Cycle to Work legislation due an update, says Jesse Norman

Responding to a question posed by Sterling MP Stephen Kerr, Transport Minister Jesse Norman has indicated an incoming update to Cycle to Work legislation.

Detail of the amendment, likely to break cover in the Autumn statement, is as yet thin on the ground, but Norman was responding specifically to a point made on electric bike inclusion within the scheme.

Jesse Norman responded by saying: “The Cycle to Work Scheme can already be used to assist with the purchase of electrically assisted pedal cycles, and is one of the many ways in which the Government is supporting active travel choices, as set out in the 2017 Cycling and Walking Investment Strategy. The Department is currently in the process of updating the Cycle to Work Scheme guidance and will make a further announcement later in the year.”

It has previously been outlined in Parliament that electric bike sales are extremely limited on the scheme due to the £1,000 ceiling imposed on many operators traditionally.

Typically, sales shy of £1,000 stem from China and recent changes to anti-dumping legislation will now likely eliminate this affordable price bracket entirely. A lawsuit has now been filed by importers of such bikes against the EU, which stands accused of wholly ignoring evidence running contrary to the original European Bicycle Manufacturer’s Association’s claims.

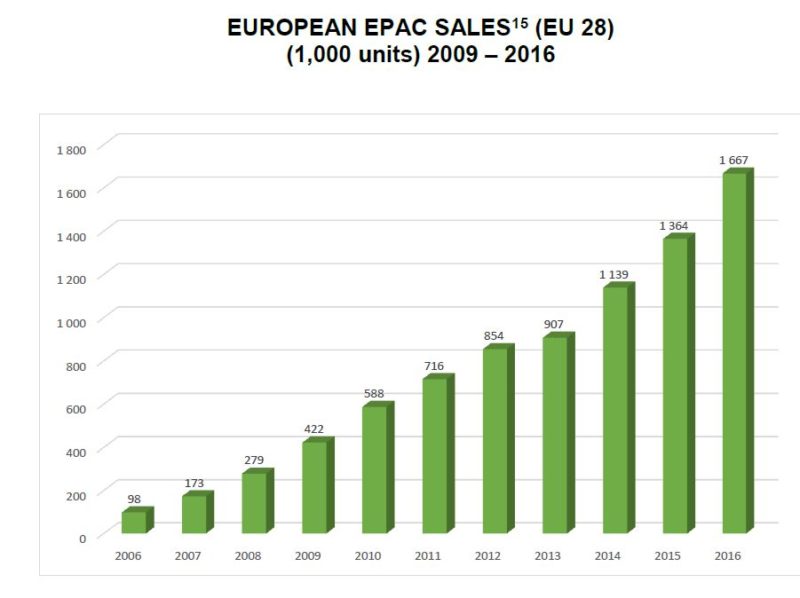

Exceptions to the rule do exist. The Green Commute Initiative, created by an expert in salary sacrifice legislation, offers bike sales with no ceiling on price and has as a result seen the majority of its trade become electric.

At the March meet in Parliament, others in the Cycle to Work market had strongly called for a lifting of the £1,000 limit in a bid to enjoy the same trading advantages, further stimulate a growing segment and bolster cycling levels nationwide.

A separate question put to Financial Secretary to the Treasury Mel Stride revealed that the Government has never assessed the financial benefits of the Cycle to Work scheme.

“Bicycles provided under the scheme are tax exempt, so no data is reported to HMRC,” said Stride.