Comment: Bike restock priority presents dilemma for southern hemisphere

It’s becoming apparent to that the Covid-19 related bike boom will have two distinct phases and that the second phase will be larger and longer than the first. Reporting from Australia, bike industry journalist Phil Latz of The Latz Report suspects bike restock priority could hit some countries harder than others…

In Australia we’re already coming out of phase one. That’s been when bored people, chafing at the bit from lockdown: closed gyms, closed theatres, closed sport, closed pubs and restaurants and closed everything else, have taken to bicycles in huge numbers.

They’ve been riding with their families, riding to let off some steam and to get some exercise.

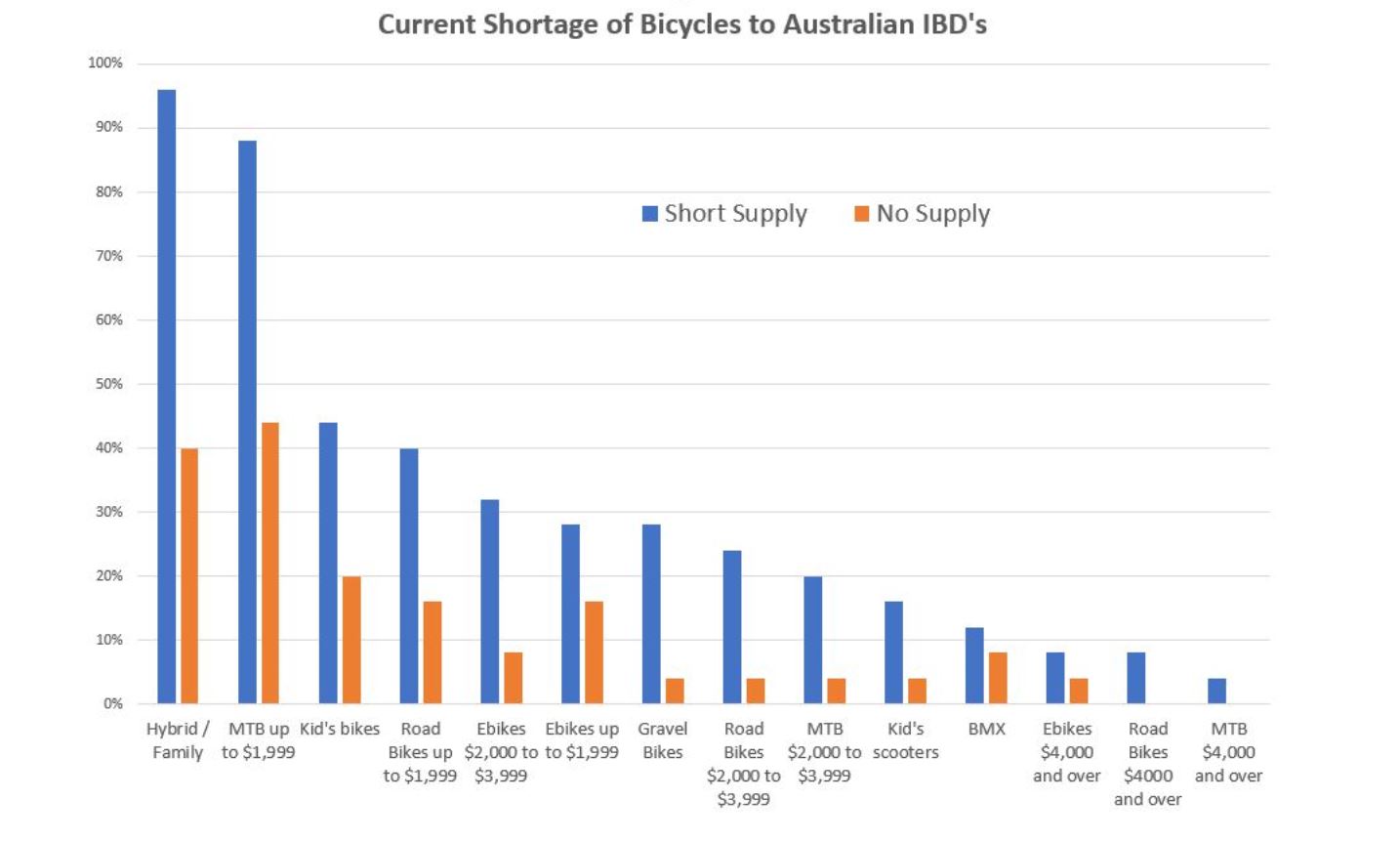

We’ve seen the results of this in out-of-stock bicycle wholesalers and retailers – at least for low to mid-range bicycles.

