Market Research: Bosch, Shimano & Bafang on electric bikes

Love them or loathe them, there is no ignoring e-Bikes. Duncan Moore speaks to some of the market’s major brands on the subject of sales, regulations, training and trajectory to find out what the future holds…

In September 2017 The Guardian reported that “e-Bike sales rose from 5% of the UK bike market in 2015 to 12% in 2016 (by value). While Halfords dubbed 2017 the “year of the e-Bike” after a 220% sales increase.”

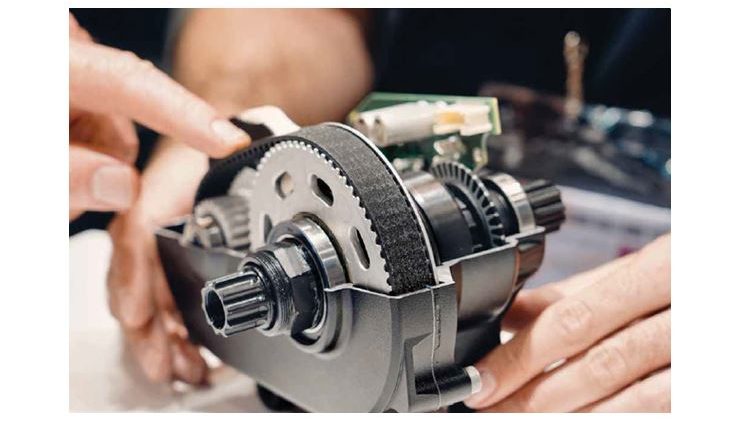

Pictured above: The Brose Drive motor

These figures are backed up by those from one of the dominant players in the e-Bike motor market – Bosch – which predicts that e-Bike sales will treble by 2023.

However, before you run off to buy a container full of electric motors to create your own range of e-Bikes there are a few things you need to know. Firstly, what is an e-Bike? According to the ACT, “e-Bikes that meet the current regulations (The Electrically Assisted Pedal Cycles (Amendment) Regulations 2015), minus a few exceptions, are classified as Electrically Assisted Pedal Cycles (EAPCs).”

So, what are those regulations? In simplistic terms, it is a power assisted restricted top speed of 15.5mph (25kph) and the motor must not exceed a maximum continuous rated power of 250W. If you want to get intimate with the nitty gritty legal requirements then head over to Legislation.gov.uk and find the section on The Electrically Assisted Pedal Cycles Regulations 1983 // (Amendment) Regulations 2015.

But what about the options that are available to manufacturers looking to incorporate electric power into a bicycle? There can be little doubt that one of the main players is Bosch, which has in place a comprehensive product portfolio for e-Bikes. “Everything from highly-efficient drive units containing the motor and gear set to premium-quality batteries and intuitively operated, smart onboard and bicycle computers,” says Tamara Winograd, director marketing and communications Bosch e-Bike Systems.

That wide selection is matched by the other significant driver of e-Bike technology – Shimano. “At a highlevel, Shimano currently has three ebike groupsets under its Shimano Steps umbrella,” says Ben Hillsdon, of Shimano Europe. “The E8000 for extreme MTB riding, the E7000 series for off-road adventures and the E6100 series for city/trekking riding, with a fourth city comfort series (E5000) announced in September.”

Shimano’s e-Bike groupsets borrow technology from the company’s regular cycling range, offering not the choice of mechanical or electronic shifting option, but also the further option of Di2 automatic shifting for hub gear set-ups.

Hillsdon notes: “All of these series now use the same platform technologies and system parameters so manufacturers can use the same frame shapes to accommodate the different compact and lightweight drive unit models. As well as the actual hardware, the software to setup the system is delivered via our E-Tube platform, which is the same platform that dealers use to set up Shimano’s electronic shifting system (Di2) on regular bikes.”

While these two manufacturers are the most high-profile there are plenty of others ready to challenge their market dominance; Continental, the same Continental best known for its line of tyres; Polini, better known for its range of tuning parts for motor scooters; Zhejiang Star Union with a 30-year plus history of is making components for light electric vehicles; Sachs Micro Mobility, whose shareholders are ZF, Magura and Brake- ForceOne; and Fazua which is providing the motor and battery pack for the electric adventure bike from Cairn Cycles, part of the TheRider-Firm.CC collective.

In addition to these, there is also Bafang Electric Motor Science Technology. The company’s European general manager, Jack Brandsen, outlines the company’s range. “Mid, rear, or front drive systems go mainly to OEMs. As a flexible partner, we also can follow customers’ requests if they want to combine Bafang applications with applications of other brands, like batteries and/or displays. Some distributors also buy direct or indirect from Bafang to sell our applications for the aftermarket.”

