Sales Agent’s View: Why Wiggle rules the waves of the world wide web

Words: John Styles director at cycling industry consultancy www.cyconomist.com. If you’d like to hear more about the future of the 5 Waves, catch John’s C.I.N talk at The Bike Place Show this weekend titled: “Demographic Cliffs and Technological Time-bombs – How to survive the next 10 years in the cycle trade”.

In December 1998 the sky turned black over Brighton as a Force 6 gale rolled in off the sea. So, like many other young men in their 20s, I stuffed my surfboard into the Volvo and headed for Shoreham Harbour. When we got there, the wind was so strong that it took two of us to carry each surfboard the 1/4 mile walk from the car park to the sheltered harbour. The wind was too strong for our usual trick of walking along the harbour arm then dropping into the sea behind the break. So we had to battle it out against an exhausting high tide shore-break, often being washed right back to the beach. The wind was straight in our faces and raining hard. The water just 4° and stinging cold. Then, just as we got past the shore-break, it hailed. Not the small stuff either.

I sat on my board with dozens of other surfers waiting for the tide to drop and the right waves to appear. Hands tucked under our armpits, shivering, many of us looked to each other thinking, “what the hell are we doing here?!”. Then the eye of the storm passed over and a huge patch of sunlight opened up, illuminating the whole harbour. The sea turned from flat grey to luminous bright green. The rain stopped, the wind dropped. Perfect, clean, 5-6ft set waves started rolling in.

I have never been a good surfer and was out-paddled by most of my buddies to many of these fantastic waves. I caught a few, but soon my arms were tired. I knew the tide would continue to drop and that the punchy short borders would soon start to give up and my Longboard would come into its own in the lower gentler swell.

Out of curiosity (and a desire to keep my arms and body warm and moving) I paddled further out to the mouth of the harbour. Just as I got there and turned my board back to face the shore, I felt the water drop rapidly beneath me. My stomach lurched as I sank lower into the trough that precedes the wave. I looked over my shoulder and stared at what was easily the biggest wave of the day peaking as it came around the mouth of the harbour.

I’d never seen a wave that big this far out in the harbour and I’d never ridden a wave much over waist height. So facing something just over head height, right up against the 20 ft of concrete harbour arm was more than a little daunting for me. I made a snap decision to paddle and I paddled as hard as I could, as long as I could. Even then, I only just gained enough speed to catch the wave, shuffling my weight forwards along my 10ft longboard and taking off right from the peak. As the board dropped rapidly to the bottom of the wave I clumsily got up to my feet, executed a turn and worked it back up along the wave. I passed all of my friends on the way to the shore. I was the worst surfer in the water and I had caught the best wave of the day. In my case, it was pure dumb luck. I had been in the right place at the right time.

About 50 miles along the coast in Portsmouth, and around about the same time, Mitch Dall was actively looking for the next big wave in business.

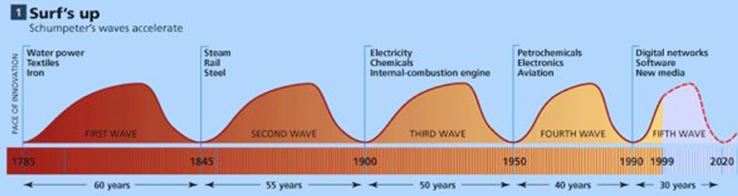

The wave he saw was part of the 5th Kondratieff wave – the Internet Revolution. These waves are deep seated changes in the economy, much deeper than the short term boom/bust cycle. They change the fundamental way that we go about our daily lives – living, producing, working and spending. They are paradigm Shifts – a change in the nature of how things are done…

…And it wasn’t just luck that he found it. As I heard it from some of Mitch’s staff who worked at the Butlers Cycles store at the time, “Mitch was always looking for the next big thing, I remember him going off to some computer show and coming back with a kind of vision. Everyone is going to have these in their living rooms he said. They are going to buy stuff on their computers all the time”.

Some established businesses at the time told me, “When I heard he was gradually closing parts of the store to focus on this, I thought he was mad.” But that’s the thing, if you’re out at the back of the pack, beyond the easy set breakers, looking for that next Big Wave you might be mad, but if you catch just a glimpse of it, perhaps you aren’t. There was a time everyone used to talk about “surfing the internet” – like it was cool, novel and fun and new, like surfing. Not an every-day hum drum fact of life, as it is now. Mitch saw that change coming, early.

Wiggle was formed by Mitch and business partner Harvey in May 1999, and I still have a copy of September 1999 MBUK in my collection. It features one of wiggles first adverts, back when the logo was silver. I thought, “What a stupid name for a website and what an awful logo. That will never work!” How wrong I was. And with the benefit of hindsight and an awful lot of experience, I can now look back and see it in a fresh light.

