Townley: How mobility shifts and the fourth industrial revolution will forever change the bike biz

There is no doubt the American bicycle business is going through difficult times. This article is intended  to help explain the turbulence and set the stage for helping bike shop owners and managers to not only survive, but ultimately thrive going forward into the future.

to help explain the turbulence and set the stage for helping bike shop owners and managers to not only survive, but ultimately thrive going forward into the future.

History is important because it provides the points of reference that we need to both understand how we got to the present, and how we can begin to understand the future which allows us to focus on what we want and helps us create our vision for what we want going forward.

The Modern American Bike Shop

I consider myself to be very fortunate because I have been able to observe, in some cases first hand, the evolution of the American bicycle business over the last 60 years as the consumer market has been changed. Several identifiable stages have occurred, with the mass market and conspicuous consumption of the third industrial revolution, the Internet and world wide web, smart phones and the digital age leading to the fourth industrial revolution and igniting the mobility revolution, cycling 4.0 and now the dawning of the fourth era of bike shop retailing.

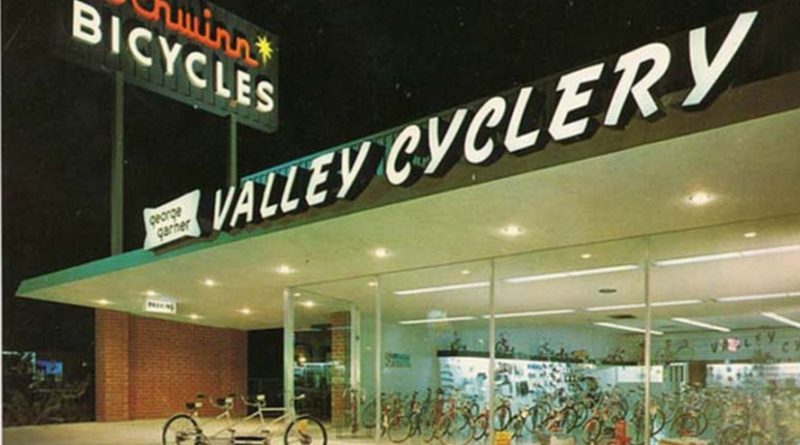

When I started working for a bike shop in St. Paul Minnesota in 1957 the bicycle business was in the  middle of cycling 3.0 and bicycle retail was just beginning to transition from the end of the second era of bike shop retailing to the third era that was started by George Garner in California and championed by Arnold, Schwinn & Company (the company name was changed just prior to the Bike Boom to Schwinn Bicycle Company) to move bike shops out of the back alleys and side streets to the main shopping streets across the country.

middle of cycling 3.0 and bicycle retail was just beginning to transition from the end of the second era of bike shop retailing to the third era that was started by George Garner in California and championed by Arnold, Schwinn & Company (the company name was changed just prior to the Bike Boom to Schwinn Bicycle Company) to move bike shops out of the back alleys and side streets to the main shopping streets across the country.

The third era of bike shop retailing that started in 1960 saw the birth of the discount store, the rise of the Total Store retail bike shop concept, we went through the Bike Boom in the early 70’s, and the introduction of the Sting-Ray, mass produced lightweight, derailleur equipped adult bicycles and the BMX craze that generated the consumer purchases and growth in bike shop sales and revenue that financed the rapid spread of the modern American bike shop from 1960 through 1980.

At the beginning of the 1980s the mountain bike explosion picked the business up from the decline after the bike boom and along with the growth of the fit athletic adult cycling enthusiast drove the migration from bicycling as an activity to bicycling as a sport by 2000. This in turn lead to the top tier American bicycle brands becoming a significant factor in international racing and the growth of triathlon, biathlon, Xtrea and cyclocross.

All in I am talking about the 50 years from 1960 to the great recession to 2010. Bike shop retailing, as we have known it, is at the end of its third era, and is in transition to its fourth era, which I predict will be the greatest era the bike shop channel has ever seen in America.

As I have documented in previous articles the third era of bike shop retailing that started in 1960 was rooted in the emergence of the great homogeneous consumer that set out after World War II and the Korean War to realise the American Dream.

In 1962 the Fair Trade Laws that prohibited discounting of consumer products were substantially repealed. That same year, 1962 Kmart, Walmart, and Target all opened their first discount stores. At the time Sears was the largest retailer of bicycles in the U.S..

America was also ramping up the third industrial revolution by converting the manufacturing juggernaut that was created to win World War II to the creation and manufacture of consumer goods to feed and satisfy the great expanding homogeneous consumer marketplace.

Ten years later, during the Bike Boom I watched the Schwinn Bicycle Company expand into three manufacturing plants in Chicago and one of them was a brand new frame manufacturing facility.

