What next for the cycling industry – more boom or bubble?

As the dust is settling on a violent jolt of global product demand and subsequent supply complexities the cycling industry is faced with the acceleration of forecast mega trends. So, what next for the bike market? We ask several trade leaders…

Our panel:

Our panel:

Tony Barton, Sales and Service, Magura UK

Dominic Langan, CEO, Madison Sportline

Lloyd Townsend, MD, Ison Distribution

Peter Nisbet, MD, Windwave

Some of the financials from listed companies are starting to show a reverse gear on record breaking. Are the true effects of trade headwinds now filtering through to the frontline?

Dominic Langan, CEO, Madison

I think there are several factors at play. Supply has prevented us and others, I am sure, from reaching our true potential this year. Since the loosening of restrictions and “freedom day” we have seen motorised traffic return to pre pandemic levels, some of the traffic calming measures and cycle infrastructure installed during the pandemic now being dismantled. This has certainly deterred people from wanting to continue to ride in the streets. A lot of staff are back in the office at least some of the week now and commuting/work pressures have taken away that extra time people had when working from home for some exercise/leisure time.

People are now spending money on greater variety of things now that restrictions have been lifted. However, people are also feeling the pinch thanks to increase energy and fuels costs. Inflation is increasing and certainly we have seen considerable cost increases in the cycling industry. There is potential for interest rate rises too, so I am sure people are anxious about the future and will be watching the pennies. This may be in our favour next year if people look to save on fuel and other costs of driving – ULEZ, congestion charges etc. and opt for the bicycle instead.

I expect we will continue to see production capacity issues throughout 2022. Raw materials, labour shortages and lockdowns continue to be a big issue and some countries which supply our industry’s products, they still have relatively low vaccination rates. In some cases they also have closed borders and no longer can rely on migrant workers to the extent they once did. In China we are seeing more and more areas operate a three-day week as the government is restricting power usage to tackle pollution.

Peter Nisbet, MD, Windwave

For Windwave, no. Output is marginally up on the “bike boom”. The current supply chain issues are slowing supply, so we have lots of back orders to fulfil. We think things will start to be sorted by quarter 3, 2022. After this the market should settle to the new norm, which we think will be slightly down on the ‘’boom’’, yet significantly up pre-boom.

Tony Barton, Magura

I am hearing of parts availability issues from dealers saying bikes are not being delivered due to missing parts.

The ‘bike boom’ was very pronounced, was the industry as a whole unprepared or underbuilt for such a violent surge in sales?

Dominic Langan, CEO, Madison

Dominic Langan, CEO, Madison

I don’t think the bike industry was any less prepared than any other industry. Everything is about “just in time” and there is very little scope for fluctuations in unpredicted demand. Also, usually you may see some territory around the globe suddenly see an uplift in sales in a certain category which can often be accommodated but this was worldwide and all at the same time! For the last few years the cycle industry has been over supplied so I think many, including ourselves, did really well in 2020 as we were sitting on a lot of inventory. Covid and the lockdowns also coincided with the start of our peak season.

It would be totally uncommercial to hold stock or have the production capacity for the off chance of a once in a hundred year global event where bike shops were seen as essential retail and when one of the two forms of allowed exercise as dictated by governments of the world was cycling!

It could have been a whole different story had retail been told to close. This happened initially to the fishing industry and it had a devastating impact – however, it did bounce back very rapidly once the government allowed fishing as an activity during lockdown.

Demand for raw materials, micro-chips, labour etc. etc. is off the grid all over the world, so I certainly don’t think the bike industry has fared any worse, plenty are in a worse position, and I am pretty sure everyone maxed out the opportunity in the UK industry – I know we did.

Tony Barton, Magura

I am not sure anyone could have predicted the demand that arose from the pandemic. We had good weather too, which meant people wanted to get out and exercise, plus bike shops were allowed to stay open. This again helped as consumers wanted to spend money on activities. It is almost impossible to gear up for this type of demand with long lead times for bike manufacturers from Asia, not to mention the availability of materials to manufacture.

Lloyd Townsend, MD, Ison Distribution

I suspect that financial results being published now by various companies will tend to indicate the position in a relatively retrospective light.

