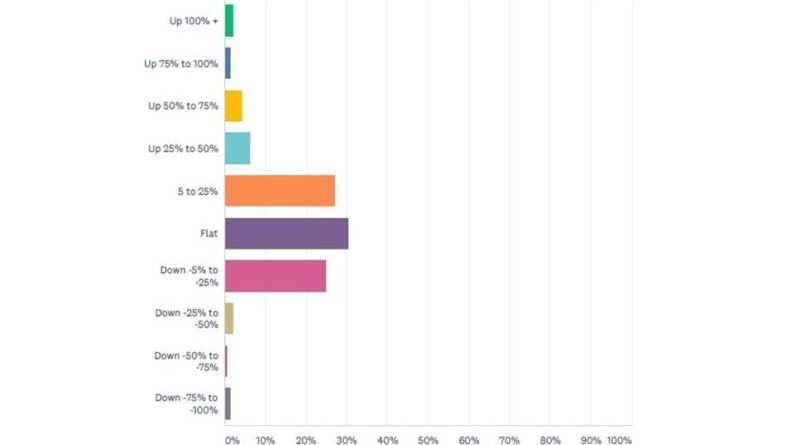

Market Study: By what percentage where IBD profits up or down in 2017?

Stemming from the findings of CyclingIndustry.News’ own Independent Retail Channel Study, the above graph shows the profitability picture of the UK’s independent bicycle retailers. Our 2018 study was delivered in association with the Cycle Show, for which trade may now register for free attendance here.

With the e-Bike market bubbling away in the UK, but perhaps yet to boom to levels familiar elsewhere in Europe, there’s a notable cluster around ‘flat’ in the absence of any other segment delivering notable year-on-year growth. The predicted gloom of “1 million less bikes” imported over the road boom averages of 2010 to 2015 did however fail to materialise. In fact, not only did 2017 figures post a 3% year-on-year growth, but Q1 of 2018 saw an eight year high in bike imports. While Q1 volume was up to a level 74% higher like-for-like against 2017 data, value was surprisingly down 10%.

Looking closely at our data, the profitability trend is erring slightly more on the side of positive with those up by 50% or more representing 7.59% of our pool, while those down by more than 50% represent 4.14% of the 145 who answered this question. Where profits are truly stemming from is detailed elsewhere in our study, which you can purchase in full for just £375. For a summary of the contents, check in here.

Anecdotally, from numerous visits our team has made, there are green shoots both for innovators in the market and those steadfastly dropping lines or services that are not pulling their weight in net profit terms. Whether it’s time to reconsider the bike’s priority on shop floor space has been strongly debated in recent months.

Those bike shops enhancing their in or out of store events, as well as creating a unique reason for shoppers to visit are tapping into a demographic that Mintel data suggests will shell out cash for experiences as part of their shopping trip.

Keep an eye on CyclingIndustry.News for more snippets from our Independent Retail Channel Study in the coming weeks.