I also watched several domestic and foreign bicycle manufacturers including Murray Ohio, Huffy and Bridgestone Bicycle and National Bicycle in Japan and Giant Manufacturing Company in Taiwan modernize and grow and in Giant’s case starting from scratch in the 1970s.

In 1982 I remember being shown a demonstration in the Schwinn plant in Chicago of a completely robotic TIG welding pilot installation utilizing American made welders and robots. I also toured the Shimano plant about this same time and was introduced to the robots they were designing and building in their plant in Japan for eventual installation in their plants around the world.

These were the first steps in advanced manufacturing in the bicycle business over the next 30-years in the march to the Fourth Industrial Revolution that emerged from the digital age just after the great recession in 2009-2010.

The Fourth Industrial Revolution

The Fourth Industrial Revolution driven by the digital age has empowered the American consumer, who is no longer homogeneous and is part of a demographically diverse population that currently consists of six living generations in America.

All six, from the GI Generation born between 1901 and 1926 and Generation Z born after 2001 represent consumers – purchasers and riders of bicycles.

What the National Sporting Goods Association (NSGA) has found through its research is each  generation of Americans doesn’t ride bicycles or doesn’t ride more often for reasons that differ by generation, and need to be addressed specifically and differently for each of the six generations – not with one singular solution.

generation of Americans doesn’t ride bicycles or doesn’t ride more often for reasons that differ by generation, and need to be addressed specifically and differently for each of the six generations – not with one singular solution.

Remember, the great homogeneous consumer disappeared and evaporated into the mythology of the mass market that was dead and gone by the time the great recession engulfed the country.

The mass market succumbed to the rise of the Internet, social media and the digital age that drove the fourth industrial revolution and empowered all six generations of American consumers in different ways and also changed their shopping habits and their paths to purchase in profound ways.

The dawning of the Mobility Revolution

On January 21, 2016 Mary Barra the Chairperson and CEO of General Motors published an article written for the World Economic Forum (www.weforum.org). The theme of the 2016 World Economic Forum was the Fourth Industrial Revolution and the following are quotes from the article.

“The auto industry is changing faster today than it has in 100 years. Many facets of the traditional industry are being disrupted, and we at GM believe this creates exciting new opportunities. Rather than fear disruption, we plan to be leading it by developing cars that don’t crash or pollute, that reduce congestion and that keep us connected to the people, places and activities that are most important in our lives.”

“The auto industry will play an important part in the fourth industrial revolution. At GM, we look forward to working with others to lead and define the future of personal mobility.”

On March 11, 2016 Ford Motor Company announced the creation of Ford Smart Mobility LLC, a subsidiary to design, build, grow and invest in emerging mobility services.

Ford Smart Mobility LLC is part of Ford’s expanding business model to be both an auto and a mobility company.

“Ensuring the freedom of mobility requires us to continually look beyond the needs of today and interpret what mobility will mean to future generations,” said Bill Ford, executive chairman, Ford Motor Company. “This new subsidiary will enable us to develop mobility solutions to address the rapidly changing transportation challenges of an increasingly crowded world.”

All of our research and investigation clearly indicates that a new mobility is developing out on the fringe that embraces a new generation of hybrid and electric vehicles, self-driving vehicles and including human powered and electric assist bicycles, recumbents and tri and quad cycles.

Ford and General Motors (GM) have joined with others in the global automotive industry in becoming  aware and acknowledging that the writing is on the wall – and it is not favorable for traditional mainstream automotive companies.

aware and acknowledging that the writing is on the wall – and it is not favorable for traditional mainstream automotive companies.

Automotive industry suppliers like PON have invested in the bicycle and electric bicycle sectors in Europe and North American and have opened sales and distribution operations in the U.S.

Bosch, a leading electronics component supplier to the global automotive industry has developed mid-drive pedal assist components for electric bicycles and has expanded into the American market to serve home-grown electric bicycle brands and to service European and Asian brands that have opened electric bicycle sales and distribution in the U.S.

As the great recession was coming to an end we started to see a separation or bifurcation between the mainstream American bicycle business and the fringe that we started calling the new-wave and outliers. This lead to my beginning a correspondence with Patrick Keating, Managing Director of Velo Capital Partners located in Lyon, France.

Cycling 4.0

We have told the story before, and we observed as Patrick immersed himself in the global bicycle industry and took a deep dive into all aspects of innovation, technology and investment in and around the current mainstream business – and the fringe as he started to investigate what the future looked like.

In December 2015 a leading European bicycle trade paper published an article titled A Vision of the Future of the Global Cycling Industry: Cycling 4.0 Is about Creating New Markets by Patrick Keating. Here is what Patrick said about the present and the future he sees for the global bicycle industry and business.

