YouGov study goes in depth on catching mobile clutching consumer’s business

A newly published Centiro and JDA study has further revealed trend changes when it comes to consumer buying habits.

Following the World Economic Forum’s paper on the next generation of retail transformation, the study covers some of the same and some fresh ground, breaking the report into sections covering click & collect habits, delivery preferences, returns policy, customer-centricity, in-store technology and predicting the future of retail.

Introducing the report, readers are told that online sales represented a £133 billion opportunity for UK retailers in 2016, a 16% increase over the prior year. Predictions for subsequent 2017 growth range from 11.5% to 14%.

Fueled by smart phone sales growth, now tied to 47% of online sales, a headline from the study speculates that the mobile will become the number one sales channel sooner than anticipated. For this reason, omni-channel is upgrade from a “nice to have” to a “must have” for those investing in online.

In meeting these modern demands, the report does outline that many retailers are struggling to make omni-channel retail profitable. Startlingly, a headline stat from the paper warns that only 3% of UK and 10% of global retail CEOs feel that omni-channel retail will assist in turning a profit, something attributed to higher demands on the business. To counter this, it is suggested retailers consider carefully their delivery methods and costs.

Among its ‘Highlights’ the study offers:

- Click & Collect is growing and improving, but home delivery issues risk alienating customers.

- People no longer expect free deliveries as a given: 75% of people are willing to exceed a minimum order value to qualify for free delivery.

- Mobile investments are proving shrewd. Nearly half (46%) of UK adults are already using mobile devices in stores.

- Digital transformation is now the number one priority for CEOs with 85% investing in ‘big data and mobile-enabled applications, as well as 79% investing in in-store mobile devices for staff.

- 76% of CEOs globally disagree that online is cannibalising in-store sales.

In-store tech and predicting the future of retail

It’ll come as little surprise that 46% of UK  adults admit to using mobile devices in store. To counter this behaviour and danger of losing the sale elsewhere, Beacon technology, where push notifications with promotions are sent to the shopper’s mobile are on the up. 76% of retail chains are reported to have already have made investments here, many in a bid to catch passing footfall.

adults admit to using mobile devices in store. To counter this behaviour and danger of losing the sale elsewhere, Beacon technology, where push notifications with promotions are sent to the shopper’s mobile are on the up. 76% of retail chains are reported to have already have made investments here, many in a bid to catch passing footfall.

30% of customers are using their mobiles in store to check and compare pricing, while 22% are seeking product reviews. 15% are said to be searching for mobile offers, while 7% are actually purchasing on their mobiles in store – 9% doing so via another outlet.

When it comes to investing in your store’s infrastructure, 22% anticipate in five years time to be shopping on self-service kiosks wherever they go.

Further interacting with the retailer, 30% anticipate using their mobiles in store, whether to pay or otherwise engage.

Customer Centricity

Intolerance of poor online service is growing. Retailers are advised to keep a close eye on “last-mile” order fulfillment. 56% of UK adults stated that they have experienced an off-putting experience while shopping in the past 12 months – a figure that has been consecutively rising.

Seemingly consumers are expecting more from their online shopping experience, with poor experience claims rising from 73 to 78% year-on-year.

However, home delivery, click&collect and returns experiences all improved slightly, suggesting retailers are getting comfortable with emerging shopping habits.

On returns, some 74% of CEOs believe that the cost associated with returns is eroding profits and that small changes to policy could here businesses slow the rate of return.

Investments in picking and packing technology has seen a slight decline in “wrong order” claims, down from 21 to 19% of consumers.

Click and Collect

Research has revealed that 51% of retailers already offer, or plan to offer, click and collect services in the next 12 months.

The reasoning for this is sound; add on sales potential is increased. Research demonstrates that 16% of Click&Collect shoppers made a further planned purchase in store and 10% and impulse buy while visiting.

However, the shopping method is said to have plateaued. 54% of shoppers used such a service in the past 12 months, the same figure as the prior year. It is further believed that Click&Collect business is used less around the Christmas period, though still by 39% of shoppers.

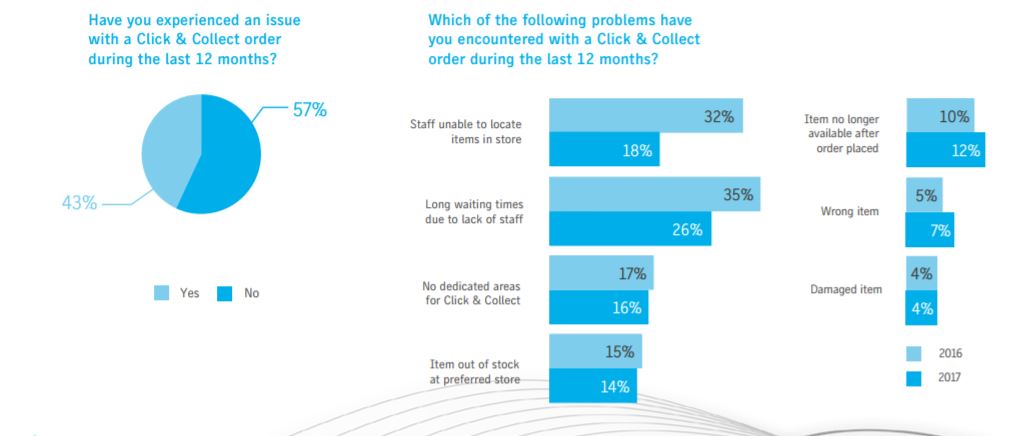

Issues relating to Click&Collect have fallen over two consecutive years, down to a still high 43% of shoppers. Leading the problems faced was long waiting times in store for pick up of the goods, though again this issue has dipped 9% year-on-year.

Delivery preferences

When asked “which factors matter most to you when it comes to online bought home delivery, cost was cited as the number one purchase influencer with some 40% saying this affected their choice. 22% said convenience mattered most, while 16% said speed was their priority.

Consumers are reportedly coming to terms with premium delivery services and associated costs, says the study. Added to this, 75% of shoppers are often happy to increase their spend to qualify for free delivery, if applicable.

Conclusion

The study’s conclusion reads:

“We’ve now reached a critical juncture for many retailers. After spending several years trying to be ‘all things to all people’, it’s becoming increasingly apparent that they need to think more intelligently about the omni-channel services they are offering to customers. Thinking in the longer-term, they need to focus on customer quality over quantity.

“Retailers now need to balance the effectiveness and profitability of the fulfillment channels they offer with customer satisfaction. If shoppers experience a problem with a home delivery or Click & Collect order, they are dealing with a possible lost sale – and unhappy customer – a situation that retailers need to avoid in today’s highly competitive retail market. As retailers re-imagine their strategies to transform the customer experience, shoppers want a seamless and personalised experience, regardless of the shopping channel. Supply chain complexities and cost will continue to challenge retailers, and moving forward, the difference between winners and losers will be how much, or how little, retailers understand their customers and how well they are able to personalise the service they offer to each customer to balance customer satisfaction and customer profitability.”

Undertaken online by YouGov on behalf of the organisations, 2,070 adults were surveyed between the 29th and 30th of December, 2016.

The study can be viewed in full here.