UK bike owners least likely in Europe to seek servicing, shows study

Shimano‘s fourth annual State of the Nation report is back for 2022, revealing plenty about bike use in Europe, attitudes to infrastructure and eBikes, plus plenty more from a pool of over 15,000 people.

A brilliant way to benchmark different countries’ progress and attitudes to cycling, the study sought the insights of 2,000 people in the UK and found, among many other things, that citizens here are the least likely in Europe to seek out a service for their bikes in the next six months; just 1 in 10 saying (10%) they had plans to do so. 30% of those booked in habitually, while 12% only booked in for a fix if something went wrong.

The UK also has one of the lowest levels of bike ownership, with 63% without a cycle compared to an average of 41% in Europe.

As far as the perception of electric bikes goes, there are signs of a mindset change. Again, specifically in the UK, more than half now see pedal assist bikes as well matched for commuting by bike. Interestingly this perception is greater with females surveyed at 58% to men’s 48%.

The same percentage (53%) see electric bikes as an environmentally sound transport choice and 32% a budget friendly option when benchmarked against alternatives.

Arguably the greatest sign of change is the low proportion that now see the electric bike as something reserved for the elderly. In the UK just 24% said as much, while in Europe the rates were more variable at 31% in Sweden; 22% in Spain and 43% in Poland.

What’s generating buyers and first time triers for UK bike shops?

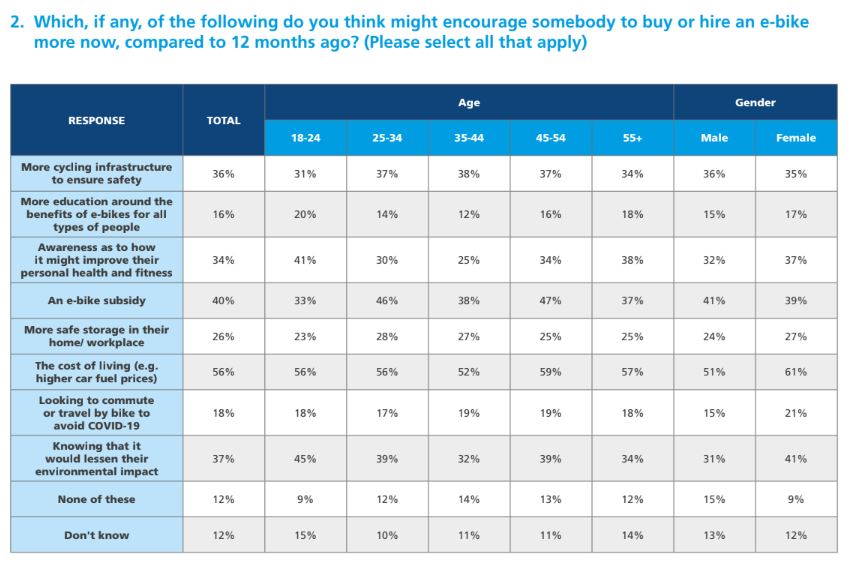

As you’ll find in many other studies, it’s safe cycling conditions that still hold the greatest sway for getting people confident to try and buy; 36% said this was the greatest factor to possibly adding an eBike to their bike stock and that was flat between males and female respondents.

It is the desire for a subsidy toward a purchase that, during a cost of living crisis, is holding increased sway. 40% hope to see this, with the greatest appeal for this held between the ages of 45 to 54. The 18 to 24 bracket had just 33% prioritising this, suggesting they may still see the pricing as out of reach, although there was a stronger tilt toward environmental reasons that wasn’t as prevalent in older groups.

Directly referencing the cost of living crisis and costs of other transport, 56% said that this was their main driver for an electric bike buy or hire.

Infrastructure

Moving on the perception of cycling conditions in any given country and the UK generally leans toward a perception that conditions have not improved for safe cycling, thus stunting the growth potential of the marketplace. 49% leaned toward disagreement with the statement that cycling infrastructure had improved, versus 27% titled toward agreement of improvement.

Jonathan Davis, PR & Communications Manager, Shimano Europe said: ”We are delighted to be launching our fourth State of the Nation report. Based on a poll of over 15,500 people across Europe, it aims to examine the motivations of e-bike users and better understand the attitudes to e-bikes and cycling more widely.

”The findings are fascinating and allow us to identify key trends in the market. The awareness of (and even attitudes towards) those who interact with an e-bike in some way are shifting upwards.

”We hope this report will be a useful tool for anyone in the cycling industry and beyond, and that it continues to play a role in advancing the e-bike sector further.”

For comparison, last year’s State of the Nation report can be read here.