World Economic Forum report: “The next great transformation in retail has already started”

The World Economic Forum has crystal balled what the future of retail may look like, speculating that in the future we may shop in virtual stores, handling virtual products from the comfort of our homes.

Ten years ago smartphones were coming to fruition, changing consumer buying habits in an incredibly small window of time. In the UK, retail data suggests that the majority of online shopping sales are now completed on tablets and smart phones. According to the industry’s internet retailer trade body, 51% of sales between November and January 2016 came via hand-held devices. In 2015 that figure was 40%, indicating an upward trajectory for the convenience of hand-held.

In the U.S. mobile sales as a percentage of all e-commerce has risen from just 16% in 2013 to 37% this year. By 2019 that figure is expected to near 43%.

So, what does this all mean for the future of retail and what consumer habits are predicted to emerge as we get to grips with so-called virtual reality headsets, among other gadgets?

(If you’re short on time, you can cut straight to the full report’s URL here)

Disruptive technology

Eight differing technologies have been identified as likely having a significant impact on global business in the next decade. These are; Internet of Things, autonomous vehicles (think drones), artificial intelligence, robotics, digital traceability, 3D printing, augmented reality and blockchain.

Each of these represents the ability for businesses to transform their efficiencies in speed to market, staffing and plenty more.

Customer satisfaction

Think your customers demand a lot now? Buckle up. It is predicted that customers will continue to demand even greater levels of convenience and price competition.

Walmart’s Ceo Doug McMillon told the WE Forum: “With the growth of the internet of things, customers will enjoy an increasingly connected or “smart” shopping experience through a network of connections linking the physical and digital worlds into an ecosystem of devices, including vehicles, stores and software. The internet of things, drones, delivery robots, 3D-printing and self-driving cars will allow retailers to further automate and optimize supply chains too. Both sides of the equation – demand and supply – will change dramatically.”

Sharing sourcing information with customers, particularly when it comes to sustainability and ethical practice, will continue to earn kudos with potential buyers.

Store closures

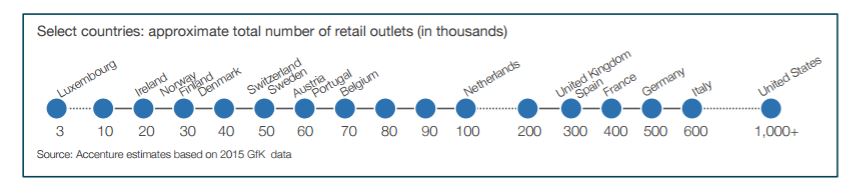

Westernised countries are said to be over-saturated with retail spaces. The U.S., in particular, has over 1,050 shopping malls packing an enormous square footage of retail space as far as digitally advanced nations go. According to the report, the U.S. has five times more square footage of retail space per person than any other country. Therefore it is no surprise to learn that around 15% of these shopping hubs are expected to close in the next decade.

The hope is that this space can be repurposed for community space, however it is perhaps more likely that such space will be used for other commercial activities.

Global Supply, no delays

One of the perils of being connected 24 hours a day is your customer is able to see content from all corners of the globe on demand. Has something just launched in China? Why is it not in stock at my local retailer now, consumers will ask.

“Not long ago on a visit to Nigeria and Ghana, I asked one of our local store managers what his one wish would be,” said McMillon. “His answer: I want you to put a Walmart Supercenter like the ones you have in the US right here and let me run it. My customers and my family have seen what you have and we want it, too. We want those items at those prices.”

Invest in all parties

McMillon outlines that investing in all levels of the business has paid dividends across the board. Educating staff and raising wages have ultimately been shown to deliver higher customer satisfaction. Customers, apparently, do want to see staff enjoying their work and in good spirits, in turn it is hoped that this will be reflected in the level of service delivered.

Blur the line between on and off line

Disruptive business models have proliferated at an alarming rate, forcing the bike industry to drastically rethink its routes to market, price points and customer base potential. This trend isn’t predicted to slow, rather they’ll scale upwards and gain momentum.

Over the next decade the global penetration of e-commerce is expected to leap from 10% today to over 40%, though this is variable depending on the sector.

All is not lost for the physical store, says the report. The physical store is expected to continue to contribute the greatest level of revenue over the next decade. The proposition of the store will be crucial to success however and interaction in store will go far beyond face to face. Technology in store is touted to become key to engaging your audience and creating a hub to which people want to remain and return. You’ve seen the giant tablets in many McDonalds already? Think those, but on the shop floor with links to your backroom picking staff.

This shift to technology will have side effects. Both required staff and shop floor footprint are expected to reduce, as will the number of outlets.

The report offers: “While re-imagining physical retail, it will be critical for retail and CPG companies to continue to innovate and embrace new digitally enabled business models, such as the next-generation sharing economy (rental and secondary markets), personalisation economy (curated subscriptions), on-demand economy (auto-replenishment or smart reordering), and services economy (“Do it for me”). Leveraging the value-at-stake methodology to quantify the impact of this digital transformation over the next decade (2017-2026), it is estimated that there is $2.95 trillion of potential value for the industry and consumers. The industry will capture 32% of total value at stake primarily from value migrating from brick-and-mortar to e-commerce. Consumers will benefit by capturing 68% of total value at stake, which represents consumers’ cost and time savings. The consumer will greatly benefit from these digitally enabled business models, and as an industry player, the focus should be on capturing the value migrating to these new models.”

Last Mile delivery

It’s been proven that last mile delivery efficiency can make a big difference to net profits, in fact it is estimated that around 25% of the total delivery cost is generated in the “last mile”.

This is emphasised in the report. As part of this it is suggested that a rethink is required on how costs are split between retailers and consumers. Establishing macro-aggregators and investing in containerization are also recommended.

To read the full report, click here.