What changed forever when Covid landed with the bike industry?

There is now no such thing as normal, or at least not the normal we know in the bike industry. Duncan Moore quizzes company leaders on the subject of on the road reps, an emerging direct to consumer business and plenty more…

The positive impact of Covid on bicycle retailing is well documented, as too is the impact that lockdowns and Brexit has had upon the supply chain that was trying to support those retailers after that initial rush of sales. But what about the wider cycle industry?

The past few years have been anything but predictable for the country’s bicycle trade. First, there was the worry surrounding the Covid lockdown and concerns about how retail businesses could survive enforced shutdowns, which was quickly followed by elation as IBD were classified as essential businesses and allowed to remain open. This in turn led to one of the biggest boom times for the cycle industry in the UK as the general public, unable to exercise at gyms, turned to bicycles for their fitness fix.

The past few years have been anything but predictable for the country’s bicycle trade. First, there was the worry surrounding the Covid lockdown and concerns about how retail businesses could survive enforced shutdowns, which was quickly followed by elation as IBD were classified as essential businesses and allowed to remain open. This in turn led to one of the biggest boom times for the cycle industry in the UK as the general public, unable to exercise at gyms, turned to bicycles for their fitness fix.

However, the joy was short-lived as the effect of lockdowns around the globe began to bite the supply chain and shipping costs suddenly skyrocketed, too. Whereas the public was panic buying toilet rolls, bottled water, flour and anti-bacterial gel, in the bike trade it was chains, cassettes and innertubes that were in short supply.

But what is the state of play now as those excessive panic buying orders begin to filter through? With a cost-of-living crisis building will anyone be in the market for new bicycles or will the cost of running a second car see more people turn to eBikes and electric cargo bikes? Will IBDs be lumbered with excess stock as distributors look to offload the parts and bicycles ordered in the depth of the Covid lockdowns when service spares were trading above RRP and old models were once again saleable?

It is also worth noting that these are not the only challenges facing the independent trade. Stories frequently appear on the CI.N website of local stores being taken over by manufacturers effectively becoming solus stores for particular brands, notable brand examples being Trek and Specialized.

The situation is not helped by the continued growth of the larger chains and the stack it high and sell it cheap outlets. Is a perfect storm brewing that could spell the end of the IBD as we know it?

If this is the case, then who better to ask than the major distributors who supply IBD with all that they need to stock the shelves?

Could it be argued that the wildly varying stock levels, with all-or-nothing supply issues, were not just due to panic buying and lack of production, but also a lack of outside guidance for IBD owners trying to figure out what to order and when while also struggling to keep the doors open as staff looked for higher salaries in different vocations? Remember that during the Covid lockdowns rep visits to IDBs stopped and suddenly there were few around able to reliably offer advice on what was due to be available, what was in short supply and what was in demand.

Could it be argued that the wildly varying stock levels, with all-or-nothing supply issues, were not just due to panic buying and lack of production, but also a lack of outside guidance for IBD owners trying to figure out what to order and when while also struggling to keep the doors open as staff looked for higher salaries in different vocations? Remember that during the Covid lockdowns rep visits to IDBs stopped and suddenly there were few around able to reliably offer advice on what was due to be available, what was in short supply and what was in demand.

With the rep visits stopped many IBDs that were not already finally made the move to using distributors’ B2B websites, but has this meant the death of the travelling rep; do they have a place in today’s retail environment and the benefits that they traditionally bought with their visits? After all isn’t one of the key selling points of IBD culture that it can offer a face-to-face service that simply isn’t available online and, therefore, can’t the same be said about rep visits?

Peter Nisbet, Managing Director at Windwave, still believes that traditional travelling reps have a place. “We believe the role of the travelling rep to be extremely important. Their role is to sell the product for sure, importantly though, more and more, they help train shop staff as products become more complex. They are also a necessary interface between the dealer and the distributor, particularly in relation to the supply of data needed for EPOS systems and B2C websites.”

However, he also offers a word of caution noting that the role is having to change because of outside forces. “Given the huge petrol price rises we now ask our sales team to spend at least one day a week working from home arranging appointments, making telesales calls and offering the dealers the support they need remotely.”

Ison Distribution’s, Managing Director, Lloyd Townsend takes a similar view to Nisbet on the changing role of reps and their need to return to visiting stores. “Our areas account managers visit our dealers to ensure that they are well-informed about the latest products, trends and special offers and have improved product knowledge to allow them to take opportunities in the market. The Area Managers will also help with forward ordering and marketing and, of course, will assist with point of sale and any queries or questions. They will also assist with IT queries such as how to use the many features on our website and assist with EPOS integration. Ultimately, our Area Managers are much more than sales representatives.”

