Townley: Predicting the new normal for the global bicycle business

What the first year of the Trump Administration has established is – the new normal and the global bicycle business having to quickly adapt to keep up.

While two branches of the federal government wrestled with governance in Washington, in New York and other financial centers around the world it was business as usual for the stock markets as they bought and sold and the global economies generally followed right along. Out of uncertainty comes financial growth. Welcome to the New Normal!

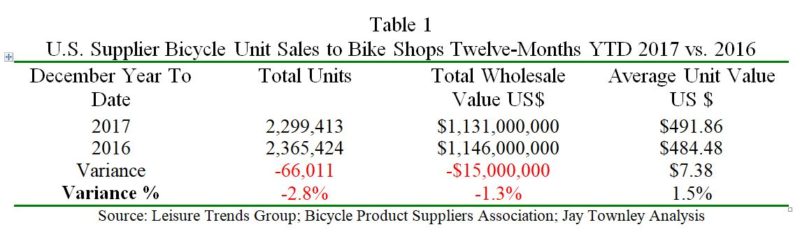

In the United States the Bicycle Product Suppliers Association reported that wholesalers shipped 2.3 million new bicycles to the bike shop channel of trade in 2017, a 3 percent drop from 2016 and a low for the last ten-years.

However, the overall value of the new bicycles shipped in 2017 to the bike shop channel had an overall value just US$15 million below 2016, representing a slight 1 percent drop.

Table 1 shows the detail of new bicycles sold at wholesale by brands and supplier to bike shops 12 months YTD 2017 compared to 2016.

The average wholesale unit value did increase over 1 percent, or an increase of just over $7 at wholesale per new bicycle sold to an American bike shop.

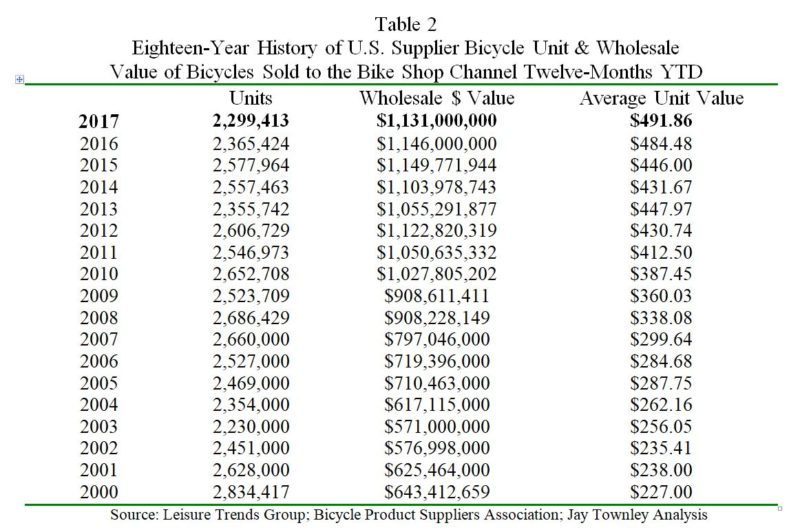

Table 2 represents an eighteen year history of U.S. brand and supplier sales of new bicycles to the bike shop channel of trade twelve months YTD from the year 2000 through 2017.

While there is only one year out of the last eighteen that is lower in bicycle units shopped than 2017 and only two years higher in total wholesale value, 2017 will go in the record books as a down year for the American bike shop channel of trade in terms of new bicycle units sold by wholesalers to bike shops.

At the same time 2017, like 2016, stands out for achieving the highest average unit value of new bicycles invoiced to bike shops out of the last eighteen years.

The bike shop channel of trade in the U.S. captures approximately 17 percent of all new bicycle unit sales annually – and because of high average unit value, around 57 percent share of annual retail dollars.

This 57 percent U.S. market share is the reason this data is important and also why the corresponding and sagging new bicycle unit market share is of concern.

Simply put – why is the bike shop channel market share of the U.S. market flat to declining?

Let’s take a look at the new normal to see if we can find an answer – or at least some clues.

The Stage is set for continued solid growth in 2018

Economists are predicting a “rosy” 2018 that will yield a good year for U.S. business, industry, and consumers that will support GDP growth and low unemployment throughout the year.

Tax reform has already been given credit for announcements in January from major companies like Walmart, the countries largest employer, pledging increases in wages that in turn are predicted to increase consumer spending.

All segments of the bicycle business should benefit and if consumer spending is stimulated, as promised, there should be an up-tick in retail sales of new bicycles in the coming year.

Market investors sense that 2018 will be a repeat of 2017

Global stock markets, including in the U.S., have set all time record highs in 2017 and so far in 2018 – and with no real threat of inflation, are predicted to continue their growth.

The publicly-traded brands doing business in the Human-Powered segment of the Light Transportation sector have, and will continue to benefit from these Bull-Markets in the U.S., EU and Asia.

