Jay Townley: About the future of the bike business…

By Jay Townley of the Gluskin Townley Group

As 2016 draws to a close we will be continuing our ongoing discussion of The Brutal Truths that represent the opportunities that individual bike shops need to overcome and act on so they can make the simple fundamental changes in the way they do business to become their customers ‘third-place’[1] and make them customers for life by creating uncontested market space for themselves while making most, if not all, of their competitors irrelevant[2]!

This article is the first in a two part series and opens by explaining Cycling 4.0 and how it will help shape the bike shop channel of trade and the new bicycle market of 2017 and going forward, but it is also about the future…that will be frightening to some and exciting to others.

We will start by introducing Patrick Keating, an American living in Lyon, France who founded Velo Capital Partners (VCP) in 2012 and became the managing director.

After working successfully in investment banking and technology in the U.S., Turkey and Europe Patrick established Velo Capital Partners as a way to pursue his lifelong interest in cycling, and innovation with an emphasis on building an investment platform to capitalize on urban cycling’s full benefits to cyclists and the wider community around the world.

His areas of focus include advanced material formulation and production for cycling clothing; vehicle frames and tires; alternative cycling vehicles; automated and modular manufacturing platforms for customized and just-in-time production of cycling vehicles; parts and accessories and cyclist-based air quality monitoring and purification devices.

Patrick immersed himself in the global bicycle industry and took a deep dive into all aspects of innovation, technology and investment in and around the current business – and started to investigate what the future looked like.

In December 2015, Bike Europe published an article titled A Vision of the Future of the Global Cycling Industry: Cycling 4.0 Is About Creating New Markets, by Patrick Keating. Here is what Patrick said about what the present and the future he sees for the global bicycle industry and business.

“While many from inside and outside the cycling industry are rushing to get a piece of the markets that already exist, there are other forward thinking players that are trying to create a new one. Many of these forward thinkers are making high-risk business decisions with little or no qualitative or quantitative data to support their assumptions.

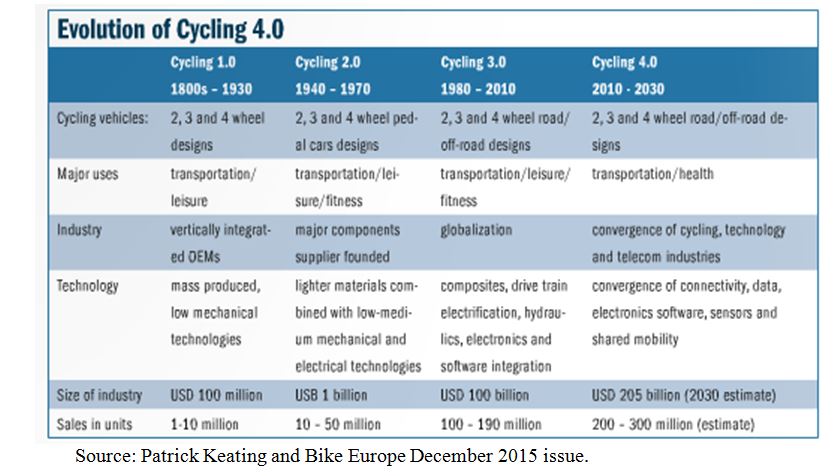

“Instead they are rushing into the market armed only with a lot of passion and, in many cases, small piles of crowd funding money with little or no knowledge of where the market is really going in the future. To help reverse this high risk/low data situation for these entrepreneurs and corporate development managers we’ve developed a vision of the future of the global cycling industry – Cycling 4.0. The table from Cycling 1.0 to Cycling 4.0 show where the industry started, where it is now and where it is heading for.”

The table referred to is shown below and Patrick Keating’s estimated size of the global bicycle industry along with his estimate for sales in units at the bottom of the table is both interesting and encouraging. Is it achievable going forward? We will see!