I think the big headwinds in supply that started in the summer of 2020 may have started to show their impact more recently in some published information and the further results of the inevitable rebalancing of supply and demand has not really started to be seen clearly yet.

There’s no doubt that several companies, ourselves included, have missed sales opportunities because of shortages in supply on certain lines in the 12 months from summer 20 to 21 that followed the tsunami like demand for ‘anything bicycle’ effect that spiked up from the original Covid-19 lockdown, where cycling became one of the only things folks could do.

That said, I think we have generally been able to maintain reasonable supply in the overall picture, so far.

Peter Nisbet, MD, Windwave

Nobody could have predicted such a huge surge in global sales. Supply was previously easily meeting the demand and if anything, there was over supply.

The manufacturing investment now going in to bolstering production lines is similarly pronounced. Is this a bet on a temporary lull and back to the good times once the supply chain resumes normality? Is it a risk?

Dominic Langan, CEO, Madison

There are definitely more people riding bikes since the pandemic, so that is a positive. In a recent survey 27% of people who bought a bike in lockdown regretted it, but 73% of people do not regret it, so that is a positive; they are all new or returning customers. 2020 has gone. I think demand in 2022 may be similar to this year if we can get the inventory and we do not face any more surprises from the pandemic or in terms of trade.

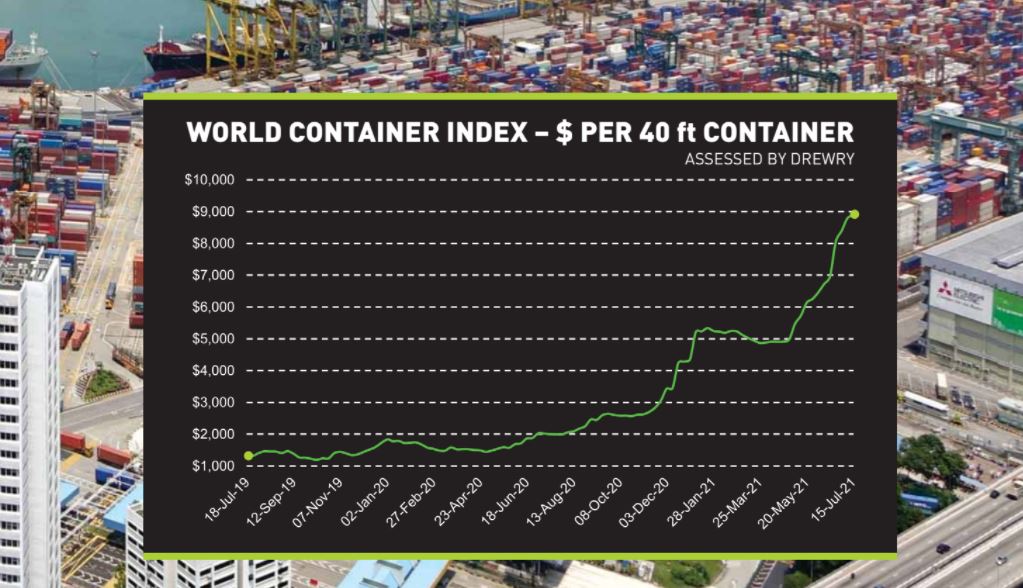

I think the experience of the last two years is making people consider the future of the container-based supply chain from Asia and “just in time” workflow. Shortening the supply time is a key factor, but the increased costs from Asia and the huge increase in the cost of container freight really starts to make manufacturing closer to home, much more of a reality. Not sure how much of that will end up in the UK or if we even have the labour available or willing to work in manufacturing/assembly but we are certainly seeing this in Portugal, Czech Republic, Poland and other European countries – if only we were part of a single market, it may have helped us!

I think the real risk is companies manufacturing or ordering to meet the demand of 2020 as that horse has bolted and we face the real danger of massive over supply when the factories eventually catch up and not enough demand in the market to cope with it. This will result in heavy stock clearance activity on product bought at peak cost due to shipping, labour and raw materials. This will damage brands, massively hit the profitability of the industry and I am sure will possibly result in some businesses failing; both retailers and distributors.

