Electric bike motor parts maker advances, yet says customers delaying deliveries

Hgears, an upstream parts maker of electric bike motor components such as gears, has alluded to some clients holding off deliveries “related to macroeconomic challenges” in the fourth quarter of 2021.

A Frankfurt Stock Exchange listed supplier that has component parts present in more than half of Europe’s electric bikes, Hgears’ financial statements are a bellwether for the eMobility business in Europe. While the results are good (and that’s in itself is a good indicator of market progress), the statements within are where the clues lie to broader industry trends and the suggestion of clients being unprepared to receive motor parts may suggest bottlenecks upstream.

Hgears’ clients include many of the leading motor makers in the cycling world and the statement does align with a warning from the Bosch CEO late last year that “there is a shortage coming.”

For Hgears new clients coming on board en masse will somewhat guarantee there is a customer order book to be filled and in fact this update speaks of onboarding five new e-Bike client wins, including one “blue-chip customer to produce and deliver several e-bike components.”

The firm does in fact now plan to implement a pass-on clause in many of its customer contracts to prevent future bottlenecks.

Pierluca Sartorello, CEO of hGears, comments: “Despite a challenging environment in 2021, we have remained a reliable partner for our customers. Our full-year 2021 performance underscores the strength of the Company’s business model. It further demonstrates our strategic focus on e-mobility, as evidenced by the five new e-Mobility customers we acquired in the year and whose orders are expected to contribute to revenues and earnings in 2022 and beyond significantly. In 2022, we also secured a new, multi-year contract with a blue-chip customer to produce and deliver several e-bike components. These customer wins are expected to play a critical role in achieving our mid-term targets. Moreover, this solid commercial performance is further evidence of hGears’ strong market positioning and status as a leading European manufacturer of high-precision gears and components. We will continue to expand our pipeline and customer base, and the deals that we have secured in 2021 and 2022 underline our capabilities to capture future growth. With the growing awareness of climate change, urbanization, and the constantly increasing need for micromobility solutions, our leading market position in a fast-growing e-bike market positions us well for future growth.”

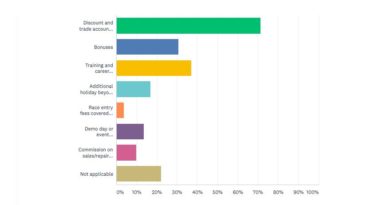

As a result of the client wins and current trade the full-year results for Hgears, which is also a maker of tooling parts, saw group revenues up 6.9% to €134.9 million. Profit increased to €76.4 million, with gross margin at 56.6%, marginally down from 57.2%.

The eMobility business as a portion of all trade actually receded slightly in the face of strong trade in other parts of the business, going from 36.3% to 35.2% this year. The firm has previously forecast its eMobility and electric bike motor parts segment of the business to keep gaining dominance. This slowdown was, however, reflective of the delivery acceptance delays.

Forward looking there’s an ambitious goal to triple the eMobility division revenue to reach €150 million and this remains unchanged; the business still of the firm belief that broader market forecasts are correct and eMobility will become a larger part of the transport mix.

The hurdles that could block progress are said to be increasing inflationary pressures, a resurgence of Covid-19 and ongoing supply bottlenecks in global chains.