Recently listed Technology Minerals to recycle electric bike batteries in UK

Technology Minerals, a recent addition to the London Stock Exchange, has confirmed to CI.N this week that it will offer domestic recycling of electric bike batteries, among other EV sectors.

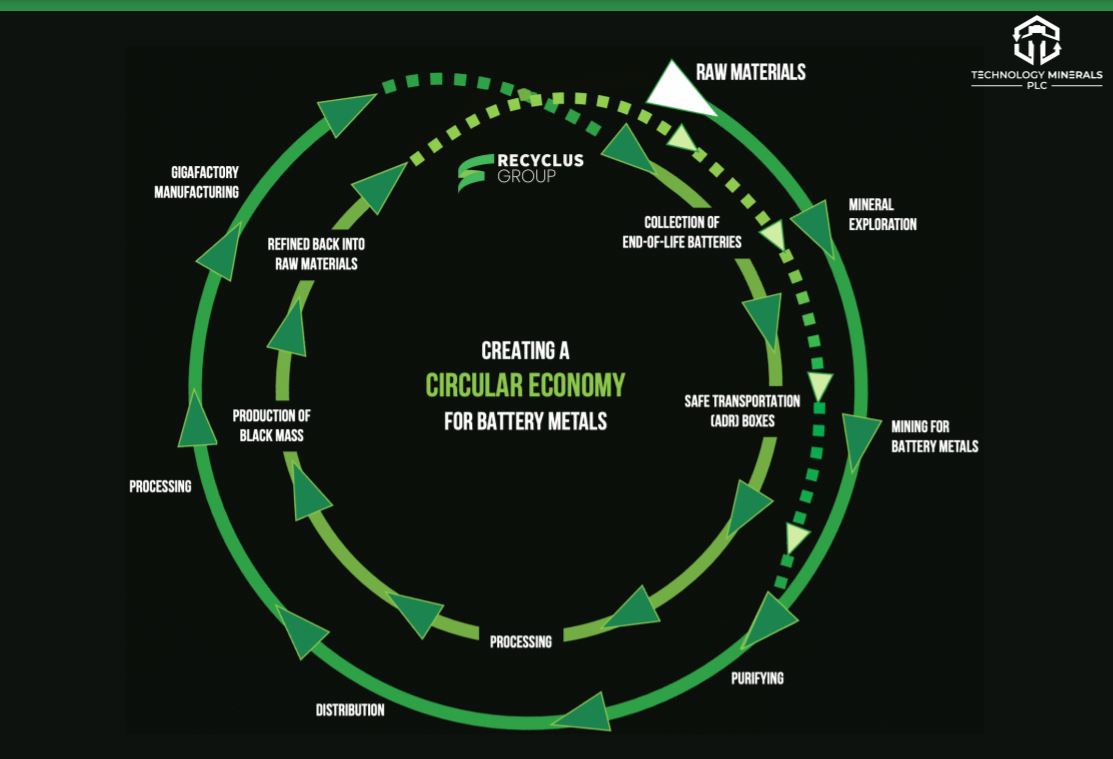

The company has set out with the objective to create a circular economy designed to help manage the post life use of the materials found in lithium ion and lead acid batteries. The global lithium-ion battery recycling market is projected to grow from $2bn in 2021 to $6.55bn by 2028 at a compound annual growth rate (CAGR) of 18.5%.

Speaking to CI.N, Chairman Robin Brundle said: “Our first UK plant will be operational by the end of Q1 in 2022 and the electric bike market is one of the sectors we are looking to work with.

“We are looking at lithium batteries from the automotive, electric bike, mobility, telecoms and other industries to test for reuse and/or process to recover the key metals from the batteries. These can then be supplied back into battery manufacturers to produce cathode materials that go into new battery cells, thus supporting the circular economy and reducing the reliance on virgin materials.”

The end of life disposal and return to service of the extracted minerals is a hot topic for the entire EV marketplace at present and indeed EU legislators have ruled that from this year a sustainable approach throughout the entire cell lifecycle should be factored in by manufacturers.

At the present rate, UK electric bike sales are accelerating far ahead of electric car sales by volume, presenting a significant challenge to the bike industry when end-of-life battery enquiries come up. Research by CyclingIndustry.News suggests that 24.7% of bike shops are currently stuck with electric bike batteries that they are struggling to dispose of. Just 15% have an end-of-life battery disposal plan underway.

There is work to be done and even recycling efforts are not yet perfected, says Brundle, though that is the aim of his company.

“EV batteries are normally replaced after they lose around 20% of their capacity, but this means that they still have around 80% capacity remaining. There are two routes for end of life or end of first life batteries; they are either testing and reuse of the complete batteries, modules and/or cells, or full recycling. The first option to test and reuse allows us to put batteries back onto the market, but currently this is focused on the energy storage market,” he says of onward usage of recycled cells.

As a shareholder across a range of battery metal projects, Technology Minerals has options in play to assist the market.

Recyclus – a company in which Technology Minerals holds a 49% stake – was established to recycle both lithium-ion (Li-ion) and lead-acid batteries. From the lead-acid batteries, the firm is able to recover lead, acid and recovered plastic materials, and as far as the Li-ion batteries are concerned, Recyclus is initially focused on recycling through to ‘black mass’.

Recyclus is commissioning its first two plants in February 2022, which will represent the UK’s first capability for battery recycling on an industrial scale. These sites are plotted for Tipton and Wolverhampton and further sites are planned to grow the group’s reach.

“There is a growing demand for the separated materials (black mass) from battery manufacturers in the UK and around the world and we are continuing to build our operational capability to support these activities,” adds Brundle.

With regard to obtaining that black mass material, those working with Technology Minerals can obtain a discount on the per kg cost if supply is broken down to a cellular level (though this may be beyond many businesses and could represent a hazard if not done correctly.

On costs we’re told each is dependent on battery chemistry (LFP, LCO or NMC). LFP, due to low level of recoverable materials, is chargeable (for complete batteries) at £2.25 per kg. If it’s broken down to cellular level than the charge would be £1.80 per kg. For LCO and NMC, complete batteries would be charged at £1.98 per kg and cellular level at £1.55 per kg.

Finally, a further partnership with Slicker Recycling Limited, one of the UK’s leading hazardous waste management and service delivery providers, may in turn provide collection of materials, with safe transport to the nearest Recyclus plant.

Recyclus believes this partnership alone could deliver up to 40% of the lead-acid battery capacity, and up to 90% of its Li-ion capacity once the two plants are commissioned in Q1, 2022.

The partnership is expected to be a driver in Technology Minerals’ growth strategy and aim to increase its recycling capacity in 2022 for lead-acid batteries to 16,000 tonnes per annum and 8,300 tonnes per annum for lithium-ion (“Li-ion”) batteries.

Brundle concludes: “The e-bike market in the UK is certainly forecast to continue to grow and with over 150,000 sales made last year it is an important sector across both retail and commercial usage and will clearly need to be part of the circular economy in lithium-ion battery sustainability.”