Lloyd Townsend, MD, Ison Distribution

I suspect there has been an element of the toilet roll panic effect exacerbating this whole supply issue. I believe some folks in the market (at all levels, from consumers to manufacturers) have bought up or forward ordered far more than they realistically need for the market usage over a given period.

This has compounded the supply problems generally and risks a glut of product appearing once the excess water from the tsunami of Covid-19 has started to drain away. This effect may even end up with a short-term reduction in apparent demand through the whole supply chain whilst excess stock starts being depleted back to more sensible levels to rebalance with true demand.

An analogy here of this additional factor perhaps would be the chap with his ten Jerry cans full of diesel; he isn’t going to be buying a lot more diesel for a while, unless he’s going to be driving around for more than he ever did before. It’s the same scenario with toilet rolls… (unless he gets really worried of course!)

Tony Barton, Magura

I think that there is always a certain risk involved. From what I can see through dealers there has been a shortage of footfall since furlough ended and there is still a reasonable demand, but the shops have the wrong mix of sizes, models or price points due to delays in the supply chains.

I think we will see levels above where we were in 2019 before pandemic and business will grow more steadily in coming years. What we need is central Government to kick on a gear in promoting safe cycling infrastructure to make commuting possible and also safe for families to ride. That’s how we’ll ensure we get the growth for the future.

Peter Nisbet, MD, Windwave

The issue now is manufacturers don’t necessarily want to invest in new machinery and production lines in case current demand falls considerably. It should also be taken into account that some production facilities in Asia still remain closed or are operating under reduced output conditions due to Covid restrictions and raw material shortages. At this point in time investment could be quite a risk.

How will the bike industry have changed for good once the dust settles and what trends accelerated during this time?

Dominic Langan, CEO, Madison

I would like to think that we gained a whole new cohort of cyclists during the pandemic. I would like to think they will all remember the freedom that cycling gave them during lockdown and how positive it was for their mental health. I would also like to think that government and local authorities also saw the benefits of cycling during the pandemic and will make a proper and concerted effort to build the infrastructure cycling needs and deserves if we are ever to realistic reduce car usage and improve the air quality in our towns and cities.

As an industry I am not sure how much it will have changed. I think in the next couple of years we are all headed for a situation of over supply as we had before, along with discounting and consequently lower margins all round which just prevents investment.

I am sure we got some exciting years of e-Bike growth ahead of us and we just need to make sure we keep that within our industry and not let the motor industry wrestle it away from us.

Tony Barton, Magura

E-mobility has grown, plus we are seeing a lot of smaller OE customers in UK asking for product from us, which is great and we can supply them currently. I think that pandemic has made us look at supply chains and I believe especially in Europe more manufacturing will be done there again. This is a good thing, in my opinion.

Lloyd Townsend, MD, Ison Distribution

The rebalancing of the water following the tsunami wave of Covid-19 effect is where the biggest headaches potentially arise. Some indications are that the market has organically grown, and I think the bicycle market will enjoy a legacy factor of increased business as a consequence of Covid-19.

The logical underpinnings of cycling are likely to continue to grow organically, but, I don’t think we can expect the levels of business to reach the peak tsunami wave levels that the industry experienced in the spring and summer of 2020 for a long time.

The rebalancing of the water following the Covid-19 tsunami wave potentially could be less extreme and less hazardous for businesses if the underlying cycling market has grown enough. I do have concerns that if the rebalancing is extreme (even though it may be relatively short term), then there could easily be some potentially nasty hangovers from the binge session our industry has recently enjoyed.

Concerns aside, it seems reasonably clear that the organic, manageable growth of cycling in general will likely continue to happen going forwards due to the continuing changes in leisure, transport and environmental attitudes and responsibilities of society overall.

Peter Nisbet, MD, Windwave

We expect more focus on cycling and more “bums on seats”, which can only be good. Many are exploring the health and wellbeing benefits. Then there’s e-mobility and e-cargo, which may be the two biggest traits to appear post pandemic, although the UK still falls far behind many other European countries.

During lockdown it looked like local government helped cyclists, and in turn the cycling industry, with more dedicated cycle paths through towns and cities, but most have now been removed. This comes up short on the ‘revolution’ the £2 billion cycling and walking strategy pledges.