Phase two will get underway as restrictions are eased. More people will be required to go back to work, but those in cities will find that traffic goes from ‘utopian quiet’ as it has been during lockdown, to busier than ever. I think that phase two won’t even happen in country towns and cities that where car’s transport mode share is already 90% plus.

So the main cities that will experience phase two in Australia will be Sydney, followed by Melbourne and followed by the other mainland capitals to a lesser extent.

We can already see what phase two will look like. Unlike phase one which was about exercise, family and recreation, phase two will be about transport.

As you can read elsewhere in The Latz Report, northern hemisphere nations, particularly across the Europe and the UK are taking unprecedented steps to fast track the provision of more space for cycling as part of their Covid-19 recovery plans.

Here is a key reason why. Most major cities usually have crowded public transportation systems such as subways, buses, heavy and light rail and ferries. These systems do the heavy lifting, particularly for commuters to the most crowed city centres.

But under social distancing requirements, these systems will be mandated to operate at just a fraction of their regular passenger capacity. Quite apart from regulations, many people would not want to take the risk of riding in a crowded compartment until there’s a Covid-19 vaccine.

As economies gradually open up, and more people need to restart commuting to work each day, what alternatives will these commuters have?

Many will still work from home. Company policies will have to change. Governments will try to stagger working hours to broaden the morning and afternoon peaks. There will also be less staff allowed in some crowded city work places. But will these measures be enough?

If more commuters drive, the streets will be choked by even worse traffic jams than normal and there will be fewer available spaces to park their cars at their destinations, often at prices they can’t afford anyway.

However, multiple studies have proven that the carrying capacity of bicycles in terms of people, per hour, per traffic lane is far higher than the capacity that cars can achieve. That’s a simple consequence of bicycles being so much smaller and being able to safely travel much closer together.

And of course, at the final destination you can fit at least 12 bicycles per single car parking space.

Therefore the smarter cities across the world are realising that, quite apart from any health, environment or other benefits, sheer space and logistics require that if they’re going to maintain social distancing in public transport and not have their city grind to a halt under the strain of increased car trips, they’re going to have to embrace cycling and walking.

Recent announcements in cities such as London and Paris, whose combined population when including their greater urban areas almost equals all of Australia’s, are little short of ‘radical’ or ‘revolutionary’ when it comes to the speed and scale of steps they are about to take to increase cycling’s mode share.

What does this mean for Australia’s bicycle industry?

The northern hemisphere is already heading into summer, their peak sales season and a bike restock is underway after an earlier than usual surge in sales prompted by the virus.

These new coronavirus-linked measures are likely to turbocharge sales across bicycle markets that are already far bigger than our own.

What are overstretched bicycle manufacturers going to do when faced with a choice between keeping their largest customers happy in their peak season versus restocking the relatively small, but currently gap filled warehouses and showrooms of Australia’s bicycle industry as we enter our usually quiet winter season?

Of course, manufacturers will not want to miss out on any sales, so they’ll be ramping up production as fast as they can to cash in on this short term opportunity. But they’ll be trying to do this at a time when many economies are still largely closed and logistics, particularly air freight, is very limited and expensive, flowing onto sea freight price increases and other challenges.

Reliable crystal balls are in even shorter supply than low end bicycles at the moment, but my prediction is that those Australian dealers who have said in our survey that things will be back to normal in two months are going to be disappointed.

Covid-19’s bicycle supply chain disruption will continue for perhaps triple that time. On the upside, for those more enlightened cities at least, the new ‘normal’, until an effective Covid-19 vaccine is developed and globally implemented, is going to include a lot more cycling, which will be supporting a bigger bicycle industry into the future. It will even further grow the e-Bike market as a lot of these new ‘little other choice’ cycling commuters will prefer them.

Phase two will be significant, but not so big in Australia because our cities are largely already built around cars. But in those cities that usually have a much higher mode share of walking, cycling and public transport compared to driving, which is pretty much everywhere on the planet apart from us, the USA and Canada, phase two will be huge.

To read more about shifts in the supply chain, see yesterday’s article on the demand in the UK and a new fluidity in supply as some sources run dry.