He then goes on to explain how the nature of the visits has been forced to change. “Naturally, the Covid-19 lockdowns have brought in supplemental ways of us supporting dealers without the requirement for a weekly ‘scratch pad sales visit’, but our Area Managers will continue to visit our dealers to help build an understanding of their needs, and in doing so, be able to help us deliver the best service for our customers.”

A similar set of views are shared by Bob Elliot & Co. Ltd.’s director Paul Elliot who says: “Our reps are back on the road full-time, but their visits may not be quite as frequent in some cases, as customers have become more familiar with our B2B during this time. However, having said that most customers see our reps every month. We may be traditional in this sense, but we believe in the face-to-face element of visits wherever possible (geography permitting sometimes) to work closely with our customers.”

Of course, it was not only the visits from travelling reps that got put on hold at the height of the pandemic. For a couple of years there were no trade shows to attend. Whether this was a good thing or not, with some manufacturers moving to virtual product launches, depends on who you speak to. In CyclingIndustry.News annual research it was found that 23% of stores were ‘unlikely to return to trade events’ against 32% who said they would; the remainder being on the fence on the subject.

For many, it meant saving both time and money with no need to close the store for a day and spend on travel, while for others it removed the ability to showcase their goods and give buyers a chance to get hands-on and ask questions.

“We pulled out of a few national shows prior to Covid as we weren’t finding them as fruitful as previous years,” says Elliot. “A lot of focus seemed put on the paying retailer who were unable to purchase from us on the stand – and we weren’t willing to sell at the same time to support our stores. This left confusion for many, although we were able to push messages across to customers about our brands.” So, while it’s a no from Elliot for the traditional trade show experience he is still relieved to be able to travel again himself, explaining: “However, we are delighted we are able to travel as a company again and be able to see suppliers across the World.”

However, Townsend is slightly more positive on the traditional show scene saying: “Pre-Covid, there perhaps was a growing feeling that physical shows were getting less desirable to attend, but perhaps the lockdowns and the increase in online business have actually increased the desire for customers to see and touch products in the ‘real world’.”

As far as Nesbit is concerned that is no doubt about the validity of trade expos. “As a co-organiser of the Core Bike Show [register at Corebike.co.uk, held 19th-21st Feb 2023], I am a firm believer in trade shows. It is important for dealers and distributors to meet in person and for shop staff to meet representatives from the brands. It also gives a great opportunity to meet the voice from the phone in person and see products in the flesh.

“During lockdown we did run a ‘virtual’ Core Bike Show and despite a huge effort from all exhibitors, the engagement was a lot less than hoped. Unless an event is attended in person it is very easy to get sidetracked, or not attend at all. The same happened to me with the virtual Taipei Bike Shows.

“We also held a Transition Bikes uplift demo event back in September at the Forest of Dean called ‘Rides on Us’, inviting dealers and consumers to attend for free and this was a huge success. Without doubt, the right participation events are hugely popular and lead to an uplift in sales as are events with a mix of static displays and participation.”

It would, therefore, appear that some normality is beginning to return to the IBD market in terms of how distributors and stores interact, but what about the changing nature of retail with brands becoming more willing to go direct to consumers, or open dedicated stores effectively cutting out extra costs? Now add in the pressure that online sales bring and which allows for greater reductions of overheads and how are distributors reacting?

