New tool lists nearly 300 EU subsidy and tax incentives for bike firms

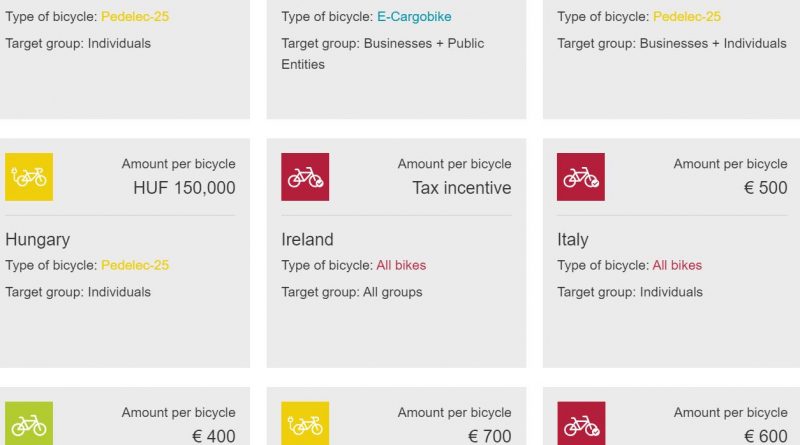

A new tool developed by the European Cyclists’ Federation (ECF) and the City Changer Cargo Bike project (CCCB) has curated a list of nearly 300 tax and subsidy benefits available in Europe.

The national, regional and local incentives have been compiled in a first of its kind directory in the hope of giving bike firms and cycling groups a clear view on perks that may help them both in business and to subsequently grow cycling numbers in Europe.

Schemes are listed in 14 of 27 EU countries and in a sign of the sudden burst of interest in cargo bikes for business use, there’s six pages worth of tips on incentives for these bikes alone. England has just the Cycle to Work scheme listed, as does Ireland with its marginally different regulations

Kevin Mayne, CEO of Cycling Industries Europe, said: “Europe’s cycling industry is leading the world in the change to e-mobility. Every year, many more electric bikes than electric cars are sold in Europe. We are happy to see that many public authorities already support this change through targeted incentives, but we hope to see even more schemes in the future. As well as the fiscal incentives, innovative companies are combining the benefits with leases and company-bike schemes which stretch the benefits even further. This will help to maintain Europe’s leading position in this field, create jobs and growth in the industry, but it will also be beneficial for consumers, the climate and our cities.”

Set to be updated as time passes, the tool hopes to shine a light on possible funding avenues that are sometimes been hard to find, under reported or overlooked.

Jill Warren, CEO of ECF, adds: “Tax breaks and purchase premiums open up cycling to large groups of the population who used cars before, including commuters and the elderly using electric bicycles, but also families and small businesses, which now can use cargo bikes for their logistics. These schemes can be put in place at a fraction of the cost governments are investing in tax cuts for company cars and subsidies for electric cars. Public administrations must reform their tax systems to provide more fiscal incentives for cycling and include support schemes for buying electric and cargo bikes in their National Recovery and Resilience Plans under the NextGenerationEU recovery fund.”