Corporate sales buoy car market in 2023. Why not for cycling?

Times are hard for the average consumer, most of us included, and it’s not just the cycling industry that is feeling that lack of spending power.

CIN has spent considerable time looking over the fence at the automotive industry lately, and there’s yet another facet of that mature market that bears comparison: 2023’s new car market saw its best year since 2019.![]()

So, consumers have been spending out on cars rather than bicycles in 2023? Apparently not so – it was the corporate fleet market that delivered almost all of the growth in car sales. That’s a reminder that the automotive market doesn’t solely rely on consumers (shall we specify high earning consumers?) like the cycling market does in the United Kingdom.

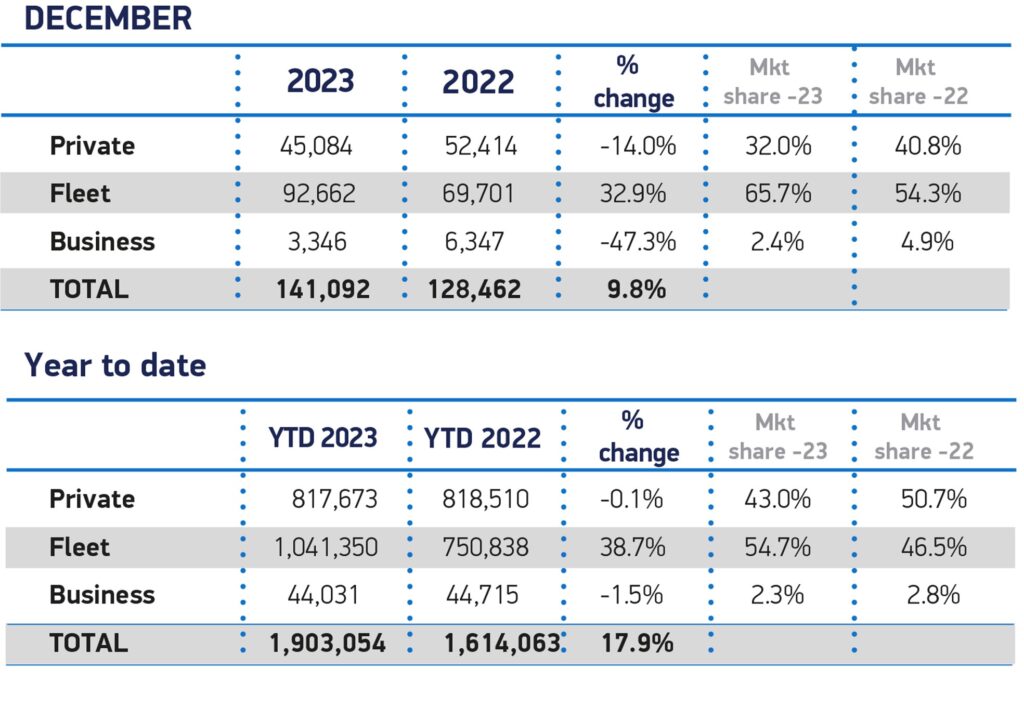

2023’s new car market grew 17.9%, with 1.903 million new cars reaching the road during the year. December saw the 17th month of consecutive growth, up 9.8% (stats from the Society of Motor Manufacturers and Traders). Fleet deliveries rebounded by 38.7% year-on-year. Private consumer demand remained stable after a strong recovery in 2022, with the SMMT acknowledging that “cost of living pressures and high interest rates [were] constraining growth”.

[Tables courtesy of SMMT]

To us, that sounds like a ‘loud and clear’ message about the wisdom of not relying on a single customer type. The latest (Winter 2023) edition of Cycling Industry News includes an interview with bike shop owner Peter Claxton and emphasised the wisdom of bike shops diversifying their revenue stream. When bike sales are slow, at least that café/workshop/boxing club that uses your spare space are bringing in some revenue. However, the principle of diversifying revenue stream is for more than just bike retailers and one that the car market has taken to heart. Consumers feeling the pinch? Let’s push harder to win some fleet car sales with corporate clients.

One of my former publishing bosses used to say he liked magazines that had lots of advertisers. It’s much more fiddly and work intensive to service multiple clients, for sure, but the alternative is much more precipitous. If you only have a few big spenders and one of those clients gets into financial difficulties then your revenue stream is severely constricted with few ways to make up lost ground.

The cycling market has successfully made inroads into the corporate world. There’s cycle to work – let’s hope that this area can be resolved given its current difficulties – and a host of businesses actively providing fleet solutions, leasing options and the likes of Pashley serving consumers and cycle hire fleets… the list goes on, but it seems safe to say that there could be a lot more, particularly in this age of ULEZ, congestion charges and sustainability probably the highest up the corporate agenda it has ever been. Cargo bikes and eBikes are not going to replace all corporate fleet vehicles but it would be plain daft to write off cycling’s opportunity to take a percentage of that market.

An addendum is that the automotive industry is currently lobbying the government to halve EV VAT, to help push more EVs onto the road, emphasising that the cycling industry efforts to lobby on its own behalf are not to be left to chance.