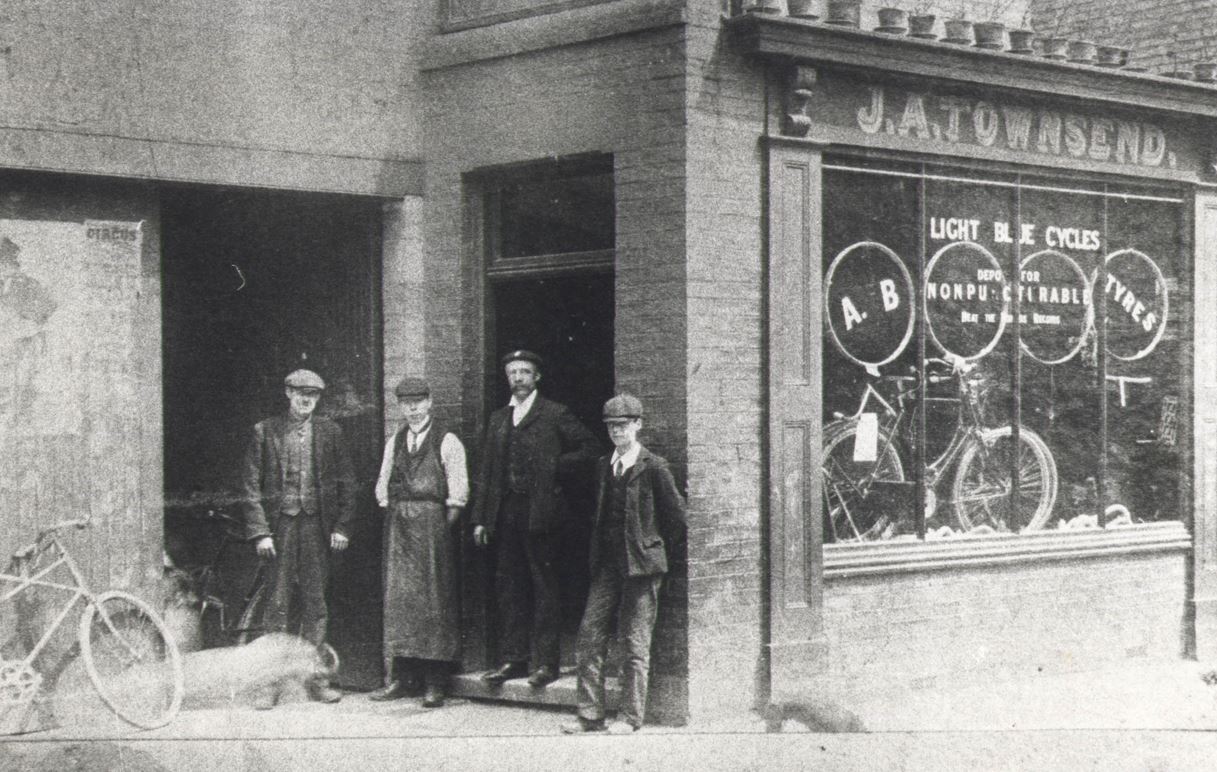

“We evolved from manufacturing custom bicycles to retail, then to distribution. We retain a retail shop, and as a consequence, we fully appreciate the pressures that retailers endure,” says Townsend. “We have no plans to open more shops than the century-old one that we still have. Ison’s distribution model involves working more closely with dealers who share our vision of working together to form a solid local retail service for the consumer. “However, I can foresee a potential future where major brands (and/or large distributors) effectively take the place in the supply chain of some of the existing independent retail shops. This will be less of the case in the more specialist sectors of the market, as the complex number of product options that the specialist sector can end up handling becomes difficult to efficiently scale for a large organisation.”

Elliot is a firm believer that there is still a place for traditional IBDs, too: “We foresee a big future for IBDs. Whilst online is prominent and extremely successful – the IBD can offer different enhancements to a ‘sale’. The expertise and skillset of many IBDs and the interaction that takes place face-to-face is still an important factor to many consumers. The workshop and service element of any store now is very important. Then there’s the evolution of a store to offer a venue experience with food on site to sustain riders, or a refined customer experience. As a business, we have no plans to bypass the IBD and work directly with the fulfilment or opening physical stores. Our focus remains 100% fully on our customer base.”

These sentiments are echoed by Nesbit, who says: “I believe there is a strong and positive future for IBDs, but I do accept they face huge challenges. There is no better place to buy a bike than from your local store. It is important for a dealer to explore all discipline options and sizes with customers. I do believe that IBDs have a great opportunity as eBikes grow, particularly as they are bringing new demographics into cycling. It goes without saying that after sales, service is a strong and profitable revenue stream for independents.

“As a company, Solent(UK) Ltd [t/a Windwave] does not believe solus style dealerships are the way forward and we feel the offering from this model is not broad enough. Consumers like plenty of choice under one roof. I can and do see destination stores with good access becoming more and more popular. This said, there is, without doubt, a trend from the bigger brands to aggressively offer direct B2C sales and create own brand chains.”

How much impact is this move away from traditional bicycle retailing impacting the industry? For Nesbit it is not yet an issue. “To date as a multi-brand distributor we are not negatively affected by the trend for manufacturers going dealer direct,” he says. However, he does then go on to caution that “we know that most large brands are watching this trend closely and could be considering this option.”

