Supply chain upheaval accelerated by Covid-19, says WFSGI study

The World Federation of Sporting Goods Industry has released a detailed picture of its member’s supply chain movements as the world continues to grapple with Covid-19 and the outstanding trends appear to be consolidation, online sales and sustainable products.

Manufacturing

Very much living day-to-day, the manufacturing sector as a whole (95%) is focusing on consolidating production capabilities and running a lean production.

36% of businesses remain in difficulty when sourcing the material required to begin production, with most citing delays in shipping finished componentry.

It is largely in South East Asia and the Far East where supply chains are most disrupted, with 64% stating that things are not running as hoped.

There is decent scope for improvement in the coming months, however, with labour shortages now being addressed; 60% no longer have workforce issues. Likewise, compared to last month the outlook is a little rosier with 5% less (70%) stating their business will be “impacted”. Most companies expect they will need “over a year to recover.”

Demand is struggling across the WFSGI’s members, though the results were not separated by sector. the European and North American markets saw 50% of businesses saying less orders were landing.

Another 50-50 comes on cash flow, with half stating that money flow is proving a difficulty.

Retail and standalone brands

In offsetting the pandemic’s affect on trade it’s little surprise to see near 90% of respondents opting to increase their online sales clout, in fact the second place and below choices racked up no more than 35%, illustrating just how crucial online trading has been to many.

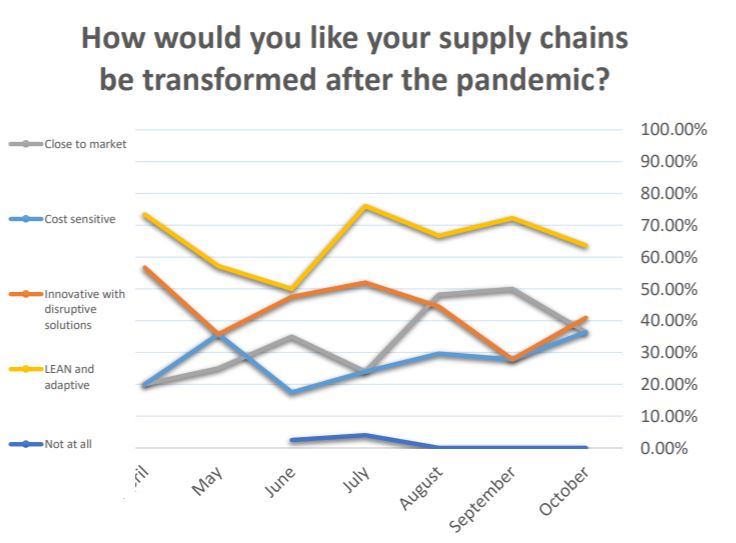

In nervy news for the many concerned by being phased out, consolidating the supply chain and keeping the same supply chain but attributing less order to each of the suppliers, are the two answers mostly provided by brands. Achieving supply chain efficiency has grown in importance as the year has gone on with 50% describing it as a “priority”. It is in fact described as a “transformation” by the WFSGI release, which says that “none of the participating industry players plan to keep their supply chain unchanged.”

In nervy news for the many concerned by being phased out, consolidating the supply chain and keeping the same supply chain but attributing less order to each of the suppliers, are the two answers mostly provided by brands. Achieving supply chain efficiency has grown in importance as the year has gone on with 50% describing it as a “priority”. It is in fact described as a “transformation” by the WFSGI release, which says that “none of the participating industry players plan to keep their supply chain unchanged.”

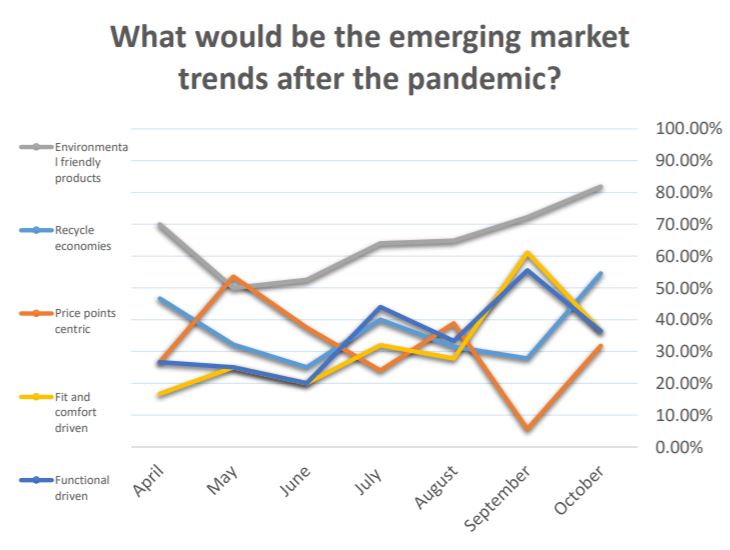

Alongside trimming perceived expendable links in the supply chain, environmental trends continue to dominate the agenda; 80% expressed that they were making efforts to become more sustainable. On the flipside of that, price point driven product demand rose and functionally driven goods design decreased.

Alongside trimming perceived expendable links in the supply chain, environmental trends continue to dominate the agenda; 80% expressed that they were making efforts to become more sustainable. On the flipside of that, price point driven product demand rose and functionally driven goods design decreased.

The WFSGI President & CEO, Robbert de Kock commented on the last survey edition: “In a hopeful way we have evaluated the results that the situation around orders do not further deteriorate. It is also good to see that labor shortage is no longer causing problems for the majority of the sector. This might help to balance the concerns still prevailing when it comes to supply chain disruption and material shortage.

“We also have to consider carefully the fact that most players in our industry are forecasting that they need over a year for their business to recover. Over 95% of companies seem to be prepared for that period as they have a plan to sustain operations, this is a promising sign to accept this challenge.

“Supply chains will undergo changes, this is something that the responses clearly show. With a clear support for environmentally friendly products, there seem to already be first signs in which directions the changes point.

“With that said, the WFSGI will put a special focus and dedication to assist the global industry as good as possible to bridge the period of recovery and provide the necessary support.”

Among its members, WFSGI counts The Accell Group, Pon.Bike, Orbea, BMC, Campagnolo, Canyon, the Cycling Sports Group, Trek, Shimano, Bosch and many other industry players both large and small.