Shift Active Media talk, ‘What’s Next? Prospects for the Cycling Industry’

With February now firmly in the rear-view mirror, Spring Classics underway, and many in the industry wondering what, post winter blues, 2023 will really look like, CI.N has been given an exclusive look at the latest ‘Prospects for the Cycling Industry’ research conducted by Doug Baker and the team at Shift Active Media.

‘Where We Are Today’, a study carried out in-house by the Shift’s research & strategy department, represents the first in a series looking at various aspects of the cycling industry and how brands can navigate what is clearly a time of change.

Headlines from ‘Where We Are Today’.

- Overall sales: Up (in value) on 2019. Down on 2022.

Whilst the UK total market volume and value, versus the first half of 2021, has declined by 27% and 25% respectively – total market value currently remains 17% ahead of 2019 – and projects to finish the year 19%. This is primarily driven by higher average prices and eBike sector growth.

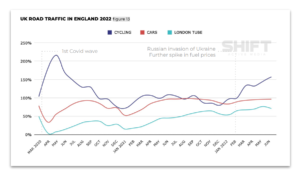

- Increased overall participation. More people are riding their bikes more regularly in 2022 than they did in 2021.

- Casual, leisure, and childrens’ bikes are the categories hardest hit.

In the UK, hybrid bikes and childrens’ bikes have dropped as a proportion of the overall market versus 2019 (Bicycle Association).

The Department for Transport has reported that the largest drops in participation from the 2020 peaks to 2021 were seen amongst general leisure and younger riders.

The Department for Transport has reported that the largest drops in participation from the 2020 peaks to 2021 were seen amongst general leisure and younger riders.

- eBike as a category is still growing. Positive short and medium-term signals for eBikes, although some slowing of growth rate in Germany (which already has a very high ownership rate (13% of all households).

- Commuting is a mixed picture. EU and UK see growth, whilst the US declines. Working patterns are likely part of this division.

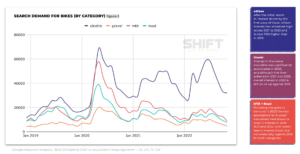

- Search demand for new bikes varies by discipline. Core enthusiast disciplines are seeing fewer searches for ‘best bike’ than in 2019

- Interest in the premium road category remains strong. Supply never met levels of demand during the Covid boom. Affluent consumers continue to be less impacted by cost-of-living issues

- Categories that better met demand during the Covid boom are down. Upgrades, helmets and apparel were easier to buy, leading to a softening of demand to pre-2019 levels

- Indoor cycling is a microcosm of the industry. Participation and interest in training platforms is higher than pre-pandemic, but hardware demand is lower

What are the implications for brands?

Based on the report’s findings, Shift’s Chief Strategy Officer Doug Baker offers the following guidance for brands: “2023 may well see a shrinking market across the board. Brands need to accept that growth will only come from stealing share and outperforming the competition, and those that cut efforts to build demand will struggle in both the near and long term. Investing in marketing during a downturn leads to long term growth, and the successful players will find the right balance between investing in demand creation (brand) and demand conversion (performance).

Based on the report’s findings, Shift’s Chief Strategy Officer Doug Baker offers the following guidance for brands: “2023 may well see a shrinking market across the board. Brands need to accept that growth will only come from stealing share and outperforming the competition, and those that cut efforts to build demand will struggle in both the near and long term. Investing in marketing during a downturn leads to long term growth, and the successful players will find the right balance between investing in demand creation (brand) and demand conversion (performance).

“Driving efficiencies will also be crucial, first by conducting regular auditing of marketing activities, and secondly by prioritising categories, territories and channels that have the highest potential for growth. Finally, being nimble is key – brands ready to take advantage of lower media costs and pivot into new types of content are the ones most likely to get cut through in what is a rapidly evolving landscape.”

“We understand and sympathise that many in cycling will face challenges and difficult decisions in the coming months. The silver lining is those that select the right marketing channels and invest most effectively, often come out of these periods stronger than before.”

- For those wanting to dig into the full Shift Active Media report, exploring the findings in greater detail, please email hello@shiftactivemedia.com

- For retailers keen to explore how they too can develop and deliver marketing that wins new customers, CI.N has a 4 part series (3 parts online / part 4 in the latest edition of the magazine)

With the 2023 CI.N Market Data Report due for release in March, built upon insights drawn from surveying of UK bike shops, the combined data and insight will be the subject of a future CI.N and Shift Active Media co-hosted podcast (date TBC).