“While many from inside and outside the cycling industry are rushing to get a piece of the markets that already exist, there are other forward thinking players that are trying to create a new one. But, many of these forward thinkers are making high-risk business decisions with little or no qualitative or quantitative data to support their assumptions.

“Instead they are rushing into the market armed only with a lot of passion and, in many cases small piles of crowd funding money with little or no knowledge of where the market is really going in the future. To help reverse this high risk/low data situation for these entrepreneurs and corporate development managers we’ve developed a vision of the future of the global cycling industry – Cycling 4.0.”

Based on our own research we agree with Keating’s analysis and definitions of Cycling 1.0, 2.0 and 3.0 and we also agree with his Cycling 4.0 vision for the future.

Accordingly we suggest that three paths have emerged that the American bicycle business is currently following, and future growth and real prosperity are dependent on how and when these three paths intersect, merge and blend to really serve the mobility, transportation and activity wants and needs of the majority of the six generations of Americans as Cycling 4.0.

The three paths are:

- The Traditional Mainstream bicycle business

- The New-Wave and Outlier fringe bicycle economy

- The Emerging Tier One OEM supplier bicycle economy

Patrick Keating’s extensive research found that the Current and Emerging OEM’s and Tier 1 Suppliers, differ from the Emerging OEM’s and Tier 1 Suppliers financially and represent a significant change primarily because they are some of the largest corporations in the world, predominantly from the automotive sector.

Shimano and Giant are the largest, in terms of annual revenue, of the Current mainstream bicycle business OEM’s with approximately $2.7 billion and $1.5 billion, respectively.

This compares to annual revenue of $202 billion for VW Group, $135.7 billion for Ford, $129 billion for Daimler, $80.4 billion for BMW, $61.9 billion for Peugeot and $38.6 billion for Continental.

The American bicycle business has already watched as Bosch and others have entered the e-bike sector of the bicycle market and the estimate for annual revenue for this European based company is $54.8 billion – a corporate revenue roughly 95% larger than the largest Current bicycle industry supplier!

What are these much larger, primarily automotive sector brands and companies interested in the global and American bicycle businesses and markets for?

The quick answer is electric bicycles – but experts and futurists we have talked to, including Patrick Keating, plus our own research and investigation, have lead us to conclude that these automotive players are looking to the future of transportation, mobility and technology beyond the bicycle and electric bicycle.

They are focusing on the intermodal human mobility mix where smart human-powered vehicles communicate with each other, the vehicular traffic around them…including mass transit alternatives and the roadway they are operating on and are legally equal to all other forms of human mobility.

With the financial power of the Emerging OEM’s and Tier One Suppliers this vision is no longer a fanciful dream – it is a high-probability scenario for the future…for Cycling 4.0.

The Fourth Era of Bike Shop Retailing

This takes us to the Fourth Era of Bike Shop Retailing and what this means to American bike shops – right now, today!

What it means is – an exciting and potentially prosperous future for bike Shops. But, and this is the biggest and most difficult piece most bike shop owners face, you are going to have to change in some way…large or small.

If you are in the bike shop business in the U.S. you already know that you are in the middle of a swirling storm of disruptions, driven by the fourth industrial revolution, which is the result of technological advancements, including information technology (IT), advanced manufacturing technology and automation, the Internet and its offspring, the Internet of things (IoT) – all of which have totally empowered the American consumer, who is now absolutely in charge.

Consumers are seizing on the power the internet has given them to expect – actually demand – 24-7 access to retailers and delivery of products to their homes or places of work with the ability to send back what they don’t like or doesn’t fit!

So…how can a bike shop survive in this churning retail storm, much less actually thrive?

The answer is actually a series of changes in the form of interconnecting consumer and customer focused initiatives, or actions that are within the reach, including financial and the management power of just about every bike shop in America.

You already know that bike shops are not all the same, so each owner will have to move the initiatives somewhat differently, depending on where they are today and what their financial and retail merchandising situations are.

First – sit down in a quiet place, with no interruptions and decide What you Want! I am taking this directly from Marie Forleo (www.marieforleo.com) and I highly recommend you visit Marie’s website and take her advice about deciding what you want for your bike shop business. Whatever you decide – write it down because, as Marie says, Clarity Equals Power! The clearer you are about what you want your bike shop to be, the easier it is going to be to communicate your bike shops Mission and your Vision to your managers, employees and your customers.

As a suggestion – don’t try to be all things to all people, and ask your customers what they want from your bike shop and focus on delivering the experiences and lifestyle solutions your customers want from you – not what you or your managers or staff want.

My next article will focus on the series of interconnecting consumer and customer focused initiatives, or actions that are within the reach and power of just about every bike shop in America to ensure they not only survive but thrive in these turbulent times that are chock-full of opportunities.