New bike launches see Dorel’s Q2 results shine

A vibrant European electric bike market and growth with US-based independent stores saw Dorel book in healthy Q2 results.

Revenue grew US$16.5 million, or 7.4%, to US$241.0 million. Excluding foreign exchange rate fluctuations year-over-year and the divestiture of the performance apparel business last year, organic revenue increased 11.1%. Six-month revenue decreased US$5.6 million, or 1.3%, to US$425.6 million due to first quarter softness in Pacific Cycle’s mass merchant business.

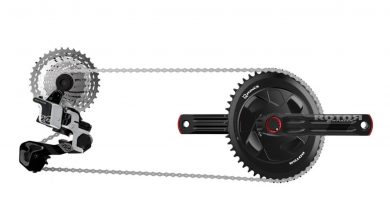

Independents stateside responded particularly well to the launches of Cannondale’s Treadwell, Topstone and EVO models, while European businesses latched on to the new Tesoro Neo X and Synapse Neo.

Announced today, CSG label GT is following with fresh launches hoped to further revenue gains.

Introductions of the model year 20 line-up came earlier than prior years’ and have thus far received strong reviews from bicycle media. Caloi was solid with low double-digit organic growth on the back of success in sales to Brazil’s bike sharing program and a better mix due to Cannondale’s growth.

Pacific Cycle reversed the first quarter sales decline with double-digit revenue growth due to a strong sales recovery at retail, both at brick and mortar and on-line.

Reported and adjusted operating profit for the quarter was US$10.1 million compared to the prior year’s operating loss of US$3.3 million and adjusted operating profit of US$8.0 million, excluding restructuring and other costs.

CSG recorded significant growth in adjusted operating profit with multiple new product launches. Partially offsetting this increase was lower adjusted operating profit at Pacific Cycle, principally due to the negative impacts of U.S. tariffs on its China based supply.

First half reported and adjusted operating profit was US$14.6 million compared to an operating loss of US$4.1 6 million and an adjusted operating profit of US$7.2 million, excluding restructuring and other costs.

The first quarter of 2018 included a US$6.6 million impairment loss on trade accounts receivable from Toys“R”Us.

Trade war to stunt potential?

“We are encouraged that, without exception, all our businesses have produced top-line growth. U.S. tariffs imposed on China-sourced goods and its impact on retail price points have created uncertainty on customers’ buying decisions as well as on supply chain and inventory planning processes. The chaotic market conditions have resulted in margin pressure, particularly at Dorel Home and in the mass channel at Dorel Sports.

“New product launches at Dorel Sports have delivered excellent results and we remain encouraged going forward, particularly with the on-going success at Cycling Sports Group (CSG),” commented Dorel President & CEO, Martin Schwartz.