CIN Market Data Survey 2023: How do bike retailers plan to invest this year?

Where you plan to invest in 2023 is either a perverse question or more important than ever, depending on your viewpoint. When finances are tight, focusing in on where you spend precious pennies is surely more vital than ever…

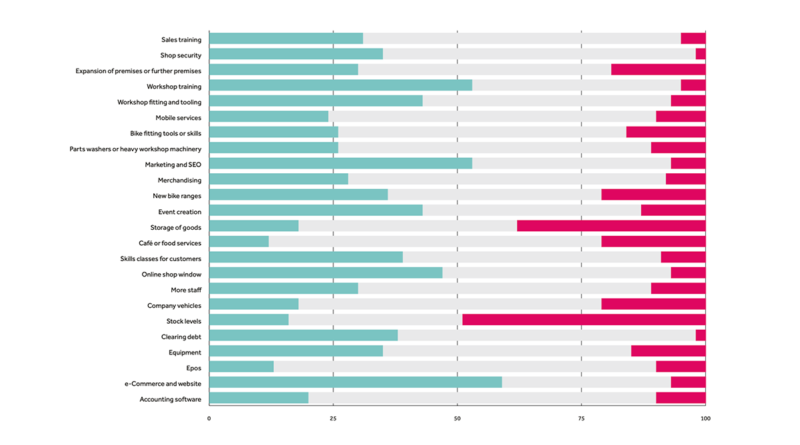

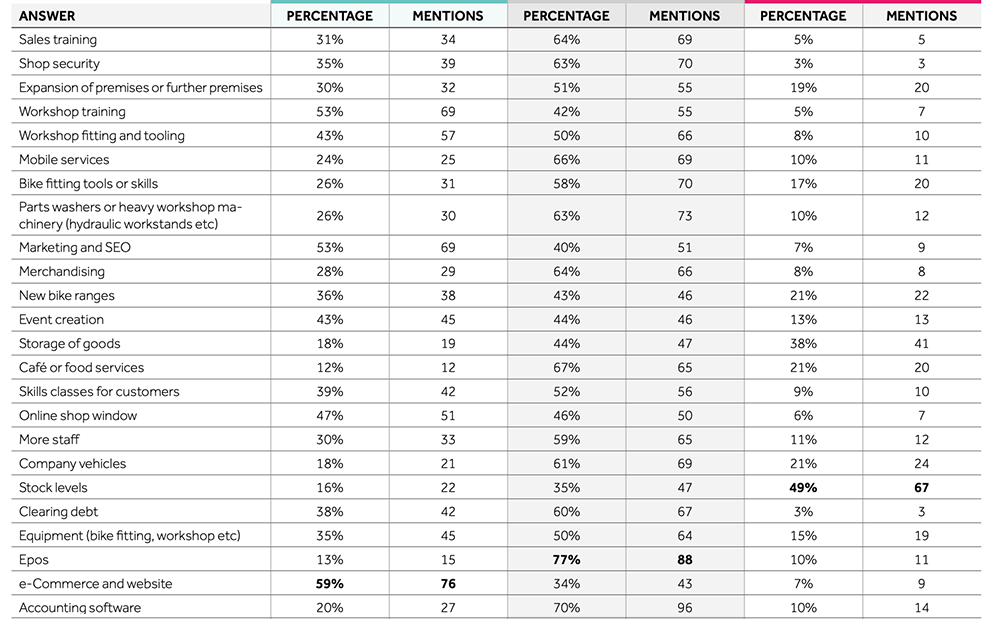

If you supply services to the bike retail sector then we’ll presume that you will be eagerly scanning through these figures. And if your business relates to the digital side of the business then you’ll no doubt be encouraged by these numbers. Retailers are looking to invest in ecommerce and websites as well as marketing and SEO, with the ‘online shop window’ also a spending priority.

CIN writes this at an interesting time, with Wiggle and CRC rebranding their respective sites and having some down time and difficulties in the process, which could make website revamps more intimidating to smaller companies – if Wiggle is having a hard time then how do they avoid similar slip ups? Doubtless there will be plenty of companies out there willing to guide smaller retailers through these processes.

Aside from digital dominance, there’s a huge willingness to spend on workshop training, backing that long held belief that most bike shops value their workshops as vital to their businesses.

On the other side of the coin, retailer investment looks to be pulled back from a few key areas, including stock levels – OK, no surprises on that one. Likewise a stepping away from investing in new bike ranges, which will nevertheless make for difficult reading for suppliers. Maybe more surprising is a fall away for café or food services, maybe indicating that more retailers see that area as a ‘nice to have’ but not an essential part of their business mix. That is a bucking of the ‘experiential retail’ trend that we’ve been hearing so much about in recent years, but when you have to pare back then keeping your coffee machine appears likely to be among the first in the firing line.

Company vehicles are seeing a comparable retrenchment in investment, which will likely be a surefire way to shore up cash levels in the short term at least.

There’s a lot of data in those charts – for a more easily digestible version, grab CyclingIndustry.News Issue #3 2023 or view it online here.

This is a very small sample of the information available in CyclingIndustry.News’ sixth annual Independent Retail Study. Find out more by contacting Frazer@cyclingindustry.news.