Bike industry begins to consult on supply chain resilience in Europe

Cycling Industries Europe, the trade body umbrella representing the bike business in Europe, has begun pulling together its combined working group knowledge on supply chain resilience and precious materials in a bid to meet head on challenges to industry found in the European Union’s EU Critical Raw Materials Act.

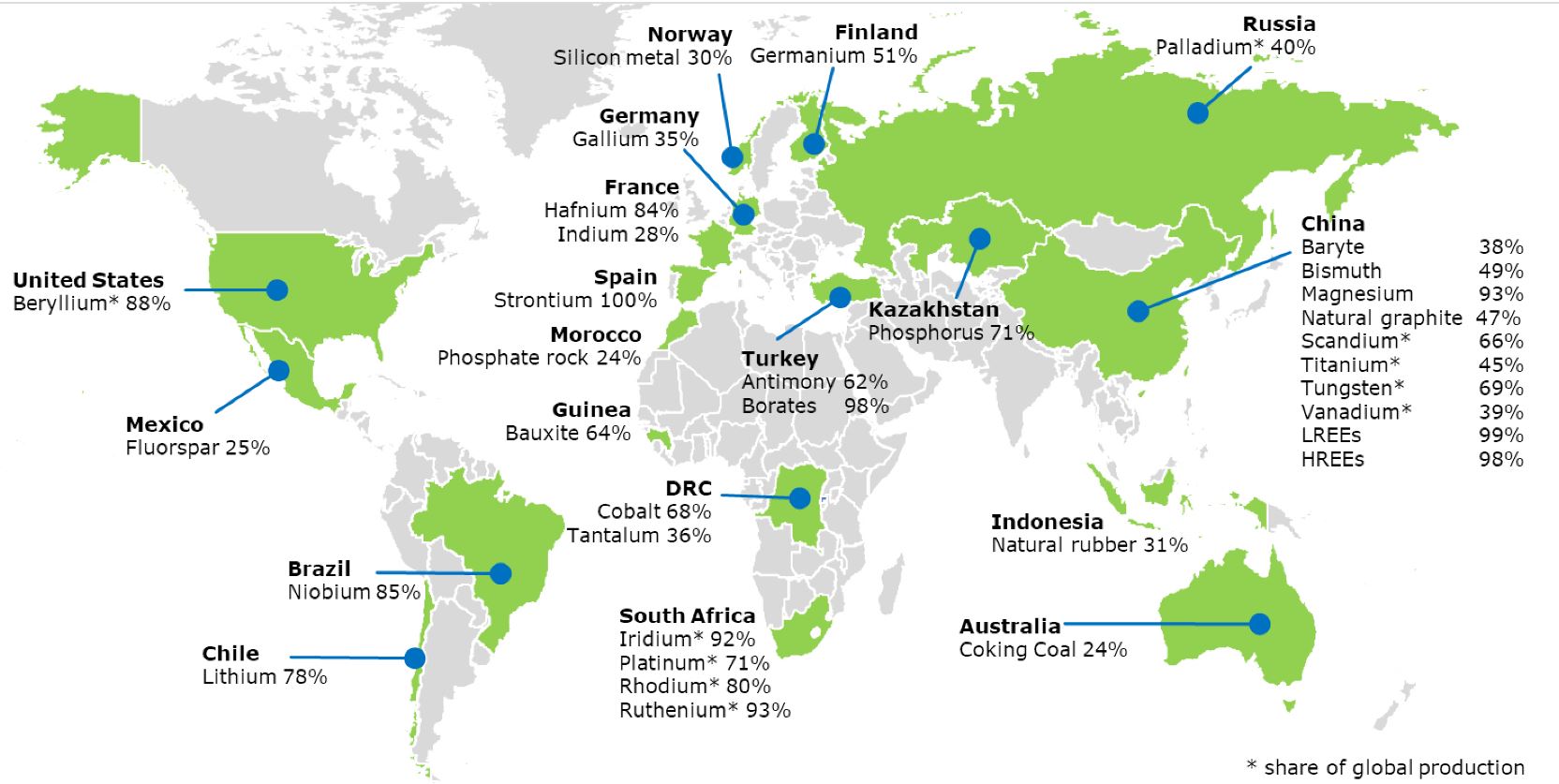

Describing lithium and rare earths as “soon be more important than oil and gas” in her September State of the Union of speech European Commission President Ursula von der Leyen’s speech called upon industrial transitions that insulate Europe against further supply shocks, but that also diversify the supply of raw materials that are critical to manufacturing. There has been a particular emphasis on getting under control supply and sustainability practices around those precious components of batteries.

Kevin Mayne, CEO at Cycling Industries Europe told CI.N this morning: “The Raw Materials Act encompasses trade competitiveness, key new technologies and so much more. Under no circumstance will bike industry do this work alone and collaboration is required from within and with other industries too. We will need to join the European Batteries Alliance and key raw materials working groups. There’s 50 raw materials on the critical elements list (see base of article), from rubber, to rare earth minerals and additives. We have begun doing an audit with our working groups to understand which most affect the European cycling industry and why.

“This is new for bike industry – we are now considered a significant part of the electromobility industry and in truth are the biggest by unit number. We are not historically used to being in these conversations, but we are now firmly at the table and obviously just as exposed as the car or drone industries, for example.”

A first round consultation is now underway with industry bodies encouraged to submit their take on achieving goals aligned to the Critical and raw Materials Act. Working on behalf of the European bike industry, Cycling Industries Europe is currently consulting experts on where future raw material supply bottlenecks may crop up, as well as how the market as a whole can work in a more organised fashion to promote a circular economy.

According to Cycling Industries Europe the legislation is likely to eventually cover:

- Increasing and diversifying the supply of critical raw materials to Europe

- Catering for increasing demand and pre-empting shortages

- Increasing domestic supply capability in Europe

- Boosting circularity and research

- Preventing uncoordinated EU Member State action

Kevin Mayne continues: “The real issue is to get everyone on board with working with other sectors, this is treated at trade association level. It’s more than the competitiveness of one company; we learned this during Covid’s worst. Ultimately, when pressure came on supply chain system it affected everyone in all industries. If we want to sell another 10 million units in Europe above where we are now it’s going to put pressure on supply chains.”

In the response to the consultation it is expected to be underlined that the electric car “require(s) as much as 250 times more raw materials for a single battery as an e-bike” and so bike industry demand is a comparably small consumer of materials in the European mobility trade, and with a product that can quickly deliver on social benefits in a meaningful way to issues like health and congestion.

Mayne highlights that battery metals do stick out as a uniform cause for concern with Europe not generally a source for the raw materials most required. There’s a further warning too, directly to non-EU member states such as the UK.

He says: “Non-EU member countries should consider that Europe is the world’s biggest trading block, so you still need to know about what’s happening as developments could become a threat, or an advantage to supply. The UK will need to act accordingly and may need to apply individual pressure. The European union is doing the work, but British companies would be wise to see the warning flag of where pressures are in the system. Your suppliers will be part of this global issue. Conversations can be chaotic between UK and EU on issues like these.”

As part of the process of identifying was to secure and streamline supply, CIE believes the process will help the trend toward re-shoring certain supply and production, ultimately creating a more localised and low-carbon supply chain in Europe.

As has been highlighted on other topics addressed by Cycling Industries Europe’s working groups Mayne concludes “We know this is a huge topic for companies, so if everybody pools their knowledge and resources we will again be more likely to have a voice in the broader discussion.”