What do you notice?

- Simple: It’s very different to every other busy “let’s cram everything we can on the page in 4pt font” mail order listing advert

- Relationship: They are not trying to sell you 1-specific-something, they are trying to start a relationship

- Web-Only: There’s no phone number or address. They are confident enough to say, just come to the website – it’s all online.

- Branding: It’s all branding. Their Plain and simple. No-one else’s brand, or products, or prices, or terms.

- Forward-Thinking: The wiggle logo is set against a sci-fi style space scene. It’s saying, “This is the future, there are limitless possibilities”, and they were right. You can see their mind-set, their forward thinking, right there on the page – wiggle were one of the original disruptors.

Here’s how things took off from there for Wiggle:

- 1995 Mitch Dall, a founder of Wiggle, bought the shop “Butlers Cycles”.

- 1999 Mitch Dall and Harvey Jones found Wiggle. Later, Paul Bolwell joins.

- 2009 Sales were £55 million. Mitch Dall sold his stake to investment firm ISIS.

- 2011 Sales were £86 million. Wiggle acquired by VC Bridgepoint Capital.

- 2016 Wiggle and CRC merger – combined turnover of £400 million.

Reading the Wiggle timeline makes it look like plain sailing or an easy ride from there on in. But that’s far from the case, many many other people were paddling for the same wave. So what made the difference? Some people would say, Paul Bolwell, and just leave it at that.

Wiggle were always scrupulously professional. In their pursuit of customer service, ease of use, free returns, fast delivery, after care. In 15 years of going in and out of bicycle stores on a daily basis and listening to thousands of consumer interactions, I have never, ever, overheard a single consumer complaint about Wiggle’s service. They cleaned up the whole “please allow up to 28 days, take your money, then order it from the supplier” sector. They built Trust and Service in a sector where previously a few sharks had muddied the waters for everyone. And in cleaning up, they cleaned up.

From the suppliers, I have always heard they pay their bills. On time. Always. Not forgetting the suppliers, we should recall that the UK benefited from a very robust and professional supply chain and importer/distributor culture. It’s likely that the UK was the best place in the world to start a bicycle dotcom. In addition, the UK

had a strong early adopter culture for internet shopping. We got the best waves and wiggle rode them best, although it was close at the end.

If Wiggle hadn’t bought CRC, perhaps CRC have bought Wiggle. When you reach a two horse race in a maturing market that favours efficiency through Economies of Scale – mergers are inevitable. So further mergers and acquisitions (abroad) come as no surprise. The Wave that started here washes all around the world.

And let’s not forget the other surfers of the world wide web. Paddling hard were Top Banana, Wades, Obsession (UK), Cycles Unlimited (UK), Blazing Saddles (South Coast), Dream Cycles, Armstrong Bike Dock, 9 feet.com. SBR. CyclesportUK, Farnham Cycles, UKBikeStore, Dotbike. Just the tip of the iceberg, so many have faded away or are no longer trading.

Anecdotally, having worked in the cycle trade for the last 15 years, my gut feeling is that the online only sector has an attrition rate of about 50%. As opposed to the bricks and mortar sector which has an attrition rate of perhaps 5%-10%? (and that may be lower on a Net basis). It’s a lot more hazardous paddling out to sea than it is fishing from the shore.

These businesses that came and went were owned and run by people much more resourceful, hard-working, knowledgeable and skilled in business than many of us. I used to build websites in my spare time, but I chose very early on not to “open a web shop and paddle”, as I always knew there were others out there who could do a better job than me.

I remember about 2005-2006 many bricks and mortar stores telling me, “selling online is easy, anyone can do it, just build a website, list some products and it’s job done.” Working inside a wholesaler, I recall receiving dozens of applications from bedroom-based start-ups – no premises, no business bank account, no VAT number. I think many of these folks were looking at the other surfers and thinking, “Hey that looks like fun!” They were not looking at… The Sea.

In my humble opinion, the attrition rate was high with good reason. If you paddle out against the shore-break, at high tide, with an onshore wind turning the waves to mush, you are quickly going to become exhausted and be washed right back to shore. And even if you do pass the breakers you’re going to find things aren’t quite as you expected as you reach the break. There are going to be plenty of other people paddling for the same wave and many of them will have been doing it a lot longer than you.

Wiggle rode the waves to success not just by catching the right wave at the right time, but by being fully committed to it and having the vision to see it through. With several management changes (Humphrey Cobbold, Stefan Barden, Will Kernan) and buyouts (ISIS, Bridgepoint) along the journey it appears like someone caught the wave on a short board, switched to kite surfing, to a jet-ski, powerboat, superyacht, super-tanker. As the waves dropped and the sea flattened, Wiggle continued to evolve and adapt.

