride it for 12/18 months. They effectively pay around £2,600 for it, sell the bike for £3,200 and make a profit, buy a new one and repeat, without ever needing much in the way of repair costs.

Lower earners want to reserve a cheap bike while they get a voucher sorted out, this may or not be in stock, there’s a cost to the dealer to hang on to it, etc. Certainly, it makes sense for dealers to focus on the higher ticket for C2W and this seems a little unfair on the normal working person. Those without stable jobs also can’t benefit from this. The C2W scheme should be something everyone can access regardless of their employment status and lower rate taxpayers shouldn’t benefit less. A regressive tax isn’t something we agree with.

Ross Kempson, Cyclex

In our store locality we have less bike to work scheme and finance purchases than some areas and both my managers agreed that most customers are choosing these schemes for budgeting purposes rather than cashflow shortage.

Bike to work scheme customers seem to be more genuine in their need for finance to afford the bike they want, but many customers using finance schemes (mostly interest-free these days) are just choosing this method because they can or just want to boost their credit rating. We had a customer with a £200k income who did it for this reason!

Len Simmons, Highway Cycles

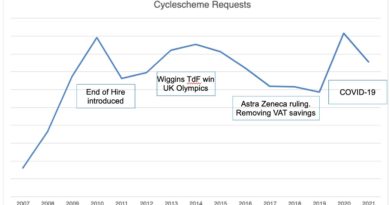

Finance availability and CTW schemes are good tools for cushioning the upfront cost for the customer. This year we have seen a significant increase in the use of CTW schemes.

The bike leasing model appears to be slowly emerging – can this become a new structure to tempt people onto higher ticket bikes?

Gavin Hudson, Butternut Bikes

The bike leasing model seems to be a major threat to business for bike shops, to be honest. We’ve already seen the impact of the kids’ club bikes and been hit from both the supply and demand side by this. Parents don’t want to buy kids’ bikes from us because the ability to lease and swap ostensibly offers better value than buying a bike.

Suppliers (understandably) focus on one huge account buying thousands of bikes rather than getting out-of-stock bikes to the IBD. One of our contract mechanics ran a workshop here and the number of bikes he was getting through in the warehouse was obscene. Here in London, you can hire a decent bike for £20 a month. That’s about the same cost as you should probably be spending on running costs and insurance over the year, so why wouldn’t you?

Ross Kempson, Cyclex

This is something we considered some years ago, especially in relation to eBikes, but we haven’t felt the need to pursue it and I wasn’t aware this was an emerging trend. Again, it could be due to the store locality and an above average wealth demographic.

Len Simmons, Highway Cycles

I think this is something that has legs, and we have been looking at this as a possibility once we can work out the logistics involved.

Have you noted any preference to repair over buying new in any particular demographics?

Gavin Hudson, Butternut Bikes

The more well-off customer generally has an eye to sustainability (as they can afford it) and is more likely to want decent quality repairs to their nice bike. Even when ‘uneconomic’ to do so, they want to keep using their bike for environmental or sentimental reasons.

Less well-off customers want to repair for different reasons, which sometimes isn’t possible to do within budget. Some cheap bikes have a lifespan of only a few months, according to some info I’ve seen. Durability isn’t cheap, and we’re only seeing this get worse with bikes coming out of manufacturers with off-brand substitute components.

At Butternut Bikes we subscribe to the Sam Vimes theory of economics (Terry Pratchett) that poverty causes greater expense to the poor than to those who are richer. A rich person can afford a £100 pair of comfortable waterproof boots that last years and can be repaired. A poor person can only afford £50 boots which last a year, so overall they’ll spend more on boots and still have uncomfortable, wet feet. The same applies to bikes.

Ross Kempson, Cyclex

During the pandemic everyone was bringing their unused bikes to a shop to have the cobwebs removed and the tyres inflated. Since then, the only significant trend that has continued seems to be people bringing in their older hybrid style bikes for a renovation or service quote. We have also seen cheap eBikes bought during the pandemic that are now going wrong electronically or are in need of some kind or mechanical repair.

Len Simmons, Highway Cycles

The repair will always be a strong case for some people’s consideration. What we do find is that when an older bike arrives for repair, a new bike is worth considering if the cost of the repair far out ways the value of the old bike.