Opinion: What is “normal” and can we ever get back to it in the bike biz?

One of the questions industry sales agent John Styles keeps hearing from retailers throughout the pandemic has been ‘when will things get back to normal in the bike biz’?. To answer that question, he suggests we might want to ask, ‘what does the bicycle industry consider to be normal’?

When people in the industry say ‘normal’ I suspect many are thinking about what we enjoyed in the late 1990 or early 2000s. There had been 50 years of continuous peace, prosperity, and economic growth in western Europe since the end of the Second World War. While in the East, the Cold War was over and, in the UK, the conflict in Northern Ireland resolved. Added to that, China had embarked upon transforming its economy into the largest and most productive capitalist system the world has ever seen. The result was ever cheaper, ever better, ever more plentiful, and more reliable flows of goods. Meaning, at least superficially for the consumer, things had never been better. So as an industry, we also ‘never had it so good’?

Pre-Pandemic Supply and Demand – The Industry’s ‘Normal’

So, what did ‘normal’ look like for the bicycle trade? UK supply is largely reliant on imported goods, often manufactured according to an OEM timescale, but with highly seasonal local demand. So, the market was characterised by a continual struggle to balance seasonal demand with seasonal supply and square the circle of cash flow. As illustrated below – a simplified representation of “pre-pandemic normal” in the industry.

PRE-PANDEMIC SUPPLY

- 3–6-month lead times

- Steady Supply (if sometimes poorly timed)

- Predictable Pricing

- Reliable Shipments

- When you want it (mostly)

PRE-PANDEMIC DEMAND

- Spring – Summer Sales Peak

- Quieter Winter

- Steady transitions over months or years

- Profit making and loss-making periods broadly similar every trading year

Overlaid upon the industry’s annual cycles was the ‘7-year boom/bust cycle’ which saw economies swing back and forth – from growth to decline. This ‘Endogenous’ or internal cycle was a fundamental, and largely predictable, feature of the economy. Meaning that, by and large, retailers knew if demand was predicted to steadily increase or decrease in any given year.

Even external events (or ‘Exogenous shocks’) such as the Foot & Mouth crisis of 2001 which largely shut the countryside to walkers and cyclists were resolved relatively quickly. We got used to the idea that if things weren’t “normal” they would soon “get back to normal”. Sadly, that belief may no longer hold true.

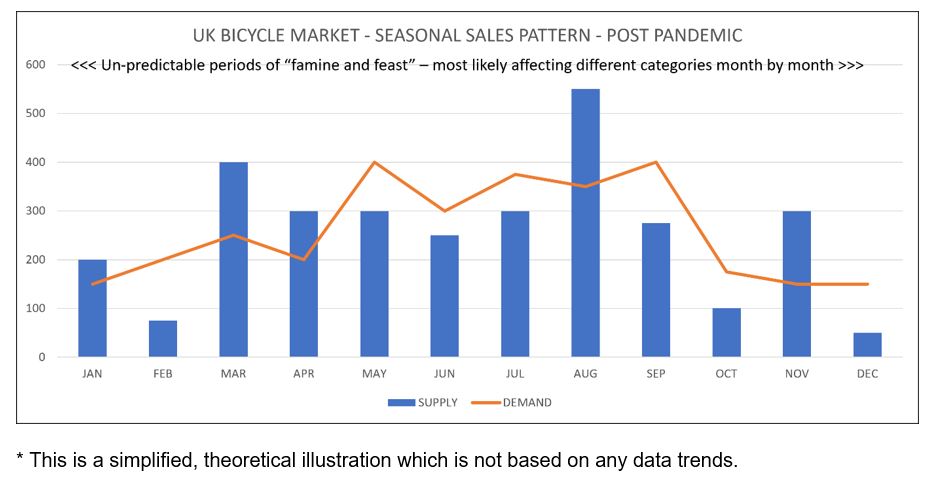

Post-Pandemic Supply and Demand – The New ‘Normal’ is ‘No Normal’?

The ONS said GDP grew by 0.9% in November 2021 to put the economy above its February 2020 size for the first time since the pandemic began. If we accept that demand has largely returned to its pre-pandemic levels – albeit possibly a little higher through the recruitment of new and additional cyclists and a lag in enthusiast sales in the market, does that mean things are back to normal?

POST-PANDEMIC SUPPLY

- 6–12-month lead times

- Unpredictable Supply

- Rising Pricing

- Less Reliable Shipments

- When we can make and ship it

POST-PANDEMIC DEMAND

- Return to Spring- Summer Sales Peak

- Stop-start effects from repeated small financial shocks

- Supply & Demand may not be as well matched

- Profit making and loss-making periods not as predictable

2022 – A Year of Adjustment?

Sadly no, things are not back to normal – even if things feel a little familiar. Demand has rapidly cooled to its pre-pandemic levels, at least for mainstream product. Meaning that, once again, some retailers have been struggling with too much stock over the quieter winter months. Surplus stock in some categories or price points does not necessarily mean that “things are back to normal” however.

