LEVA-EU questions “damage” data used to validate electric bike dumping case

LEVA-EU has today issued a press statement again calling into question the evidence for the now imposed provisional dumping duties on Chinese electric bikes.

Referring to the alleged damage to European industry, LEVA-EU turn to the data. In today’s release the following figures tied to European business are put forward to question to claim of injury:

– Sales volume: + 21%

– Production volume: + 29%

– Production capacity: + 35%

– Capacity utilization: -4%

– Employment: + 40%

– Labour costs: -10%

– Profitability: + 25%

– Investments: + 77%

– Return on investment: + 103%

“Against all logic and sense, the Commission has managed to conclude from all the above that the European industry is suffering injury,” said the European Importer Collective’s representative body. “According to the Regulation, the sales volume of the European industry increased by 21% between 2014 and 30 September 2017, total consumption grew by 74%. As a result, sales’ share of the European industry declined in theory from 76% to 53% in that period, and that was due to the alleged harmful, growing imports from China, according to the Commission.”

LEVA-EU goes on to allege a manipulation of figures to fit the narrative of injury.

“One obvious example of this is profitability mentioned in recital 192. The Commission interprets the evolution of this indicator as follows: “Starting from a low base of 2,7 % in 2014, profits margins eroded from 4,3 % in 2015 to 3,4 % in the investigation period.” (Recital 194)

“If an increase of profit margins by 25% is referred to as “eroding“, then one must seriously question whether any argument can be raised at all against the Commission’s determination to prove dumping,” writes LEVA-EU.

The release goes on to state that the Commission’s findings are “mathematically impossible”, citing data outlined in the Provisional Regulation, Table 11.

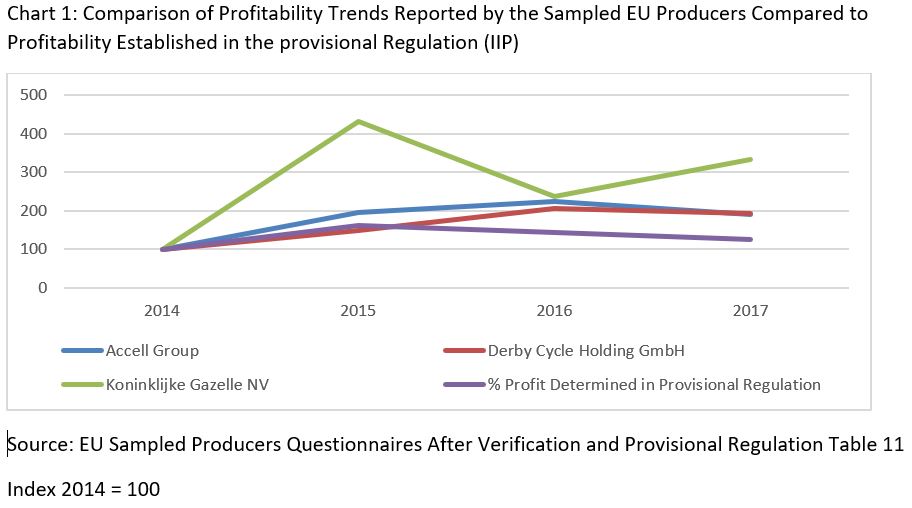

“This graph clearly shows that an increase of only 25%, as stated by the Commission, is mathematically impossible,” starts LEVA-EU.

“The lack of consistency permeates the whole Regulation and reaches a culmination in recital 177 where the Commission concludes: “The Union Industry had to reduce its production, sales, employment and capacity between 2016 and the investigation period due to dumped imports from the People’s Republic of China.”

“Once again, we question why the Commission makes a comparison between 2016 and the investigation period. In that period, production declined by a modest 1.7%, sales by 3%, production capacity by 9.2%, while employment grew by 1.8%. For the entire period, however, these factors were, respectively, 29%, 21%, 40% and 35% higher on 30 September 2017 than on 1 January 2014.”

In a letter seen by CI.N, EU Commissioner Cecelia Malmström has responded to LEVA-EU’s criticisms, outlining that the importers represented will have “additional time to make comments” leading up to the anticipated January 18th, 2019 formal decision on whether duties will become definitive and if they will be collected retroactively.

An early complaint put to the EU centred on what LEVA-EU describe as production figure inconsistencies between the regulation index and the complainant EBMA’s own index. These two datasets are both said to site CONEBI data.

LEVA-EU has pointed this inconsistency out as part of its rebuttal, but has apparently not received a response.

With a decision on the admissibility of the proposed lawsuit now in progress, a further hearing has been requested with the EC’s Hearing Officer. It is expected this dialogue will resume once the Commission and Parliament return from summer recess.

A series of questions has now been officially raised with the EC in relation to the case, as seen below:

The European Commission during its investigation period visited producers of electric bikes both in Europe and China.

In Europe the sample included the Accell Group, Derby Cycle, Koninkijke Gazelle NV and Eurosport, among others.

Citing data from these sampled producers, LEVA-EU believes profitability to have not been severely adversely impacted, as alleged, with the profit determined in provisional regulation to sit at 160% in 2015 and 145% in 2016 over 2014 levels.

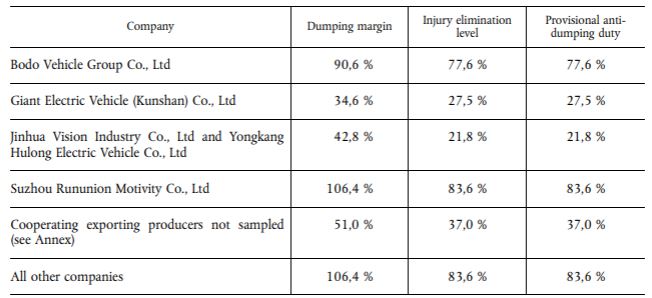

Where Chinese assessments were made, specific provisional tariffs were established for the following businesses:

Those importing electric bikes from China into Europe are now reacting in numbers, with some shifting their country of assembly and others being dealt blows that could ultimately mean closure.

In representing European importers and upon publication of the Registration Regulation, LEVA-EU carried out a small Internet survey about possible injury caused by the proceeding to importing companies. 72 companies have completed the survey of which 65 (= 90%) confirm that the proceeding is causing actual damage to their business. The reported damage is significant and diverse:

- Almost 42% is short of product to sell, in the height of the season;

- 39% state that they already had to increase the price of their products;

- 5% have suffered financial loss since the initiation of the dumping proceeding;

- 33% have stopped import of electric bikes from China and have not found an alternative solution;

- 6% state that their company will have to close down if retro-active collection is imposed;

- 21% will not continue if definitive duties are imposed;

- Almost 21% had to lay off staff.

LEVA-EU manager Annick Roetynck signs off today’s release by stating: “This is a political game which fits with the current, general European attitude to discourage trade with China. Furthermore, a very small number of large companies in Europe try, through abuse of trade defence instruments, to push competition out of those markets they have lost out on due to their own rigidity and short-sightedness.”