How the Trump presidency might affect global bicycle trade, manufacturing and purchasing

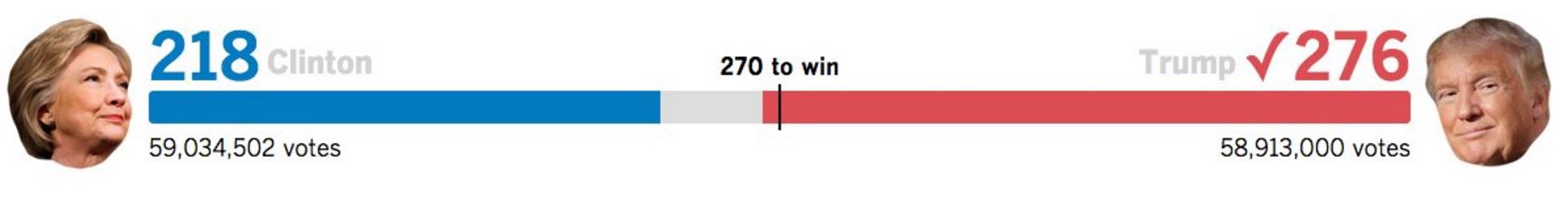

With the news that America’s 45th president will be Donald Trump there is a glut of information to digest this morning, much of which will directly impact on the bicycle business.

Markets around the globe are reacting to the news, with shifts already apparent in currency and investment. With the information presently available, CI.N analyses some of the likely outcomes:

Free Trade

On the one hand Trump has advocated fair trade, but we should not necessarily expect that to mean free trade.

Despite having some of his own campaign merchandise produced overseas, Trump has often sounded off about about taxes on imported goods. Riled by cross border trade with Mexico, he has expressed dismay at other countries taxing exported goods. “When they sell into us, there’s no tax,” he has said.

However, despite tensions with Mexico, Asia is said to be most at risk. On goods exported from the Far East, which for the time being at least remains the heartlands of the industry’s manufacturing, a 45% surcharge has previously been touted. If this were to come to fruition the ripple effects on currency and trade around the globe could be enormous.

A Nomura survey of investors, titled “Trumping Asia” analysed which regions would be most at risk on a Trump presidency. 75% of respondents expected the U.S. to impose steep tariffs on exports from Asia. 77% expect the U.S. to brand China a currency manipulator.

Is this important? Sure it is, China was the U.S.’s largest partner in trade last year with around $620 billion in business completed in 2015. Number two on the list is Canada and third, Mexico, worth around $540 billion and $500 billion, respectively. Should trade with the U.S.’s top three customers be restricted, expect that to have significant knock on effects around the globe. Furthermore, smaller nations with strong export business to the west – the Philippines and South Korea, for example – could be even more vulnerable to loss of trade.

Trump has in his campaign pledged to withdraw the U.S. from the Trans-Pacific Partnership, an agreement signed only in February, linking 12 Pacific Rim nations around the globe to business said to be worth 40% of the global economy. The deal is still awaiting ratification and thus the U.S. could still withdraw.

Should your business rely on exports and imports, a Trump presidency is highly likely to mean more attention paid to your customers and potentially new tariffs and trade restrictions.

Year to date trade with the US.

Transport cycling, climate change (and therefore bike sales)

Trump has been loud and clear on this one. “Climate change is a hoax”, specifically a Chinese one.

That doesn’t bode well for pressing active travel’s case, at least when it comes to the pollution arguement. Describing the Environmental Protection Agency as “a disgrace“, it appears the department may face the chop, potentially creating headaches for those heading into the great outdoors.

A likely certainty to directly affect the bicycle business is Trump’s plan to repeal all federal spending on clean energy. This includes any chance of electric vehicles benefiting from subsidy against polluting counterparts. It’s safe to assume, then, that Trump won’t be seen aboard a gold plated e-bike, nor will he be pushing people to sling a leg over themselves.

Research pitting Trump’s policy against Clinton’s demonstrates that a further 3.4 billion tons of Co2 emissions are projected during his four year spell as Commander in Chief.

Encouraging Americans out of cars and onto bikes is therefore unlikely to feature in transport policy.

Might sport cycling see a resurrection of the Tour de Trump (also know as the Tour DuPont) of the 80s and 90s?

Manufacturing

During his campaign Trump repeatedly pointed to the North American Free Trade Agreement (NAFTA) as “the worst trade deal maybe ever signed anywhere but certainly ever signed in this country.”

Indeed, manufacturing jobs did dip, but often not by the margins quoted by the incoming US president. A Bloomberg fact check reveals that quite contrary to Trump’s claims of a “30, 40 or sometimes 50%”, manufacturing jobs across the US declined by 1% during the 90s.

It is safe to assume, though, that Trump will place emphasis on domestic jobs in manufacturing. Like Brexit’s silver lining for the UK, this could be good news for a gradual resurgence in domestic manufacturing.

Indeed, having opened an assembly plant in South Carolina in 2014, Kent International had projected to be producing around 500,000 bicycles domestically by 2016. In a recent article with the New Yorker, the ambition was revealed to extended to manufacturing, potentially increasing the number of American-made bikes significantly. The bulk of these bicycles, however, are destined for Walmart. In that same article, CyclingIndustry.News columnist Jay Townley suggests that sales of a million bikes a year would be required to create a domestic parts industry.

At present, around 99% of bicycles sold in the U.S. stem from abroad, totaling around $1,613.6 million in business. In 2014 this equated to around 17.8 million bicycles shipped into the US. Around 200,000 bicycles are produced within the U.S. annually, according to the NBDA.

A weaker Dollar could make exports from the U.S. more attractive to foreign buyers, though large scale domestic production isn’t widespread.

Currency

In summary, today will be a volatile day for currency, financial markets typically don’t like shocks.

Foreign exchange traders had largely banked on a Clinton victory, meaning the currency markets have suffered a second landmark jolt in a matter of months.

Initially the Dollar dropped against the Yen and Euro, but has since begun a slight recovery. Pre-election, analysts had predicted the USD to be worth around 100.28 Yen, should Trump scoop the presidency. At the time of writing, the Yen has climbed from 105.46 to equate to a high of 101.15 to the dollar.

Meanwhile, the British Pound strengthened against the Dollar to be worth $1.24, while the Euro also gained, up from $1.09 to just over $1.1097.

For further analysis of how the news has affected currency around the globe, see here.

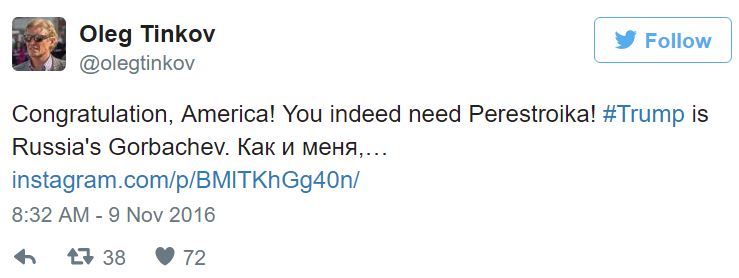

Reaction on social media

Is this issue likely to affect your business? Let us know how here.