And they did that better than anyone else at every step of the way. Now the sea is flat and calm, and we see the super-tanker gobbling up other ships (like a scene from a James Bond movie) it comes as no surprise that this is the natural order of things. Despite short term losses, their on-going success seems assured.

As an independent agent I also have the freedom to dip my toe in the interesting world of consulting. Where the questions are either obvious, or deeply profound, depending on who is asking the question. Several projects recently have involved large financial organisations who often ask the same type of question. “How would an organisation replicate the success of Wiggle/Rapha/other high-profile cycling success story with a lot of media coverage”.

My answer is most often the same. You can’t. At least, not without a time machine. Their success is a product of its time and of its roots and often those roots are way further back than people (from outside the cycle trade sector) expect. Of course, there are some very big players in the internet sector after Wiggle, but notice many of them also have very deep roots, for example, Merlin, Planet X or Sigma (as featured in the latest Trade Journal). But in the race for the No.1 spot, Wiggle had perhaps already won in back in 1999 when their very first adverts went live. It’s time to look at the next Wave, not chase the past.

First off, the 5th wave isn’t done with us yet. As my brother (a CTO with a major website) put it to me “so far the internet revolution just tided up a lot of existing offline sectors and activities, it just made things more efficient. Now it’s moving on to things that did not exist or could not be done before the internet was around.”

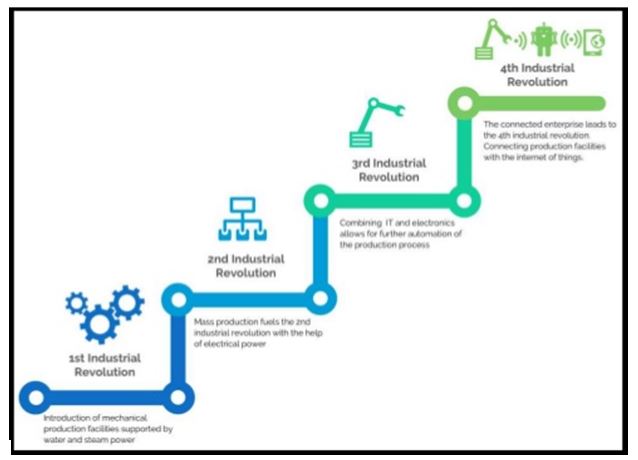

And, there is another Wave coming and it’s going to make this one look like a tea party. The 6th Kondratieff Wave is going to feel like we are living in a sci-fi movie. The most profound change is that energy will become clean, almost limitless and so cheap it might as well be free. The changes are going to be deeper, faster and more transformative than anything we have seen in our lifetimes thus far (see Jay Townley’s articles about the 4th Industrial Revolution – which is kind of the same as the 6th Kondratieff – for more). And if you want to research the subject yourself, I recommend “The Zero Marginal Cost Society” by Jeremy Rifkin.

We are already just seeing both the latter part of the 5th combined with the early 6th Wave impact on the cycle trade: Strava heat maps, bike-share, self-driving cars, automotive giants entering the sector, 3D printing, drone delivery, the Sharing economy.

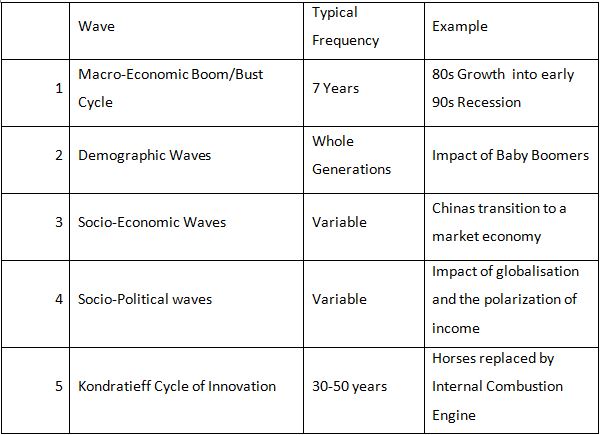

Now there are other waves too, I’ve mentioned demographic waves before, for example when discussing the BMX>MTB>Road>e-Bike booms all being linked to the same individuals over time. In all there are 5 major waves that affect us:

These Waves will continue to impact on (and interact with) each sector of the cycle trade. So what’s occupying my evenings and weekends now is research into how each Wave will impact (positively and/or negatively) on sub sectors such as road, e-bike, MTB etc etc. Believe it or not, I may even end up with a concise, 1-page summary. One day.

There is nothing we can do about these coming changes, except perhaps, be prepared for them.

Water always wins.