Halfords takes comfort from high-end bike sales as weak pound and weather dents forecast

Halfords has today released its Q1 report in which the firm has pointed to a weakened pound as a likely source for headaches down the line.

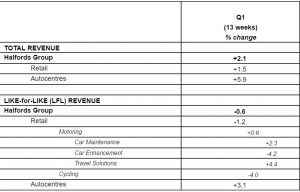

The first quarters results were relatively flat on a like for like basis, with retail revenues falling 0.2%. Cycling was one of the departments feeling the effects of a damp start to the year, declining 4% like-for-like.

Perhaps worryingly for the independent specialist, the statement speaks of strong sales of premium priced bikes, as well as strong performance of the Tredz business since the £18.4 million May acquisition.

Total revenue for the group rose 2.1% in the first 13 weeks, with autocentres driving the lion’s share of the positive news. Adjusting for the timing of Easter, LFL revenue was Group 0.0%, Retail -0.2% and Autocentres +1.7%

In June Halfords outlined a net impact of £3m on profit for FY17 at a USD:GBP rate of 1.45. Today the retailer revealed it has over 75% of its FY17 purchases hedged at around 1.45. The pound is currently trading at around $1.32.

“If the USD:GBP rate continues to be weaker than 1.45 it may have a small further impact later in this financial year, depending on the extent to which it can be mitigated,” added the statement.

Jill McDonald, Chief Executive, commented: “This was a solid performance from our motoring categories, which account for around 70% of Group sales, with continued growth in service-related sales, demonstrating Halfords’ credentials as a specialist retailer. In Autocentres our sales continued to grow through improvements in the customer offer. We had good sales growth of premium bikes, but Cycling sales across the quarter were impacted by both the timing of Easter and poor weather, particularly in April. We look forward to the peak summer cycling season, including our exciting new ranges from Laura Trott and Sir Bradley Wiggins launched ahead of the Olympics. While the recent decision to leave the EU does create uncertainty, we are well-positioned as a business and focused on delivering sustainable long-term growth.”

Joshua Raymond of XTB.com told CyclingIndustry.News that it’s over to the Bank of England now to determine just how big an impact Brexit may play on retailers like Halfords.

He said: “The retailer warned of the impact on the weaker pound will have on its future earnings, having hedged most of its sales at a US dollar exchange rate of $1.45. With that exchange rate now falling to $1.32 and forecast to continue to fall should the Bank of England cut interest rates and announce new stimulus measures, this could make a larger impact on Halfords for its full year.

“In terms of Halfords shares, prices remain more than 30% lower than at this same stage a year ago and expectations are quite subdued. In this sense, these results are unlikely to dramatically change investor confidence and trigger a long term revival. That being said, there remains long term buyer interest at the 300-330p level and this has formed a strong base of support to share prices.”

You can read the full summary here.