Credit Assessment: Can you access the funds to help grow your business?

Courtesy of The Association of Cycle Traders

Nearly half of UK SMEs say they have experienced barriers when looking for finance, with one in four SMEs being turned down when they applied.

Having an insight into your business’s Credit Health is key to accessing funds you may need to help grow your business.

One of the reasons so many small businesses are being turned down for finance is the level of risk that traditional lenders perceive. SMEs are less likely than bigger businesses to have the information required by lenders to make an informed investment decision, including a lack of credit history or trading record.

As a result, the lender’s funds are usually driven towards larger and more established firms that better fit the credit assessment methods, leaving small businesses without the financial support they need.

According to a report by the Department for Business, Innovation & Skills (BIS) 69% of SMEs have never checked their business and personal credit scores, with less than a fifth saying they take active steps to manage their score. Often this is because of the perception that credit scores are not relevant to the way SMEs manage their business and cash flow. As such, credit scores are largely ignored by the SME sector.

However SMEs need a credit assessment that really considers what they are doing and how their cash flow works. Whether you’re a start-up looking for finance to get off the ground, or a growing company seeking funding for expansion, a lender using the right credit assessment method will look to build a picture of your circumstances to assess how much they can lend you.

With the right method of credit assessment, SMEs are much more likely to receive a score that opens their access to credit.

The right solution for your business

Until now there have been few options for SMEs to turn to when seeking business credit. However, the ACT have teamed up with inFund to offer SMEs the chance to view their Credit Health for free.

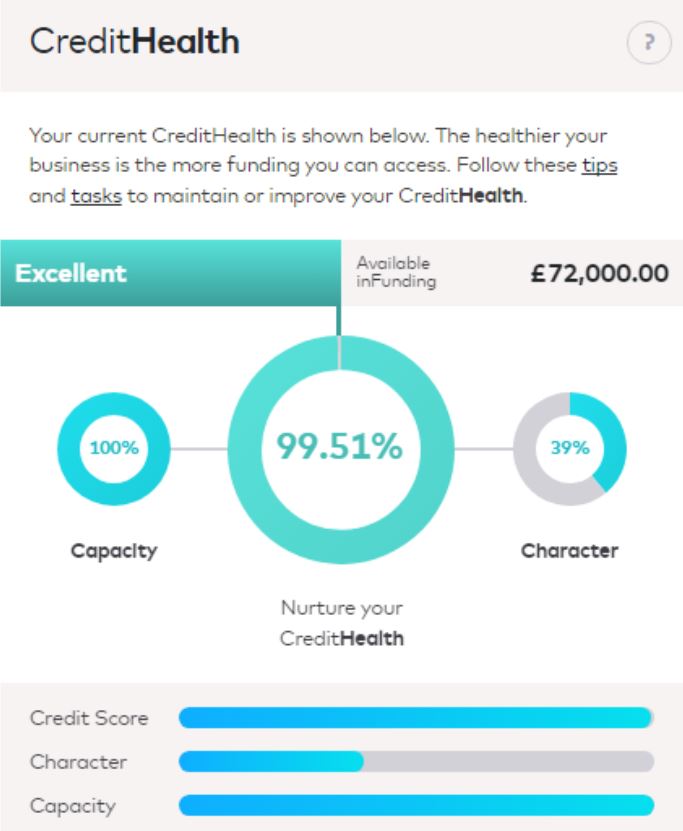

It takes just a few minutes to create and it is more than just a score. It is a live representation of where your business is today in respect of creditworthiness and it comes with pre-approved Credit Capacity – the maximum amount that could be made available to you as a business loan or line of credit with suppliers.

Don’t wait until it’s too late to find out if you could get the funds you need – start managing your Credit Health today. Visit www.actsmart.biz/infund to set up your free account.