While direct to consumer sales may be being considered by the big players Nesbit also feels that it will not be a rapid transition simply due to the costs involved in abandoning the traditional IBD model and going direct. “The costs to set this up in a country are high and more specialist brands would not have the sales, even with bigger margins, to create the profit needed to sustain such operations. The customer service cost alone is huge, for a company our size, for instance, we have three fulltime staff in the servicing department. In some cases, this brings IBDs to us as they look to replace big brands who are gradually shifting to the direct model.” So, for Windwave at least any competitor going consumer direct is potentially a good thing.

Elliot too is similarly sanguine about the threat to independents of bigger brands going consumer direct. “Quite often these models revert back to type if unsuccessful. We believe our relationship with our suppliers is very important and we hope that our transparency in our model aligns with theirs to hit the market.

“We did launch our own brands (KranX & KX) to keep control of what we were able to push into the market without the fear of change a few years back. This added extra security, but also to ensured we are bringing the customer desirable and relevant products. There are huge numbers of manufacturers still wishing to work with distributors and the travel corridors opening up once more should only aid this. And obviously, this will in turn be of benefit to IBDs.”

It would therefore appear that there is still a place for IBD but what will be the next challenge they have to face up to? Will it be the continuing rise in subscription services turning the heads of non-committal customers, or will the rapidly increasing uptake in eBikes bring other new and more dynamic players into the market, for example car dealerships looking to grow sales revenues with the addition of eBike ranges?

“I can see a place for subscription services for children’s bikes as the life cycle of a child’s bike is quite short as they grow so quickly and with the increasing awareness of sustainability,” says Nisbet, adding “It is great that some providers also ‘recycle’ previously sold bikes. Over the years I have seen several companies try to offer subscription services for adult bikes, although personally, I haven’t seen any of these being particularly successful. Perhaps with further market segmentation, adults may look at this service to have the use of a bike in a subcategory perhaps ‘try before you buy’.

“I can see a place for subscription services for children’s bikes as the life cycle of a child’s bike is quite short as they grow so quickly and with the increasing awareness of sustainability,” says Nisbet, adding “It is great that some providers also ‘recycle’ previously sold bikes. Over the years I have seen several companies try to offer subscription services for adult bikes, although personally, I haven’t seen any of these being particularly successful. Perhaps with further market segmentation, adults may look at this service to have the use of a bike in a subcategory perhaps ‘try before you buy’.

He continues “Ebikes represent a fantastic opportunity. Ebikes are bringing new cyclists into the market, which can only be good as they need P&A. Growth in pedal assist is by far the strongest in the market. In recent months several dealers have said ‘If it wasn’t for eBikes I wouldn’t be selling bikes at all at present’. The UK still lags far behind many European countries where eBikes account for up to 70% of all bike sales. With more government funding for cycling infrastructure, motorist education and an increasing awareness of environmental issues I believe we could enter a new ‘golden age’ for cycling.”

Elliot is positive too about the impact of eBikes on the retail market. “Ebikes are a big plus for stores. There is an investment required, of course, but it is the big growth sector across Europe and now the UK, too. It can help drive greater revenue due to the cost of the bikes, but with accessories not necessarily taking the same trajectory in costs – it could help with more spend in this sector too – we can only hope!”

Townsend doesn’t yet see a great demand for subscription services within the cycle sector, saying: “I believe the vast majority of folks still prefer to have their ‘own things’. The more specialist the product sector, the more I think this still will be the case.”

He does, however, think there may be some opportunities with youngsters’ bikes. “The most logical area for subscriptions to make an impact to my mind is probably the children’s market where the customers literally outgrow the product way before the product itself needs to be replaced or often even repaired.”

And like Elliot and Nisbet, he sees eBikes as having great potential. “I can definitely see eBikes sales growing, but whether that is via specialist eBike stores, or by other retailer sectors adopting more of the eBike culture, I’m not quite so sure. I expect we will see both expand. I’m also conscious that the current motorised vehicle markets may become more involved.

“Ebike-specific P&A will almost certainly become more and more relevant as eBikes develop and use more bespoke products other than those which are currently taken directly from existing bicycle technology.”

It would therefore seem that while the boom is well and truly over, with the cost-of-living crisis beginning to bite there is potentially still a place in the retail market for reactive IBDs and that the supply chain behind them is still there to support and supply the sector’s stand against some increasingly varied competition.