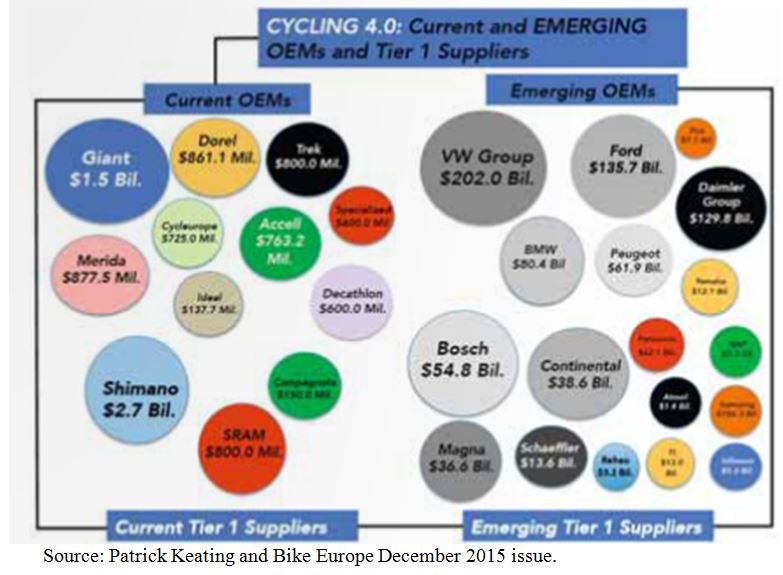

The second table that accompanied the December 2015 article is shown on the next page and it should be eye-opening to the American bicycle business. What it shows graphically is what Patrick Keating’s extensive research found are the Current and Emerging OEM’s and Tier 1 Suppliers – which should be about the same, shouldn’t they?

While we are familiar with most, if not all of the Current OEM’s, the emerging OEM’s and Tier 1 Suppliers represent a significant change. Some of the largest corporations in the world, many of which are predominantly from the automotive sector.

Shimano and Giant are the largest, in terms of annual revenue, of the Current OEM’s with $2.7 billion and $1.5 billion, respectively. This compares to annual revenue of $202 billion for VW Group, $135.7 billion for Ford, $129 billion for Daimler, $80.4 billion for BMW, $61.9 billion for Peugeot and $38.6 billion for Continental.

The American bicycle business has already watched as Bosch and others have entered the e-bike sector of the bicycle market and the estimate for annual revenue for this European based company is $54.8 billion, a corporate revenue roughly 95% larger than the largest Current bicycle industry supplier!

What are these much larger, primarily automotive sector brands and companies interested in the global bicycle business and market for? The quick answer is electric bicycles – but experts and futurists I have talked to opine that these automotive players are looking to the near-term and long-term future of transportation, mobility and technology beyond the electric bicycle – topics we will examine later in this article.

Futurists believe everything is changing and this leads to an interesting story that might not appear to be directly comparable, but which is a real world example of a technology and a company that had a dominant market share that all changed in a few short years.

In 1998, Kodak had 170,000 employees and sold 85% of all photo paper worldwide. Within just a few years, their business model disappeared and they were bankrupt. Many futurists believe that what happened to Kodak will happen in a lot of industries in the next 10 years – and most managers don’t see it coming!

Here is a question for you: Did you think in 1998 that 3 years later you would never take pictures on film again? For some of you reading this article – you have never taken anything but digital pictures and don’t even know what film is – and some of you have never taken a picture that hasn’t been taken by your smart phone.

Digital cameras were invented in 1975 – in the Kodak lab! The first ones only had 10,000 pixels, but followed Moore’s law.

Back in 1965, Gordon Moore co-founder of Intel established his law that states that – the number of transistors per square inch on integrated circuits had – and would continue to double every year – and with only a slight deviation this law has continued being realized for over 50-years!

So, as with all exponential technologies, digital cameras were a disappointment for a long time, before the technology became superior and mainstream in only a few short years.

This, the futurists predict, will now happen with Artificial Intelligence, health, self-driving and electric cars, education, 3D printing, agriculture, jobs – and as a result, all or a part of the American bicycle industry and business!

Part Two, to be published later this week, is titled: Welcome to the Exponential Age and a New Era of Bike Shop Retailing!

[1] Third Place is a term originated by Paco Underhill, retail anthropologist.

[2] Creating uncontested market space and making competitors irrelevant are concepts and business strategies originated by the authors of Blue Ocean Strategy.