Halfords share price dives as EV and cycling headwinds hit

Cycling and motoring retail giant Halfords has this morning seen its share price dive by over 20% on the back of preliminary results for the FY22.

It’s been a tough week for the retailer, whose boss has called the Government’s removal of a £1,500 EV subsidy a “backwards step” in driving uptake of plug in cars. Add to that the enduring hangover of a bike boom that is no longer delivering in quite the same way and investors took this morning’s update as a reason to be cautious.

Trading at 161 pence at the time of writing, the FTSE listed company has seen its share price more than halve in the year to date and analysts have trimmed targets sharply furthering the retailers’ pain.

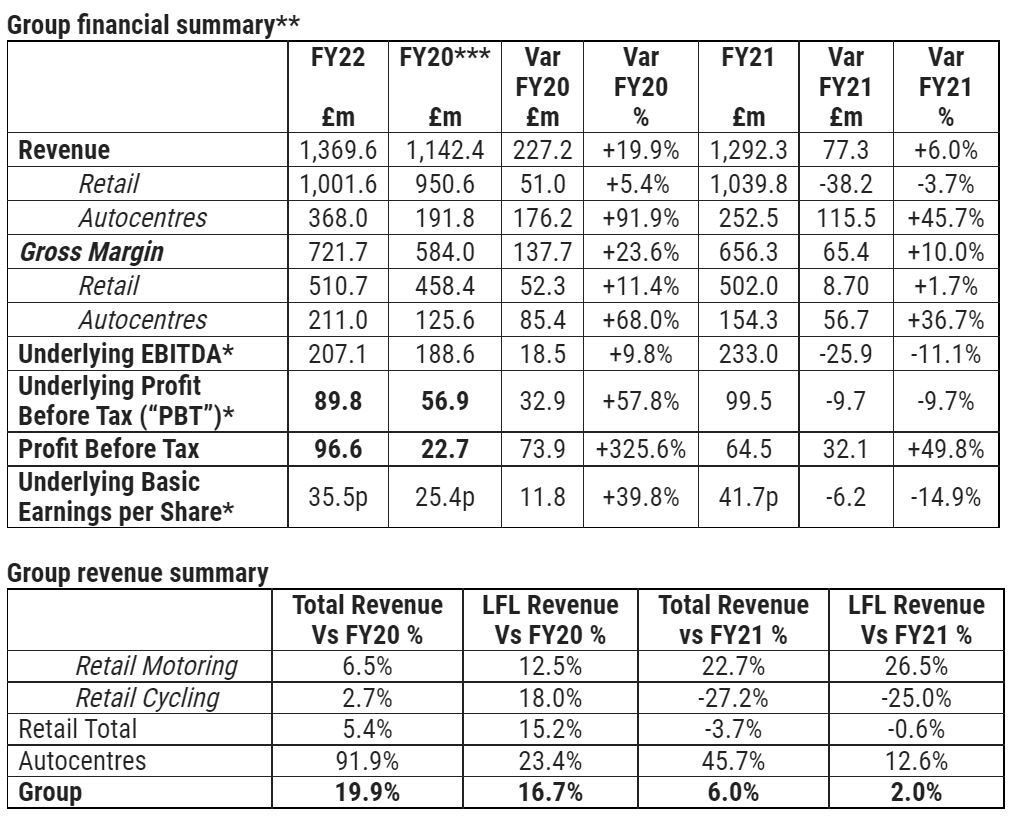

Again choosing to compare its figures to FY20 rather than benchmark against an anomalous FY21, Halfords revenue was in fact up 19.9% over the two years, but just 6% year-on-year. On profitability that meant a sharp reversal. While on FY20 the retailer is up 57.8%, it is 9.7% down on FY21 as the market heads into uncertain territory (which could in theory be a positive for its cycling arm).

Specifically on cycling trade, total revenue sits down 27.2% on FY21 data, which proved to be a sore point as it took the shine off positive motoring performance, up 22.7% in total revenue terms on FY21.

Over the past year the investment has largely gone toward shoring up the firm’s motoring business, which represents 70% of trade. “Acquisitions of both National and Iverson Tyres during the year mean that we are now the UK’s largest motoring service provider,” wrote the CEO Graham Stapleton.

It’s the forward looking picture that has unsettled investors, however. Rising inflation and declining consumer confidence won’t have helped, but further than that there remain supply chain grumbles in the cycling market as well as the Government’s removal of support for EVs.

Stapleton said: “We are continuing to play a key role in helping consumers to choose electric forms of transport and are constantly investing in the training and upskilling of our technicians in this critically important area. Sales of e-bikes, e-scooters and accessories were up 74% on two years ago, and servicing for electric cars in our garages was up 140% year-on-year. We have also rolled-out free electric bike trials to encourage customers to make the switch and are the first mainstream retailer to offer an end-to-end EV charging solution for the home.

“While rising inflation and declining consumer confidence will naturally present short-term challenges for any customer-facing business like ours, we remain confident in Halfords’ long-term growth prospects due to our service-led strategy and the enduring strength of our brand, people, products and services.”

Forward looking

Stapleton wrote that the transformation of titling the business more in favour of higher margin motoring goods is yet to be completed and that the business has been far from immune to “the external challenges, with reduced demand, particularly for more discretionary, higher ticket items, and significant cost inflation impacting our financial performance.”

“Forecasting FY23 with any degree of certainty this early in the year is particularly challenging,” he added, in a line that might have troubled shareholders looking for a reason to stick around as the markets hit a downturn.

FY23 guidance is therefore pinned at between £65m and £75m, with the caveat that “we acknowledge the uncertainty that this year is likely to bring.”