The big question hanging over world trade in 2018

Trade disputes with China, the primary source of complete bicycles consumed by the American market have risen up on the probability scale over the last three month of 2017. Given the trade policies being pursued so far in 2018 by the Trump Administration it now appears much more likely that U.S. importers of bicycles and related products from China will face increased restrictions and costs going forward.

The president speech at the World Economic Summit January 26 and the decision by the ITC in favor of Bombardier have served to somewhat reduce the probability of trade issue with China going forward, but not enough to greatly modify this concern – at least not yet.

Automotive brands expand manufacturing in the U.S. and Apple plans investment in U.S. production and supply chain

A leading Chinese automobile company has announced it plans to sell vehicles in the U.S. in 2019. BMW also announced the investment of $600 million in its Spartanburg, South Carolina plant by 2021, over the next four years, and spending an additional $200 million on training and education of employees.

In addition Nissan, Toyota and Mazda have recently announced large, multi-billion dollar investments in U.S. production facilities that in turn will drive growth of U.S. automobile parts supply chains and logistics providers.

The investments by the automobile brands that spill over into the parts supply manufacturing and logistics sectors will benefit any onshoring of bicycle manufacturing

There can be many related reasons that the Apple board of directors and senior management decided and announced the week of January 16th that the company would take advantage of the new tax law that allows repatriation of profits earned that are now in foreign banks (earning interest) to the U.S. at very attractive, low tax rates. However, none of this matters as much as the simple fact that Apple plans to spend $30 billion on new facilities and with U.S. suppliers between now and 2022.

All of these investments by the automobile brands and Apple will spill over into the parts supply manufacturing and logistics sectors and collectively benefit any onshoring of bicycle manufacturing.

2018: Top Risks

Market and product sourcing risks for the human-powered sector of the U.S. light transportation business are at the highest level they have been in recent history.

Protectionism in international trade is on the rise and the American human-powered bicycle business that has enjoyed the benefits of globalization over the last 40-years is now facing the specter of both trade restrictions and increasing costs of landed-goods and logistics.

As noted recent events, including the tone the president expressed in his speech at Davos and the ITC decision in favor of Bombardier have served to reduce the probability of the risks associated with protectionism, but the risks remain very real.

Increasing wages paid to bicycle manufacturing employees, increasing costs of raw materials and components and increases in ocean and domestic freight have been closing the gap between the landed cost of imports from China and the same human-powered goods manufactured in the U.S., an economic reality that retailers like Walmart clearly recognize.

These risks by themselves started effecting the bicycle sourcing and supply chain prior to 2013 and have continued to increase and grow as the international trade environment has changed rapidly since the 2016 U.S. election.

Conclusion

The first piece of good news is the automotive sector is providing cover for those in the American human-powered bicycle business that understand the urgency of exploring onshoring and locating all, or a portion of their product manufacturing, inside the customs territory of the U.S.

Unfortunately, Mexico no longer represents the slam-dunk opportunity to onshore it once represented because of recent developments relative to the North American Free Trade Agreement and this option is fading before it ever had a real opportunity to evolve.

This takes us to China.

The vast majority of bicycles, 97 percent of the 17.3 million bicycles of all wheel sizes and types that are consumed annually in the American market are imported into the customs territory of the United States. The largest percentage, 93-percent of all the annual imports of bicycles into the U.S. originate in China.

As identified under the risks, the increasing wages paid to bicycle manufacturing employees, increasing costs of raw materials and components and increases in ocean and domestic freight have been closing the gap between the landed cost of imports from China and the same human-powered goods manufactured in the U.S., an economic reality that has been recognized by retailers like Walmart and bicycle brands like Kent International.

This economic reality had already started a slow but steady onshoring movement before the 2016 election.

The first year of the Trump Administration established unilateralism by way of unwinding multilateral trade and related agreements in favor of negotiating bilateral or unilateral deals.

What has emerged with passage of U.S. tax reform is what we have identified as a literal rush by the foreign and domestic automotive and electronic sectors to onshore manufacturing.

This analysis has resulted in our advice to clients and potential clients that they immediately begin investigating the option of bicycle and related component manufacturing in the continental United States.

We view this as the best win-win scenario because the economic shifts that started the onshoring movement will continue to be present and growing no matter what the arch or time frame of the Trump Administrations’ trade policies that favor manufacturing inside the continental United States for domestic market consumption.

With all the tax, trade and sourcing issues and risks stuffed in our question bag about why U.S. bicycle sales aren’t better in the face of economists predicting a “rosy” 2018, we come back to the same themes we have presented and talked about since the flat U.S. bicycle market trend started back in 2013 – relevance and making it simple, easy and fun to purchase bicycles.

The global bicycle business and human-powered sector has to sort out individual brand and company responses to the risks – and craft distribution and sales strategies that will resonate with the wants and needs of the technology empowered and experientially evolving consumer. Welcome to the new normal!

Enjoyed Jay’s writing? He’s a regular on CI.N, so check in with his past pieces here.