CIN Market Data Survey 2023: What makes a bike retailer choose a supplier?

Every year, CyclingIndustry.News conducts a survey with the participation of independent bike retailers in the UK. In each mag we analyse some of the results (you can get hold of the whole Market Data 2023 report here). This time around, we focus on what makes a bike retailer choose a supplier.

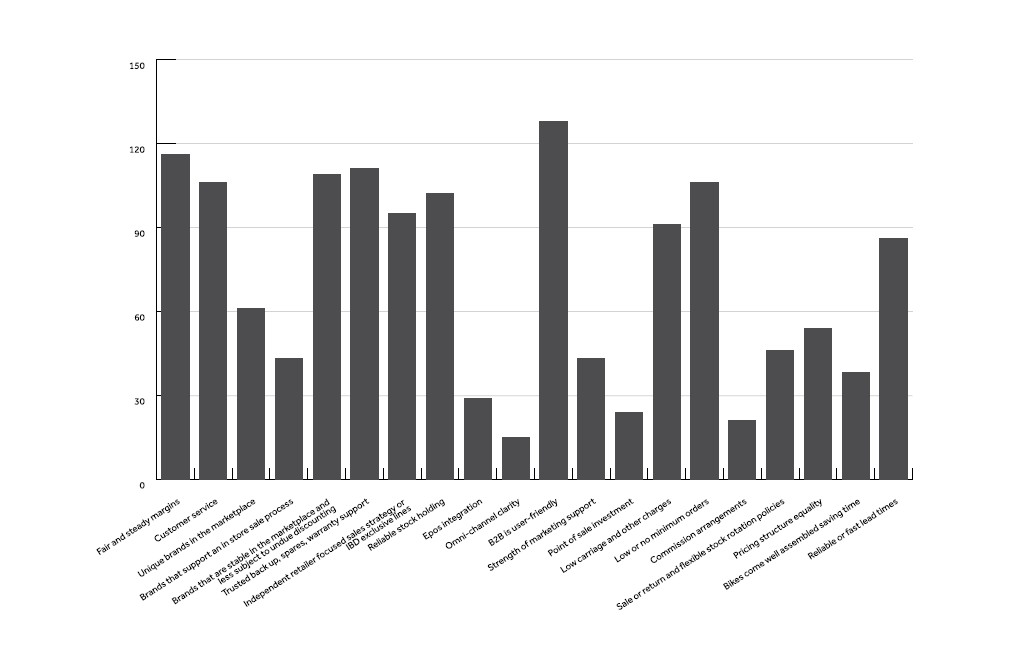

The supplier/retailer relationship is always critical, but in lean years those relationships can be put to the test, with the good ones finding ways to work through difficulties. So, what is it that draws retailers to suppliers? Fair and steady margins (70%) are an evergreen factor, but a whopping three quarters now see the quality of B2B sites as integral in drawing them to suppliers. There’s a cost implication for suppliers there – websites can be a tricky business to get right and imply some cash lay out to bring them up to speed, but as younger generations value the speed and access of B2B it would be hard to logically ignore the area. Convenience (and accessibility) makes sense for time-poor retailers which often have few staff performing many roles. Related, but far further down the list, we see EPOS integration, further implying that there’s still a lot of potential to further digitalise retail transactions in the industry.

Perhaps naturally when the purse strings are tighter, low or no minimum order values were picked out by our survey respondents this year. Stability was on most of our wish lists for 2023 and likewise reliable stock holding, trusted back up (in terms of spares, warranty support, etc) and reliable or fast lead times were all picked out by over half of our survey respondents as key draws when choosing a supplier.

Good old fashioned customer service rated highly – the fifth highest consideration for the nation’s independent bike dealers. Another big factor likely to swing business toward particular suppliers was those with IBD focused sales strategy or IBD exclusive lines. In this issue we hear from brands that have dabbled with consumer direct approaches to market, only to find that working with independent dealers is a more successful strategy and the continued resilience of the IBD – compared with other sectors where independents have all but vanished – possibly provide independents with the understanding that they are in a position to demand such exclusive lines or strategies where they are properly catered for.

There’s a lot of data in those charts – for a more easily digestible version, grab CyclingIndustry.News Issue #3 2023 or view it online here.

There’s a lot of data in those charts – for a more easily digestible version, grab CyclingIndustry.News Issue #3 2023 or view it online here.

In that issue we also investigate spending priorities for bike retailers – surely essential reading if you provide a service to retail (if we do say so ourselves).

This is a very small sample of the information available in CyclingIndustry.News’ sixth annual Independent Retail Study. Find out more by contacting Frazer@cyclingindustry.news.