The enthusiast market appears to be more resilient. Likely because many of those consumers enjoyed higher/protected incomes during Lockdown and have not spent money on foreign holidays, cars, and kitchens. Many of them may also have been frustrated in trying to purchase their ideal “n + 1, next bike” during 2020 – so have been coming back for that in 2021/2022. Especially as events, races and foreign trips begin to open up.

Or as one retailer put it to me “we’ve only sold a fraction of the kids and teenage bikes we normally sell at Christmas, but our high-end sales, especially electric bikes, are right up, so December felt desperately quiet, yet we enjoyed record sales”.

So, in the short term, 2022 is looking like “the year of the enthusiast consumer”. We might also expect mainstream spending on lower price points to fall back further as Britain faces its “year of the squeeze” with rising energy prices, inflation, National Insurance, and interest rate increases – all of which affect lower income families disproportionately. This sort of “abrupt shock” tends to make demand very stop-start – as consumers pause their spending in the face of uncertainty, then resume only when they are confident that they have sufficient disposable income.

There are perhaps some lasting positives, however. According to a BBC report, 2/5th of office workers are declaring they won’t be going back to the office. The ‘stay at home’ consumer appears more likely to have time and money to spend on cycling. Coupled with the “race for space”, this may mean more sales at higher price points outside city centres. In addition, with supply still disrupted, there are only surpluses in certain categories, overall scarcity prevails. Meaning retailers are likely to be selling fewer units at higher price points.

Let’s return to that theme of ‘normal’ in respect of supply. Normal to the bicycle trade meant goods were reliably delivered, with stable pricing, within a 3–6-month lead time – and broadly when you wanted them. But during the pandemic we have seen factory closures, container shortages, rising prices and disruption from civil unrest and other pandemic-related events. From end-to-end the supply chain remains under duress.

Added to that, for the UK at least, is the on-going complexity of Brexit. A year on and we still find confusion around HMRC importation, duty rates and procedures. CyclingIndustry.News’ market research has a 12:1 ratio of bike shops saying they are selling less versus more goods into the EU. Couriers are imposing charges where they shouldn’t, and goods are taking longer to enter the country. Once in the country the UK has a shortage of HGV drivers which makes ongoing distribution more challenging and less predictable than before.

If anything, it is surprising how well the UK supply chain has continued to flow and how resilient the brands importers and retailers have been in their flexible and dynamic responses to these ongoing challenges.

The On-going 21st Century – An Age of Extremes

The new normal is that things don’t get back to normal. They change. Extreme events have long lasting and permanent effects and are followed by further extreme events. Here are just a few.

Even before the pandemic, the industry was adjusting the effect of the financial crisis. The “squeezed middle” has long been used to describe the polarized income pattern of the rich getting richer at the expense of the poor and middle class. It’s no surprise then that bike sales have been adjusting to an increased volume below £2.5k and booming sales in the “super-high end”. There’s a kind of £2.5k-£5k “nowhere zone” – too expensive for many, and not expensive enough for others. It’s simply a reflection of society’s spending power. Most of the retail failures (or closures) I have observed in London during 2015-19 were among stores who were, to some extent at least, aiming at this “mid-range” price point or consumer.

Of course, these are just the events that are “top of mind” and have affected the UK the most. We are also living through other unexpected and extreme events such as the Capital Riots, Afghanistan withdrawal, record breaking wildfires, floods, and blizzards. Just consider the weather for a moment, Summer 2020 was one of the UKs hottest and driest ever recorded, whilst Summer 2021 was one the wettest. What we used to take as a “given” is no longer steady or predictable.

To really understand the effects of the pandemic, you have step back from it and see it as just one event in a series (Google ‘Black Swan’ events if you want to know more). According to some thinkers, these events are set to become ever more frequent and more severe. In 2015 ‘The Age of Earthquakes: A Guide to the Extreme Present’ was published. It’s a central proposition is that “The future is happening to us far faster than we thought”.

Added to this is the shortage of materials and rising prices already being felt in the industry, such as recent steep rises in aluminium pricing. Or the scramble for batteries, chips, and semiconductors. With the drive towards electrification within the major western economies, long term shortages of materials seem inevitable. And indeed, the cycle industry is experiencing delays, shortages and prices rises in some of these areas as we speak.

Looking even further down the track we need to be aware of the long-term structural geopolitics of Asia, upon which the bicycle trade is extremely reliant. And for anyone wishing to understand the headlines further, you may want to check out ‘Prisoners of Geography: Ten Maps That Tell You Everything You Need To Know About Global Politics’ by Tim Marshall.

Given these long term, structural and deep-seated trends, it’s hard to imagine how society and industry in general could return to the “normal” we used to enjoy. So, in answer to the question ‘when will things return to normal’ I suggest two answers. For demand, right about now – albeit with a slightly different, unpredictable, and evolving pattern. For supply, quite possibly, never.

Enjoyed John’s take on the return to normal? Why not read his last column on workshop profitability here.