On the subject of how widespread the uptake of its technology is and how much market share it gives Bosch Winograd notes that “over 70 renowned bike brands worldwide trust ‘e-powered by Bosch” components, all of whom are providing e-Bike riding enjoyment across the globe.”

“Almost every major bike brand now has an e-Bike in its line-up so, without doubt, Shimano’s e-Bike components are an obvious point of conversation during the discussion of Shimano components,” says Hillsdon. This is backed up by the fact that 20 MTB brands use Steps and nearly 70 road/hybrid brands employ Steps technology.

Brandsen points out that Bafang works with many OEM companies but that people might not realise as the product is often supplied on a white label basis. However, he then notes that Bafang’s turnover grew 270% between 2014 and 2017 and that its current production is one million engines per year, which is the maximum level the current production unit is capable of working at. The company has now planned a new factory in Suzhou, China, as well as a second factory in Europe due to the provisional anti-dumping measures introduced by the European Commission on Chinese imports.

With electric motor technology now becoming so prevalent, IBD workshops will have to adapt and understand the new technology, too. Fortunately, however, the producers are ready to address this situation. “We can do dealer training in cooperation with the brands [which use the company’s products],” says Brandsen. However, he then goes on to explain that, “spare inventory and warranty arrangements are always through the brand, no dealer direct service, but service through the brand. We do not offer dealer (or service agent) direct services because many OEMs have mixed set-up of applications with parts from our competitors which we cannot service.”

The training package in place from Bosch includes a complete service to Bosch e-Bike Systems dealers. “Full training is provided by our dedicated UK technical representative,” says Winograd. “Once a dealer is trained, they will gain full access to our online portal and Bosch e-Bike Systems diagnostics tool. Any Bosch e-Bike issues can then be resolved directly by the dealer, with the assistance of Magura UK if required. Point of sale (much of which is free) can also be ordered by the dealer.”

Of course, dealers do not have to rely on each individual supplier for training as a dedicated Cytech e-Bike training course is available. Launched in 2016, it’s currently available in any ATG Training centre in the UK – Oxford, Stafford and London. More details on that course and a wide variety of advice relating to the law around e-Bikes and more can be found on the dedicated section of the ACT website – www.cycleassociation.uk/e-bikes.

Potentially the greatest concern for those working on e-Bikes and also the retailers of them are customers who hack or ask a shop’s mechanic to hack the bike’s control system to illegally increase top speed.

This is an issue recognised by Winograd, who explains: “Bosch e-Bike Systems is committed to responsible e-Biking. More than anything else, this is about defending the status of pedelecs up to 25kph as ‘bicycles’, along with the rights and obligations this entails. The negligent and irresponsible behaviour of tuning providers must not be allowed to put this status at risk. This is why we’re persistently fighting the practice of tuning and are continuing to develop our technology further.

“The revision of the pedelec standard EN15194:2017 states: ‘Predictable manipulations must be prevented or compensated by suitable countermeasures’. This standard becomes valid in May 2019 and Bosch e-Bike Systems is driving forward the development of measures against tuning. Our first measure from MY2019 on is that Bosch e-Bike dealers can use the Bosch DiagnosticTool to determine whether and how often Bosch e-Bike systems have been tuned. This is only a first step towards avoiding manipulation – further steps will follow. We as manufacturers are aware of our responsibility and see the need to develop solutions that make tuning significantly more difficult or even impossible.”

On the subject of illegal hacking, Brandsen simply says of Bafang’s efforts to counter the issue: “We try hard but it always an interesting competition between ‘us’ and the hackers.”

He also notes that there is another battle taking place – one to get e-Bikes more widely accepted.

“In The Netherlands, it is often more convenient to travel by e-Bike than by car. This is due to the law. Cyclists are very well protected and The Netherlands has a very good infrastructure for cyclists. The UK has to catch up there…” This sentiment is echoed by Winograd, who says: “Given the size of the population and the number of conventional bikes that are sold in the UK each year, the UK’s market potential for e-Bikes is significant. However, the UK’s infrastructure appears to be the limiting factor. The relatively low number of segregated cycle lanes means that the majority of small journeys are still made using a car or on public transport – with the majority of bicycles (and therefore e-Bikes) being reserved for leisure rather than being used as a transport solution.”

Yet, despite this reluctance to change, the great British public slowly appears to be accepting e-Bikes. More and more are appearing on the streets and sales figures from the manufacturers (and the investments they are making in developing new e-Bike models) suggest an optimism that the cycle industry as a whole needs if it is to not only to survive, but also prosper.