Townley: Are we facing the end of retail as we know it?

CNBC posted an article Tuesday, March 21, 2017 with the headline: “Some retailers might not survive until the end of the year, eBay CEO says.”

Some bike shops have a big bone to pick with eBay, but the CEO, Devin Wenig is a smart guy and according to him, the 2016 holiday season may have been a historic turning point that will take down more players in the retail industry.

“The fourth quarter of last holiday season was a really important moment,” Wenig told CNBC’s “Closing Bell” from the Shoptalk Conference in Las Vegas. “I think it was an inflection point where that was the end of retail as we know it. And I do think the restructuring of this industry is going to happen faster than a lot of people think…. the fourth quarter is the moment that people will look back on and say, ‘That’s when the current structure of the industry was irretrievable.'”

“I’m not sure all the retailers are going to even make it, in a healthy economy, to this holiday season,” Wenig said. “And I do think you are going to see drastic changes in store footprints and what stores do.”

Since the end of 2016 and the beginning of 2017 iconic retail brands like J.C. Penney, Macy’s and Sears, which at one time was the largest retailer of bicycles in the U.S., have collectively announced hundreds of store closures scheduled for this year.

This is in contrast to Amazon which announced it had its best holiday shopping season ever in 2016.

Wenig said he doesn’t think stores are completely going away: “I think the complete death of stores has been greatly exaggerated,” Wenig said. “The consumer wants stores. The entire world will not be online. But there are both capacity and utility issues in retail. People don’t like poor store experiences.”

EBay has challenges of its own, and the company now competes for shopper’s money with the likes of Amazon, Walmart, Etsy and others, just like bike shops do. Wenig is also quite correct in predicting that retail stores aren’t dead – but his point that people “…don’t like poor store experiences” has to be taken very seriously by bike shop owners and managers.

The National Retail Federation (NRF) economic forecast for 2017 projects U.S. retail industry sales, which exclude automobiles, gasoline stations and restaurants, will grow between 3.7 and 4.2 percent over 2016. Online and other non-store/online sales, which are included in the overall number, are expected to increase between 8 and 12 percent.

“The economy is on firm ground as we head into 2017 and is expected to build on the momentum we saw late last year,” NRF President and CEO Matthew Shay said. “With jobs and income growing and debt relatively low, the fundamentals are in place and the consumer is in the driver’s seat. But this year is unlike any other – while consumers have strength they haven’t had in the past, they will remain hesitant to spend until they have more certainty about policy changes on taxes, trade and other issues being debated in Congress.

“Prospects for consumer spending are straightforward – more jobs and more income will result in more spending,” Shay concluded.

NRF Chief Economist Jack Kleinhenz said. “Regardless of sentiment, the pace of wage growth and job creation dictate spending.”

If the economy is so good and all the economic indicators dictate spending – why are well known retail brands and chains going bankrupt and closing their doors?

Because, according to Christopher Leinberger, chair of the Center for Real Estate and Urban Analysis at George Washington University, retail is transforming to an “experience economy.”

Marshal Cohen, chief retail analyst for The NPD Group, says: “We are entering an interesting phase of consumption,” Cohen went on to say “We’re not interested in buying products. What we are doing is building memories.”

Leinberger recently told National Public Radio (NPR) that: “It’s certainly not the end of retail. Retail always transforms,” but according to Leinberger, “This is a much bigger transformation than we’ve had in 50, 60 years. The previous big transformation … was from walkable urban in the early 20th century — the Main Streets — to regional malls. Well, we’re going back now to the 21st century version of Main Street!”

Matthew Shay of the NRF, says historically, changes in retail have happened slowly. Not so today. “The velocity of change is unlike anything we’ve ever seen,” he says. “Before, things happened over a generation; now they’re happening overnight.”

What does this mean for bike shops? To begin with this is an opportunity to change the public image of bike shops – for the better! With the retail environment shifting and changing “overnight” bike shops can reinvent themselves and in the process greatly improve their retail brand image during one season.

What do bike shops want to reinvent themselves into? Let’s start with “…the 21st century version of Main Street” and a bike shop’s opportunity to be the go-to bicycle and human-powered mobility expert in their neighborhood which can provide a bicycling lifestyle experience for individuals and their whole family.

Many bike shops have already changed to become the Omni-Channel, sticky places that their customers want to visit and hang-around. Their customers have seamless 24-7 access, meaning the store now has the opportunity to use positive word of mouth and social media to attract more consumers who are looking for the human-powered mobility experiences that allow them to change their lifestyles.

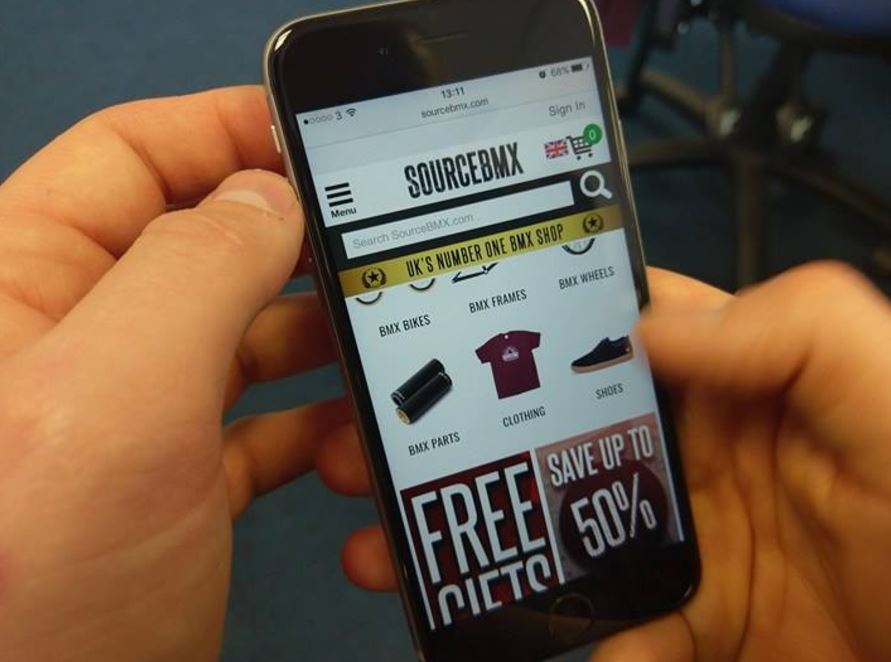

The accelerating disruptions and turmoil in the retail sector, including the bankruptcies and store closings in the midst of a good and growing U.S. economy are being driven by the consumer and technology – and the literal explosion of powerful digital empowerment that is being placed right in the hands of consumers.

The latest Pew Research data shows that 89 percent of American Adults use the  Internet, 72 percent report owning a smart phone and Mobile Marketing reports that 90 percent of shoppers report using their smart phone while in a store.

Internet, 72 percent report owning a smart phone and Mobile Marketing reports that 90 percent of shoppers report using their smart phone while in a store.

This empowerment is giving consumers the ability to shop when they want, where they want and do their own detailed research before buying from the retailers that deliver the experience and create the memories that they want.

Related: YouGov consumer study detail changing retail landscape and engaging the mobile clutching consumer