Containers stuck in the west to blame for global slowdown, finds study

Containers are spending significantly less time in Asian ports, but are getting stuck at depots in the USA, UK, UAE and South America for extended periods of time, keeping the supply chain chuntering along at a slow speed.

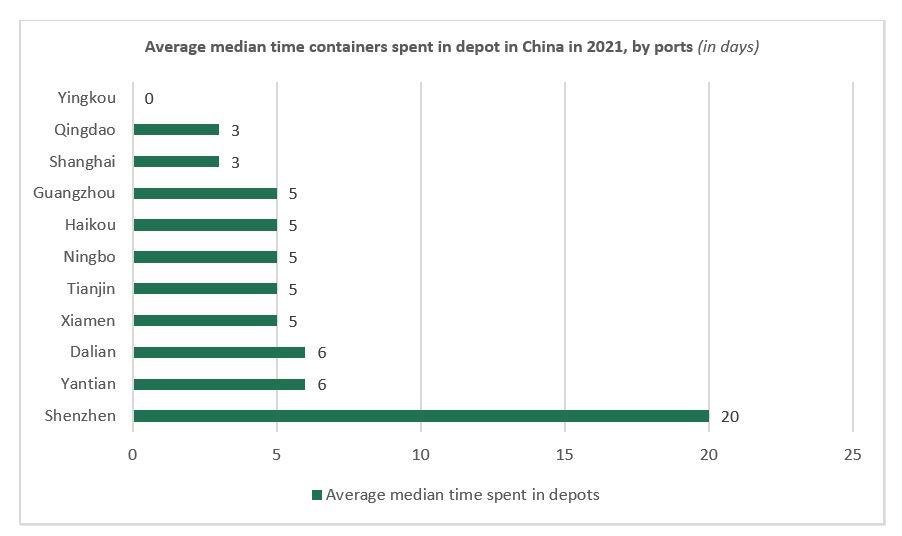

That’s the conclusion of an annual review by Container Xchange, which has found that containers are averaged a five day turnaround in 2021, compared with a painfully slow 61 days in 2020 when the world first locked down due to Covid.

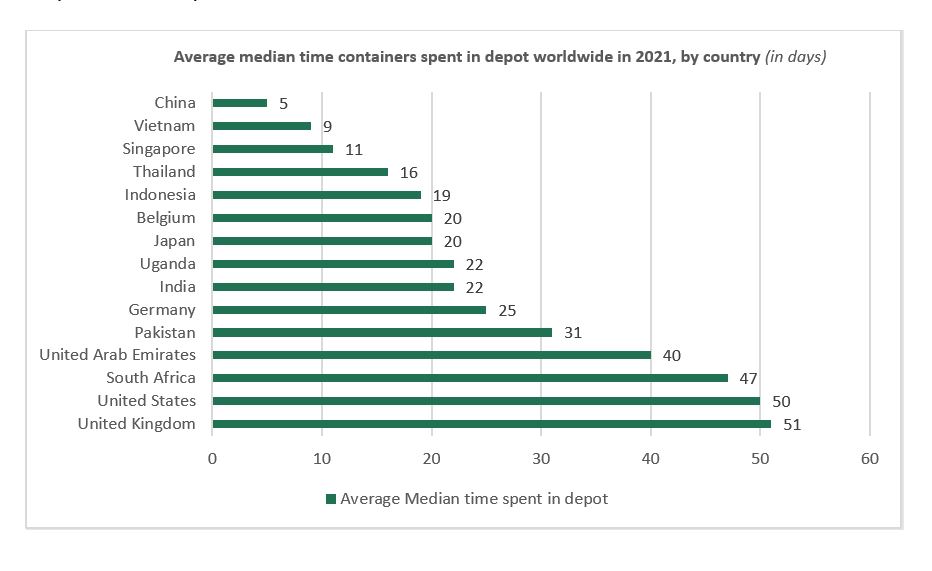

The joint report conducted alongside Fraunhofer – CML, one of the world’s leading applied research organisations, discovered that China was not alone among leading exporters in seeing rapid box turnarounds last year. Vietnam, Singapore, Thailand and Indonesia recorded average median times that containers spent in depots of nine, 11, 16 and 19 days, respectively.

“Once containers reach Asia, they are being redeployed at record speeds. However, the mismatch between supply and demand at many origin ports, including in China, means it is hard for US and European importers to always secure boxes unless they have planned ahead, or are working closely with their box supplier, forwarder or container line, to ensure they have both a vessel slot and a container available in advance,” commented Dr. Johannes Schlingmeier, co-founder and CEO, Container xChange.

It is apparently congestion at destination ports that is causing much of the backlog that still troubles global industry, simultaneously prompting much higher than historical average pricing structures.

The Drewry Container index this week has the average price for a 40ft container up 1.4% to $9,544.66. That is about double the pricing during the spring of 2021, which was the last time you could obtain a price under $5,000.

The worst performing countries in terms of the average median time containers spent in depots in 2021 were the U.S. and the UK which suffered average dwell times of 50 and 51 days, respectively. The next worst performers were South Africa (47 days), United Arab Emirates (40 days), Pakistan (31 days) and Germany (25 days).

Dr. Johannes Schlingmeier added: “Container shipping rates have bounced back after a slight downturn in the fourth quarter with the Shanghai Containerized Freight Index (SCFI) breaking through the 5,000 mark at the end of December. Port congestion is a major factor. Jefferies Equity Research found that in November last year some 36.2% of boxship capacity was at port. Until that congestion is cleared, we’ll continue to have major imbalances in the supply and demand of both vessel capacity and containers. As the Omicron variant brings more disruption, with Chinese New Year around the corner and some ports including Ningbo already facing lockdowns, we are expecting a volatile start to the year for ocean freight logistics.”

The study found that in the USA performance varied hugely by port. Across the country, average dwell times were 50 days last year(2021), down from 66 days in 2020. New York recorded 61 days of container idle time at depots followed by Houston (59 days) and Savannah (56 days). The ports of LA and LB, on average recorded 40 to 42 days of container idle time.

The project on which this report is based was supported by the Federal Ministry of Education and Research under the funding code 01IS20004A.